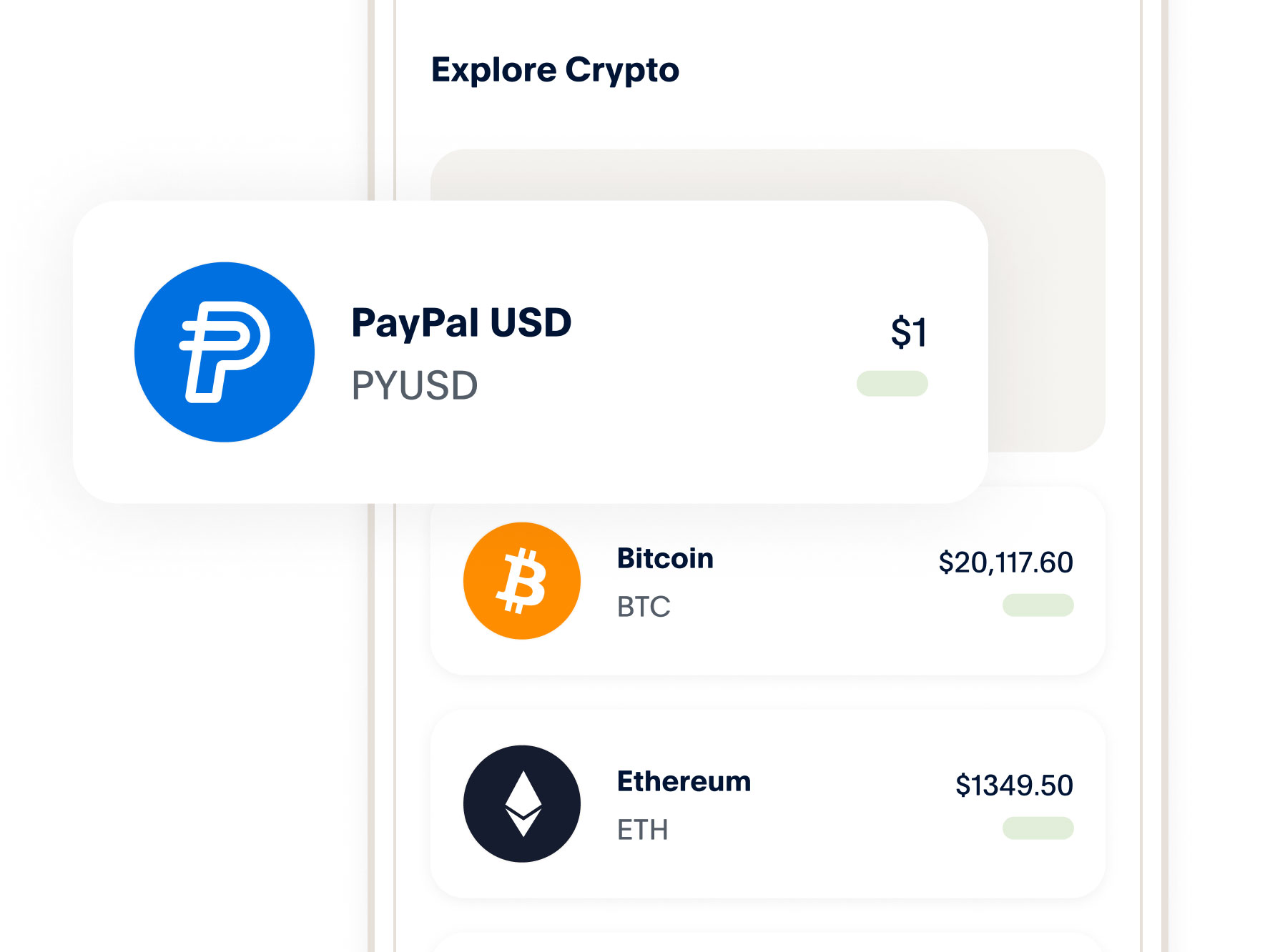

On August 7, PayPal, the largest payment system, announced the launch of its own stablecoin called PYUSD. Here is a quick overview of what we know so far.

PYUSD is pegged to the U.S. dollar at 1:1 and “100% backed by U.S. dollar deposits, short-term U.S. Treasuries, and similar cash equivalents”. The stablecoin is set to launch on Ethereum, making it available to a wide range of users.

So, what can PayPal customers look forward to doing with PYUSD?

💸 Transferring PYUSD to other PayPal users or any external Ethereum address.

🛍️ Paying with PYUSD for online purchases via PayPal.

♻️ Converting cryptocurrencies supported by PayPal to PYUSD and vice versa.

According to the company’s statement, their stablecoin aims to act as a “bridge between fiat and Web3 for consumers, merchants, and developers”.

Paxos Trust Company will become the issuer of the stablecoin. The company operates under the oversight of the New York State Department of Financial Services (NYDFS). Paxos is already known for its blockchain products: they are the brains behind the USDP, another dollar-backed stablecoin, and the PAXG, a stablecoin tied to physical gold.

Notably, Paxos Trust Company was previously the issuer of BUSD, which was considered a Binance stablecoin. However, due to regulatory matters raised by the SEC, the issuance of BUSD stopped earlier this year. Since then, the stablecoin’s supply has been dwindling.

Starting this September, Paxos plans to publish a monthly reserve report for PYUSD.