Trading (exchanging cryptocurrencies, such as bitcoin, on an exchange) is a sort of activity that requires labor to generate income from the trading process. As with any other activity, trading involves the development of specific skills needed to achieve high proficiency, especially an analytical mind and attentiveness.

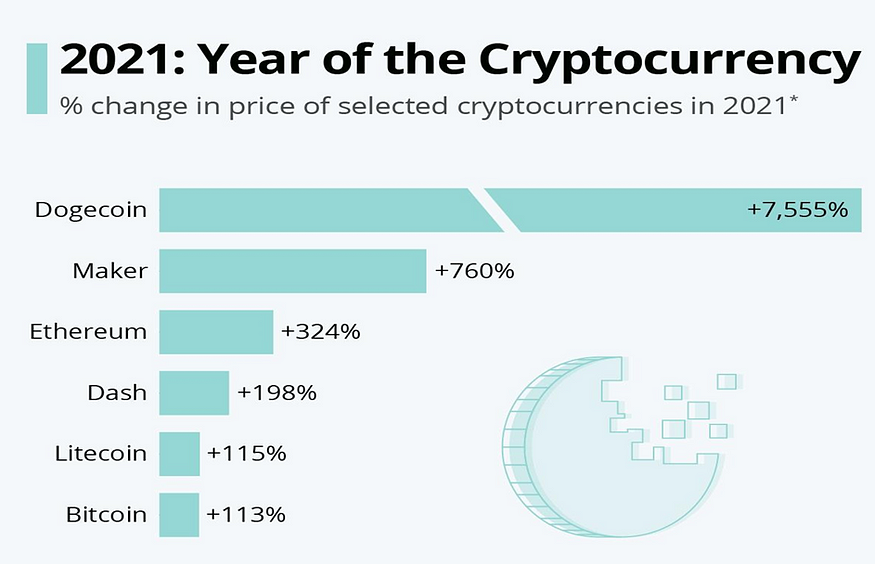

The first half of 2021 saw a phenomenal adoption of cryptocurrencies. Influential organizations like Tesla and Mastercard have taken action to embrace cryptocurrency. Although traction slowed in the second half of 2021, adoption rates remained much above the benchmark set in the previous year. In conclusion, the use of cryptocurrencies grew steadily throughout 2021

How can you invest in cryptocurrencies without losing all of your hard-earned money? Here are some beginner-friendly crypto blunders to steer clear off as assistance.

Not Putting in the Effort For The Research

In any case, you will be the one to spend money on cryptocurrency purchases. You will get into serious trouble and lose a lot of money if you don’t grasp the product and its worth and instead rely solely on “experts” from Youtube, Twitter, or Telegram who tell everyone when to buy and sell currencies.

You must rely on the judgment of others if your choice to purchase or sell a currency is based on their view. Do not act naively. Investigate the industry you work in.

Some people have perverse characteristics. They like to make difficult things easy.

You are investing with the money you cannot afford to lose

For instance, we’ll bring all your available loan funds or savings to the deposit.

Nobody is protected against mistakes and failures; even veteran traders frequently suffer substantial financial losses. With independent commerce from scratch, the accounts of newcomers who avoided the common faults at the start of the trade route can be deemed abnormal or, at the very least, unusual.

Trading with Emotions & Not by Book

Of course, it might be challenging to avoid making this error, especially if you follow cryptocurrency news on Twitter and see tweets like “To The Moon,”

Let there be some truth in these claims; it is physically impossible to keep up with everything at once, and, generally speaking, the most patient ones still prevail.

Sales at peak prices

Expert investors advised: “This is not the maximum; hold and do not sell.” The key idea here is that you can never predict how much a specific token will increase.

For instance, if you purchased bitcoin for $100, you most likely felt a strong want to sell it when the price increased to $1,000. But given that Eth is trading at more than $9,000 today, you would have significantly regretted it.

Purchasing cheap coins

You cannot invest money in the currency for no reason other than price. Many beginner users are accustomed to believing that most low-quality alternative coins are just undervalued. This is because several accounts of incredible value increase already exist. However, this is untrue because not all cryptocurrencies are of the same value. Coins have different prices due to various factors like Total market capital, Circulating supply of the coin, projects it’s doing .etc, etc.

“Never Judge A Coin by its Price”

Abrar ul Haq

Security

Perhaps the most significant error that can be made in the crypto-community right now is this. Individuals lost millions of dollars because they trusted a compromised stock exchange or a business that ceased functioning with all of their data.

Always put your long-term coins in cold wallets,

Your secret keys and passwords must be written down, printed, and stored in a secure location.

Only put funds in centralized exchanges which you are day-trading with.

FOMO

A concern of missing out. It shows up in scenarios like the early selling of an asset out of respect for losing earnings, the maximal purchase out of concern for missing something crucial, or the concern for missing a promising ICO, which leads to investment in dubious projects.

New changes in cryptocurrency arise every day, so calm yourself and allow this worry to subside.

Revenge Trade

Because they lack the strength to accept defeats, many users trade in retaliation. Such trades are highly harmful to your trading career since they are motivated by frustration and fear. Such traders frequently try to engage in riskier work to reduce losses. It’s referred to as “revenge trading.”

Spread out your cryptocurrency holdings

Too much investment in a single coin is not logical and is good advice. Please do not put all of your eggs in one basket, or as they say.

Spread your money between many coins like we would with shares. There are several varieties, so do your research. Sade Moon and world coin are two examples.

You are not doing your research.

Do your research. DYOR. That is a common phrase in the cryptocurrency community. And with good cause. In this sector, it can be challenging to separate the truth-tellers from the

hype-sellers, so completing your research is essential.

Conclusion

The secret to bitcoin trading is patience. There will be enough money for everyone, so don’t be scared to miss any deals because the market is so large and expanding. However, keep in mind that while making money on the market is simple, keeping it is not. Avoid letting your greed overcome you. I’ll repeat it: cryptocurrency will always be available and ready to take off like a rocket!