Ethereum recently experienced a flash crash alongside Bitcoin in the past 7 days; this is something we’ve literally never seen since the onset of COVID. This occurrence provides valuable insights into the future.

Let’s begin with a concise analysis:

While the analysis might seem basic, it’s likely more accurate than the elaborate graphs I’ve encountered previously.

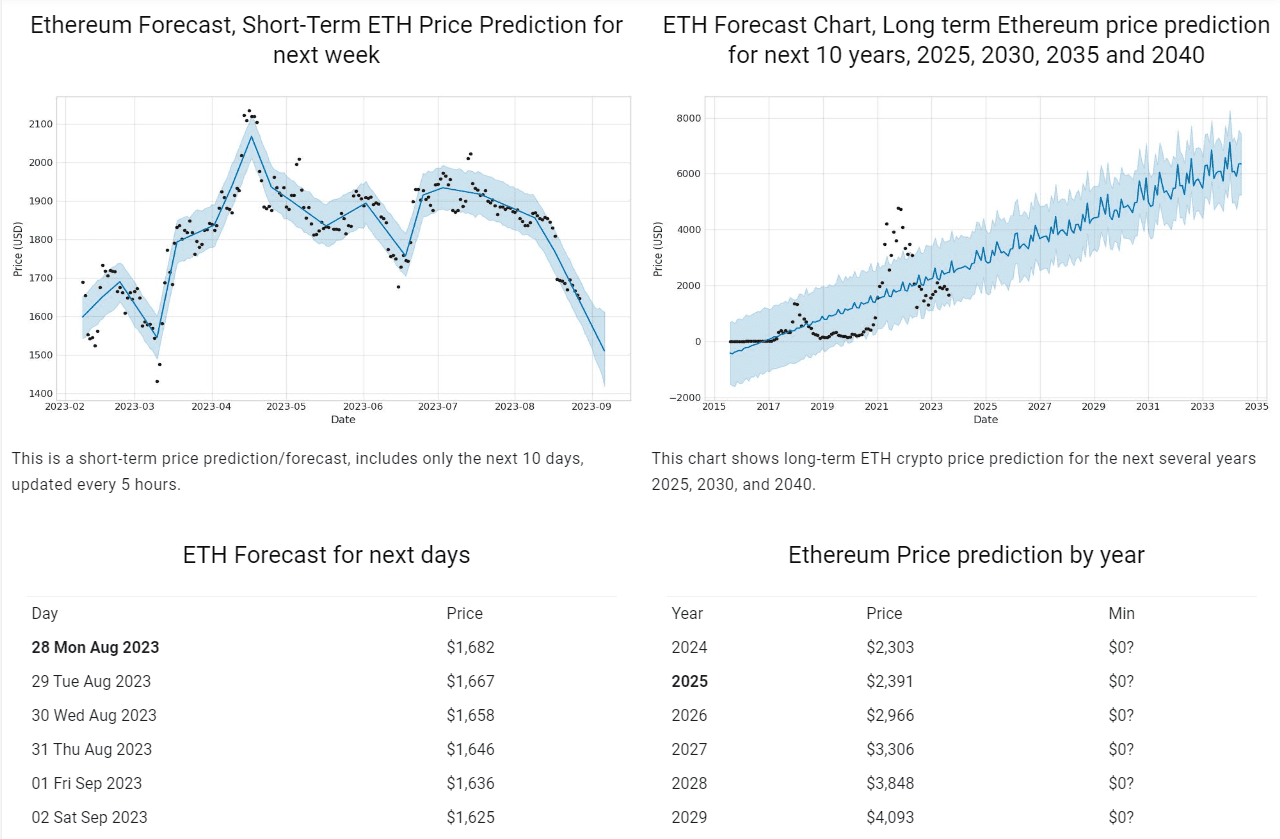

According to the simple sketch I’ve created, Ethereum follows a typical pattern of declining, stabilizing, and then recovering. Notable moments include instances of consistent fluctuations with minimal price stability. Referring to the graph representing the past year, it’s evident that Ethereum is poised to maintain its price for a while. Therefore, prepare for price stability, possibly lasting for 2-3 months. My credibility lies in my crypto portfolio’s growth, which is up 80% this year, compared to 120% last year. This trajectory indicates a similar outcome to the previous year. In 2021, my returns were 102%, and in 2020, it reached 246.19%. Preceding years averaged around 20%-30% in the stock market (annually). Keep in mind, crypto assets comprise only about 30% of my portfolio, starting at less than 5%.

Enough about me; let’s return to the topic at hand:

To diversify opinions, according to leading Ethereum price predictors, their forecasts for the next few days generally lean towards:

During this bear run, the wisest course of action is to hold. Avoid active trading and allow your assets to rest until the bull market resurfaces. Keep an eye on the news to ensure you don’t miss a potential surge. While the preceding analysis suggests a decline in price over time, I personally predict it will maintain its value within a $100 range.

Speaking of individual financial decisions, here are a few additional statistics to bolster a more comprehensive portfolio analysis:

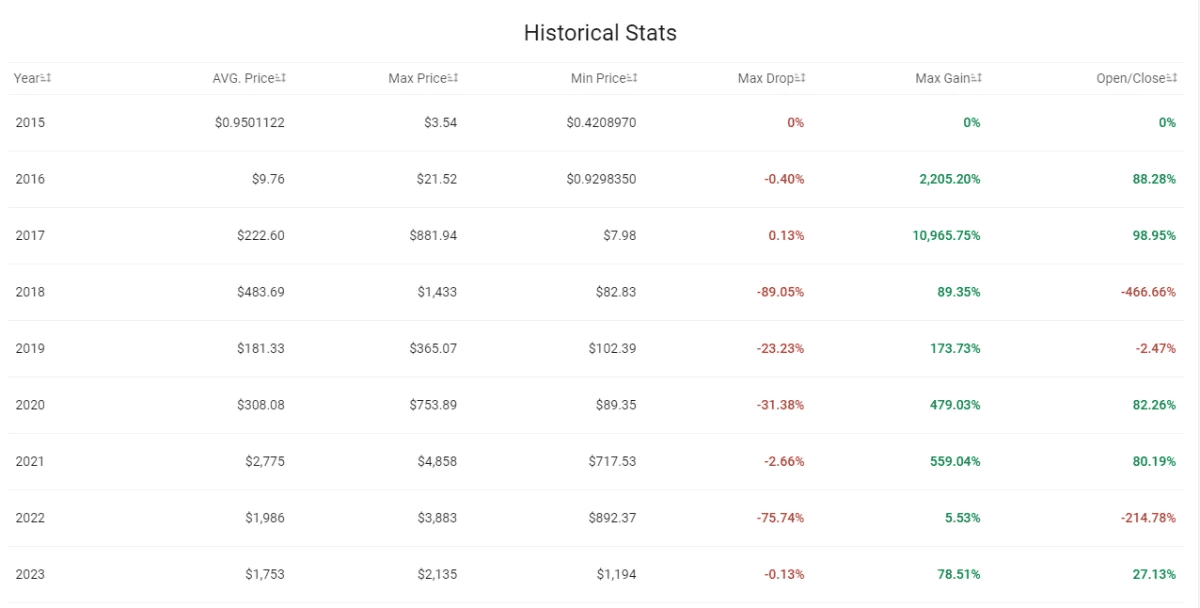

Historical Annual Statistics:

Interestingly, last year and 2018 share a common trait: unpredictability. If we follow the trend of the past few years, we could surpass the current price within the next several months.

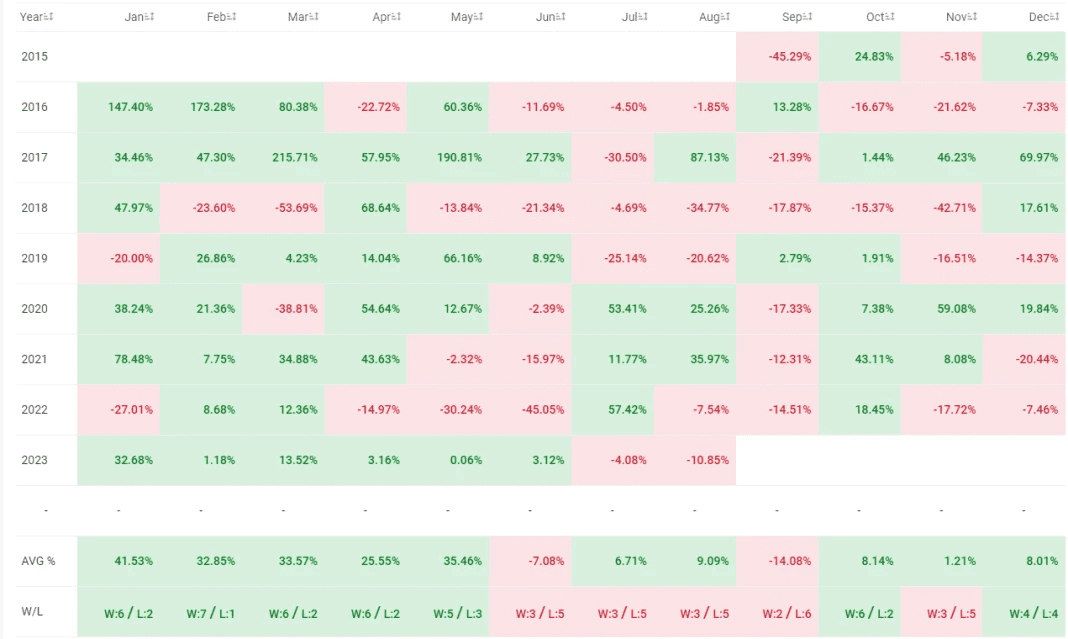

Monthly Statistics:

The graph above clearly illustrates seasonal fluctuations over time. Almost every July, September, and November yields negative returns. With September approaching, it’s uncertain how severe the situation might become. Our performance has been lackluster in every September except for 2016 and 2018—both years when crypto garnered significant global media attention as the impending financial revolution. Presently, the outlook for crypto isn’t favorable, a reality I deeply dislike, but it’s the truth. To make the most profitable choice, consider shorting Ethereum; that’s what I would do, at least. Utilize the data above and available online resources to inform your decision. The best long-term strategy is to hold and buy, while the optimal short-term decision likely involves shorting it, if feasible (though few individuals are well-versed in shorting crypto without incurring substantial fees—I count myself among them, humorously enough).

That concludes today’s discussion.