Maximizing Profits from Crypto Futures Trading: Expert Tips for Optimizing Funding Rates

Introduction

Funding rates are periodic payments between traders based on the difference between perpetual contracts and spot prices. This guide explores how to leverage crypto funding rates for passive income.

Understanding Crypto Futures and Funding Rates

What Are Crypto Futures?

Cryptocurrency futures involve buying or selling an asset at a future date or time with leverage, aimed at speculating on the future price.

How Funding Rates Work

Funding rates are payments exchanged between buyers and sellers of perpetual futures contracts, calculated based on the difference between the contract and spot prices. These rates keep the perpetual futures contract price close to the spot price.

The Roles of Funding Rates in Profitability

Cost of Holding Positions

Funding rates can affect the cost of holding positions, influencing whether long or short positions are more costly or profitable.

Influence on Trading Strategies

Funding rates impact trading strategies by affecting short-term trading versus long-term holding. High rates can encourage scalping, while negative rates might promote long-side positions.

Market Sentiment Indicators

Positive funding rates often signal bullish sentiment, while negative rates suggest bearish market conditions. These indicators help in devising contrarian strategies.

Risk Management

Effective risk management is crucial as funding rate costs can outweigh potential gains. Adjusting positions based on funding rates helps mitigate risks.

Opportunity Costs

Funding rates create opportunity costs, influencing capital allocation decisions. A strategic approach to funding rates can enhance overall returns.

Cheap Remote Crypto Mining for you – Click Here

Strategies for Making Profits from Funding Rates

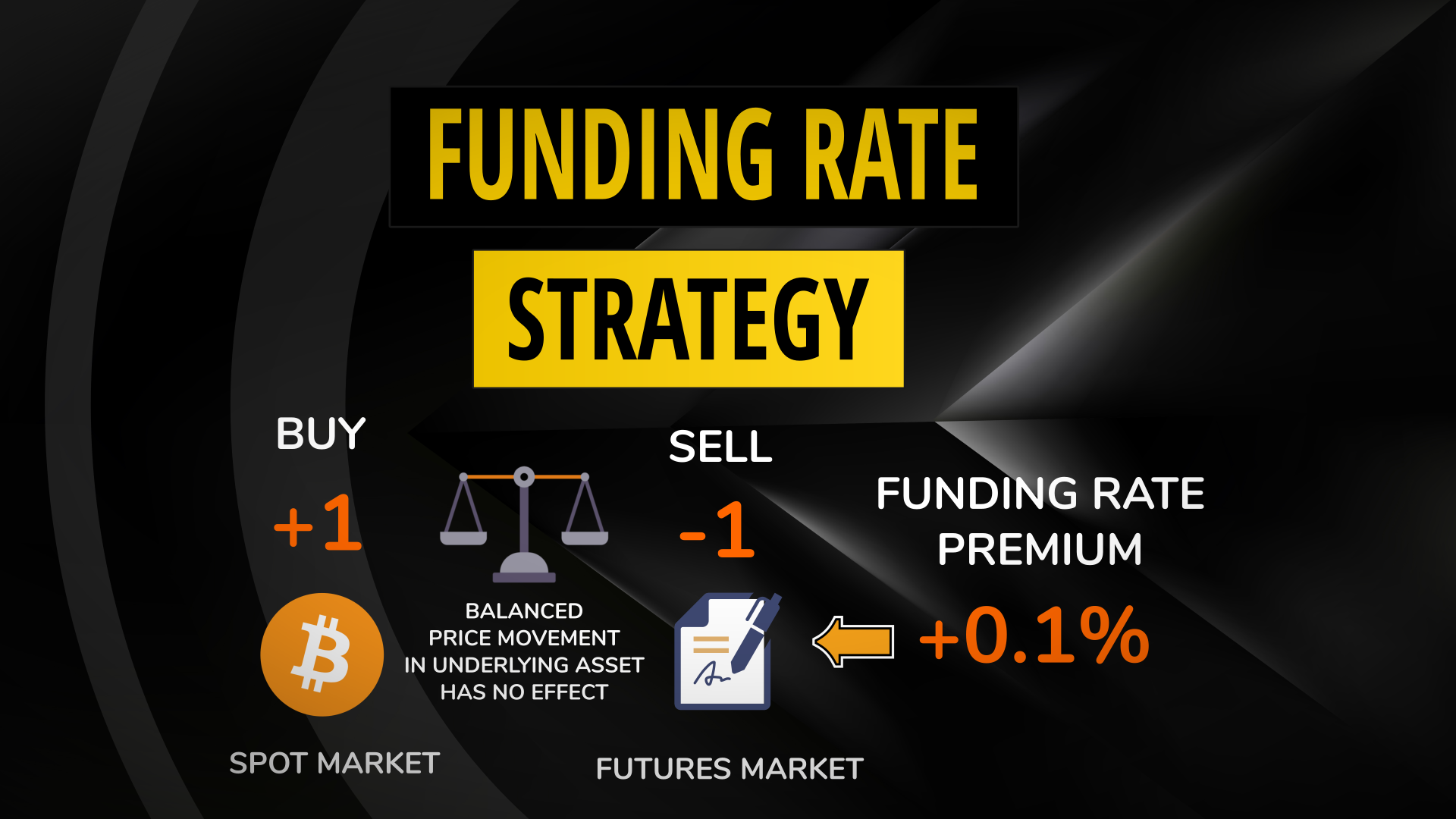

1. Cash and Carry Arbitrage

What It Is: Exploiting differences between spot and futures prices to earn funding payments. How It Works: Buy in the spot market and sell futures contracts to capture funding payments. Risk Consideration: Volatility can affect profitability.

2. Market-Neutral Strategies

What It Is: Profiting from funding rates while avoiding directional risk. How It Works: Open long and short positions across platforms or exchanges to collect funding payments. Risk Consideration: Liquidity and fee changes can impact profitability.

3. Long-Term Holding in a Negative Funding Rate Environment

What It Is: Earning income from negative funding rates while holding long positions. How It Works: Go long in markets with stable or trending assets and consistently negative funding rates. Risk Factor: Sudden market reversals can offset funding income.

4. Funding Rate Reversal-Based Short-Term Trading

What It Is: Using extreme funding rates as signals for market sentiment reversals. How It Works: Short when rates are excessively positive or go long when rates are extremely negative. Risk: Reliant on accurate market timing; potential losses if reversals do not occur.

5. Yield Enhancement in a Stable Market

What It Is: Generating income through funding rates in low-volatility markets. How It Works: Hold positions in stable markets to receive regular funding payments. Consideration: Adverse market movements can impact profitability.

6. Leveraged Funding Rate Arbitrage

What It Is: Using leverage to increase returns from funding rate payments. How It Works: Amplify position size to gain more from favorable funding rates. Risk: Increased potential for losses due to leverage; proper risk management is essential.

7. Speculation with Funding Rate

What It Is: Predicting changes in funding rates to benefit from market sentiment shifts. How It Works: Position based on anticipated changes in funding rates. Risk Consideration: Requires advanced market knowledge; incorrect predictions can lead to losses.

Conclusion

Profiting from crypto futures funding rates involves balancing market conditions, risk management, and strategic timing. By understanding and leveraging funding rates, traders can enhance their profitability while managing risks effectively. Regular monitoring and adaptive strategies are key to success in the dynamic world of crypto futures trading.