The market leader Bitcoin has had a tough sail since the start of 2022. The cryptocurrency after brushing its multi-year lows is currently building momentum at levels around $22k. Successively, occurrences such as FED’s interest rate hikes, the Russian Invasion, and Europe’s vote on PoW chains. And insolvency crisis of Celsius and 3AC, have collectively collared the price projection of BTC.

With the recent spike in liquidations, coming in light of longs and the equity market’s turmoils. Investors and traders hold cynicism around the short-term prospects of Bitcoin. Are you one of the many, who are keen on Bitcoin’s Price Prediction? Fasten your seatbelts, as this write-up decodes the plausible BTC price prediction for 2022 and beyond.

Bitcoin Price Prediction For 2022

BTC price had initiated the year with continuity in its downtrend from the bygone year. With a price tag of $46,165.73, which spiked to $47,889.75 on the same day. But had a fall over the days to hit its bottom of $39,875.14, on the 10th of January. Whilst it did get interim relief with a spike to $44,543.13 on the 13th of January.

Bitcoin price slipped to its quarterly bottom of $33,116 on the 24th of January. Whilst the star crypto did pose a gradual rise to $45,760.08 on February 10th. Torrential torments in the business took the price to another fall at $34,401.85. After a series of oscillations, the star crypto traded at $39,771.4. Following a leg up to $45,311.6, BTC took a dip to $38,946.15 by the 5th of March.

Thereafter, a steady uptrend took the price to $47,499.73 by the 31st of March. Bitcoin had a rough sail in the second quarter. The star crypto lost close to 60% of its gains by the 19th of June. Following a spike, in volumes, Q2 was concluded at $20,108.27.

Q3 has been volatile for Bitcoin’s price projections. Succeeding a series of tug wars between the bulls and the bears, BTC’s price rose to $25,202.87 by the 15th of August. Thereafter, the trajectory has been coarse for BTC, in a recent fall the price brushed the $18,257 mark.

BTC Price Prediction For Q3

If the star crypto carries forward the third quarter with a bullish surge. The price of the star crypto could brush the levels of $21,374.24. Which could follow after oscillations at crucial levels. On the downside, picking up pace from the lows could leave the price at its crucial level of $18,537.25. That said, an equilibrium in buying and selling pressures could land the price at $19,981.53.

Bitcoin Price Prediction For Q4

Continuity in the bullish momentum from the third quarter could help BTC’s price rise towards the level of $26,532.41. On the flip side, if bears weigh heavier than the bulls, the price could settle at $20,291.02. That said, usual buying and selling pressures could settle the price at $23,437.51.

Price Prediction Of Bitcoin For 2023

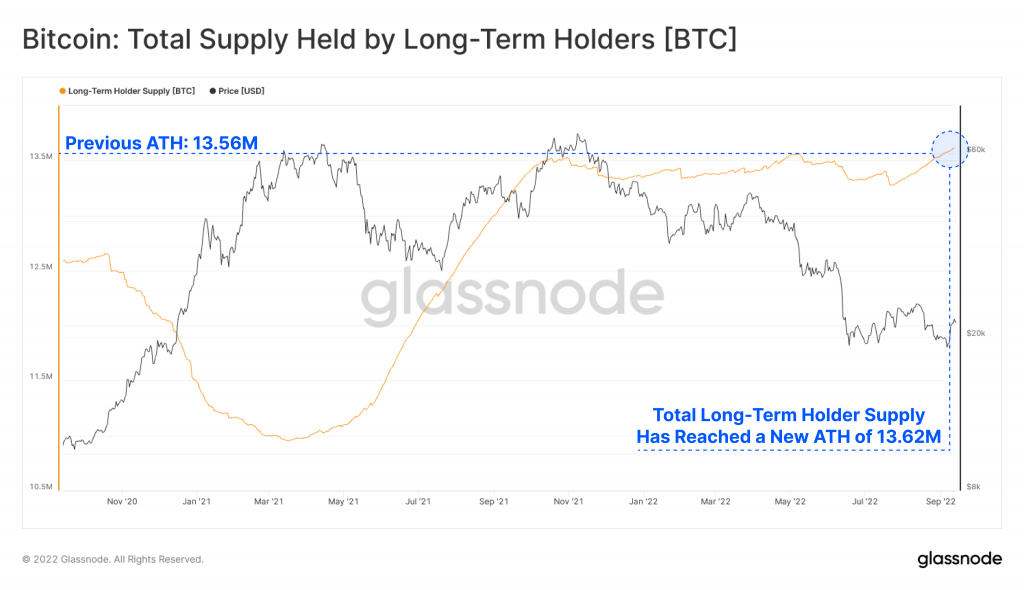

According to Glassnode, the total supply held by hodlers has reached a new ATH of 13.62 M BTC. A steady rise in volumes could push the price to $44,356.47. In contrast, the price of the star crypto could sink to the lows of $24,469.14. Successively, a balance in trade activities could settle the price at $34,415.06.

BTC Price Forecast For 2024

We will be able to see notable changes in scalability, with developments in the taproot. Moreover, the supply crunch would grow more evident, with the approaching halving event. Wherefore, the price could surge to a maximum of $70,190.77 by the end of 2024.

In contrast, factors like a prolonged bear run could knock the price down to $38,734.71. That being said, the regular price of BTC could land at $53,979.02.

Bitcoin Price Prediction For 2025

If Bitcoin manages to diversify and empower its liquidity over the next three years. It holds the possibility to attract more investors, which would result in global recognition. That said, the chances of investments fueled by FOMO would be on the higher side. Prevailing that the price could skyrocket to $115,612.11 by the end of 2025.

On the flip side, if the star crypto falls prey to the bears. Owing to criticism coming from the concerns of mining, energy consumption, and regulation, amongst others. The possibility of the BTC price ending the yearly trade at $60,719.60 cannot be ruled out. Consecutively, factoring in the bullish and bearish targets the average price might land at $88,500.59.

Market Analysis

Wallet Investor:

According to Wallet Investor’s algorithm-based BTC price prediction. The largest crypto asset could hit a maximum of $40219.00 by 2022. And the downside could flip the price to $17874.76. The average buying and selling pressures could propel the price to trade at $29155.72.

Successively, the firm agrees with the broader market, that Bitcoin can be a profitable investment for the long term. The firm cites that BTC would rise from a minimum of $51763.92 and could pursue the rally to claim $75488.92 by 2025.

Digital Coin Price:

According to Digital Coin Price, BTC’s price will meet an uptrend in due course of time. Further citing that BTC could close 2025 trade at an average price of $25,605.54. The firm hints at a maximum price target of $27,340.49, and a minimum target of $23,487.66.

Trading Beasts:

Trading Beasts predicts that the BTC price might close the trade for 2022 at a maximum of $24,482.344. Whilst a reversal in trend could drag the price down to $16,647.994. A balance in trade activities could land the price at $19,585.875.

Gov. Capital:

Gov. Capital expects Bitcoin price to hit a maximum of $30335.436 by the end of 2022. The analysts from the firm have pinned the minimum and average targets at $22421.84 and $26378.64. The firm also hosts predictions for the long term. Accordingly, the price of BTC is anticipated to close in 2025 at its potential high of $166843.15.

What Is Bitcoin?

Bitcoin is a digital currency that aims to emerge as an alternative to FIAT across nations. And empower individuals with its decentralized nature and peer-to-peer technology for instant payments. Unlike the traditional financial system, Bitcoin is not controlled by any government or organization, or by individuals. The price of Bitcoin solely depends on its demand and supply.

Since its inception in the year 2008 by an anonymous creator or creators known to the world as Satoshi Nakamoto. Bitcoin has taken the digital age by storm, it also enjoys the title of being the oldest and largest cryptocurrency. Bitcoin’s working relies on a completely decentralized system, making use of its open-source protocol. Which pushes it head-on against the flaws of FIAT.