A Straightforward Approach to Making Money through Crypto Arbitrage

Introduction

In the dynamic realm of Bitcoin, traders are constantly seeking methods to increase profits while minimizing risks. A fascinating and potentially lucrative tactic is known as “crypto arbitrage.” By using this technique, traders can profit from variations in digital asset prices across exchanges. But how does it operate, and how can you profit from it? This article covers the fundamentals of cryptocurrency arbitrage, how it works, and how to get started using it to generate additional income.

Understanding Crypto Arbitrage

What is Crypto Arbitrage?

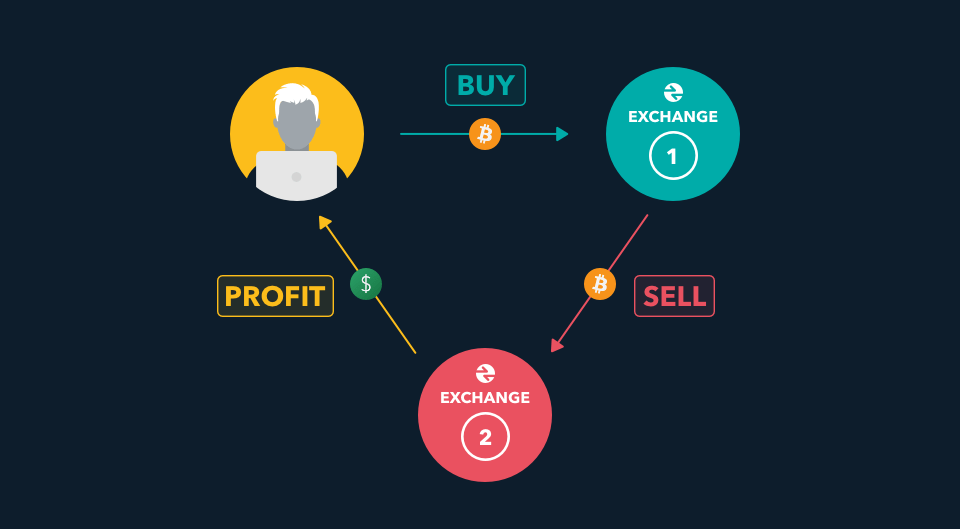

“Crypto arbitrage” is a trading strategy where you can profit by purchasing a cryptocurrency at a lower price on one exchange and selling it for a higher price on another. This price difference occurs because cryptocurrency marketplaces are decentralized, meaning each exchange sets its prices. This decentralization opens up profit potential as prices fluctuate across different exchanges.

How Does It Work?

In cryptocurrency marketplaces, the price of a cryptocurrency is determined by the amount each exchange is willing to buy or sell it for. This means that a cryptocurrency like Bitcoin may have a variable price on each exchange. For instance, if more users wish to buy Bitcoin on one exchange, the price will increase on that platform. Conversely, if more users seek to sell Bitcoin on another exchange, the price will drop. Traders can profit from these variations by purchasing low on one exchange and selling high on another.

The Arbitrage Method

Step 1: Identify Price Differentials

To start, identify a cryptocurrency price differential (using Bitcoin as an example) between two distinct platforms, such as Coinbase and Kraken. Purchase the cryptocurrency on the less expensive platform and promptly sell it on the more expensive platform. After deducting any fees, you keep the profit from the price difference. This method is similar to buying an item on sale in one store and selling it for more money in another.

Step 2: Types of Crypto Arbitrage

- Spatial Arbitrage: Buy a cryptocurrency from one exchange and sell it on another.

- Triangular Arbitrage: This involves trading three different cryptocurrencies, usually on a single exchange, to profit from the price differences. For example, trade Bitcoin for Ethereum, Ethereum for Litecoin, and then Litecoin back to Bitcoin, profiting from the price differences between these trades.

- Statistical Arbitrage: A strategy that uses mathematical models to identify price discrepancies across different markets, often using robots and algorithms to execute trades.

Steps to Start Crypto Arbitrage

1. Create Accounts on Various Exchanges

To begin arbitrage, open accounts on several cryptocurrency exchanges. The more exchanges you can access, the more opportunities you’ll have to discover pricing disparities. Start with well-known exchanges like Kraken, Binance, and Coinbase. Smaller exchanges with lower trading volumes may have larger price disparities but could also carry more risks.

2. Fund Your Accounts

Once your accounts are set up, deposit money into them. Having funds readily available across all your accounts is essential for quick arbitrage opportunities. Consider spreading your wealth across different exchanges to ensure you can quickly capitalize on new chances. Keep in mind that transferring funds between exchanges can take time and incur fees.

3. Monitor Prices on Various Exchanges

Monitor cryptocurrency prices on various exchanges to spot potential arbitrage opportunities. There are several approaches to this:

- Manual Monitoring: Independently monitor prices, though this can be laborious.

- Arbitrage Bots: Automated bots can locate and execute arbitrage transactions by checking multiple exchanges simultaneously.

- Crypto Aggregators: Use aggregators like CoinMarketCap, CoinGecko, and CryptoCompare for real-time price comparisons across exchanges.

4. Execute the Trade

Once you identify an arbitrage opportunity, act quickly. Speed is critical due to the fast-changing nature of cryptocurrency prices. Consider transaction fees (trading, deposit, and withdrawal fees) and other factors like transfer times and liquidity that could impact profitability.

5. Repeat the Process

Crypto arbitrage is a continuous endeavor. As you gain experience, you’ll become more adept at spotting opportunities and managing risks. You’ll eventually develop a customized trading strategy that works best for you, whether that involves focusing on specific coins or exchanges or using bots to automate trades.

Risks and Challenges of Crypto Arbitrage

1. Market Volatility

Cryptocurrency markets are known for sharp price swings. Arbitrage opportunities can disappear in an instant if prices move before trades are completed, leading to potential losses.

2. Transfer Times

Moving funds between exchanges takes time, during which the price differential could narrow or vanish entirely. Some traders mitigate this risk by keeping funds on multiple exchanges.

3. Fees and Liquidity

Transaction fees and low liquidity on smaller exchanges can impact profitability. Always factor in these costs when determining if an arbitrage opportunity is worthwhile.

4. Regulatory Risks

Different countries have varying laws and regulations regarding cryptocurrency trading. Trading on exchanges operating in unregulated environments can be risky, especially if an exchange shuts down or regulations change suddenly.

Advanced Tips for Profitable Crypto Arbitrage

1. Start Small

Beginners should start with small amounts to understand the process without taking significant risks.

2. Use Advanced Monitoring Tools

Managing multiple accounts on different exchanges can be challenging. Consider using an advanced cryptocurrency portfolio tracker to streamline the tracking of assets and earnings.

3. Stay Informed

Keep up with market dynamics, regulatory changes, new coin releases, and other factors that could affect arbitrage opportunities. Staying informed is crucial for making smart and well-informed decisions.

4. Consider Automation

Using bots or automation tools can make finding and executing arbitrage deals more efficient. However, thoroughly understand how these tools work and conduct extensive testing with small investments before relying on them.

Conclusion

In conclusion, crypto arbitrage offers a unique opportunity to profit from inefficiencies in cryptocurrency markets. By exploiting price differentials across platforms, traders can generate consistent returns. However, like any trading strategy, cryptocurrency arbitrage comes with its own set of risks and challenges. Success in this field requires unwavering diligence, perseverance, and a proactive approach to market monitoring and education. By following the steps outlined in this article, you’ll be better positioned to succeed in crypto arbitrage.