We often associate cryptocurrency investments with the pursuit of instant wealth through short-term trades or the crafting of long-term passive income strategies. However, given the relative youth of blockchain technology and the volatility of cryptocurrencies, many remain skeptical. Few would consider linking it to savings for their children. Yet, this perspective holds merit. Why? Let’s delve into this in our latest piece.

Cryptocurrency for Children

A recent study by the Pew Research Center reveals that while about 90% of Americans are familiar with cryptocurrency, most harbor uncertainties regarding its security. Despite this, approximately 40% of U.S. citizens owned crypto assets by 2024.

Saving for children’s future is a common practice, with many parents opening bank accounts for purposes such as funding college education, purchasing property, or acquiring a vehicle. Recently, decentralized systems have complemented traditional ones. Adults are not only creating crypto wallets to transfer money to their children but also to impart skills in handling cryptocurrencies and navigating the digital market. This positive attitude toward crypto assets mirrors a global trend of widespread adoption.

Invest and Forget

The primary reason for choosing cryptocurrencies as a financial cushion is the devaluation of traditional currency, supplemented by the active development of the decentralized sector. Even during the challenging crypto winter of 2023, many investors remained hesitant to return to the traditional centralized market.

For most parents, cryptocurrency deposits offer convenience from a “set it and forget it” standpoint. While crypto exchanges provide various services for swift and comfortable transactions, they may not be suitable for daily use by the average user.

For those not involved in crypto trading or entrepreneurship, entering the Crypto World may not be a priority. However, for many, keeping money in a crypto account serves as a shield against temptation. Cash transactions or fund transfers from digital accounts are more straightforward and familiar than crypto transactions for fiat withdrawal.

How Children Advance Cryptocurrency?

The same study highlights several key points:

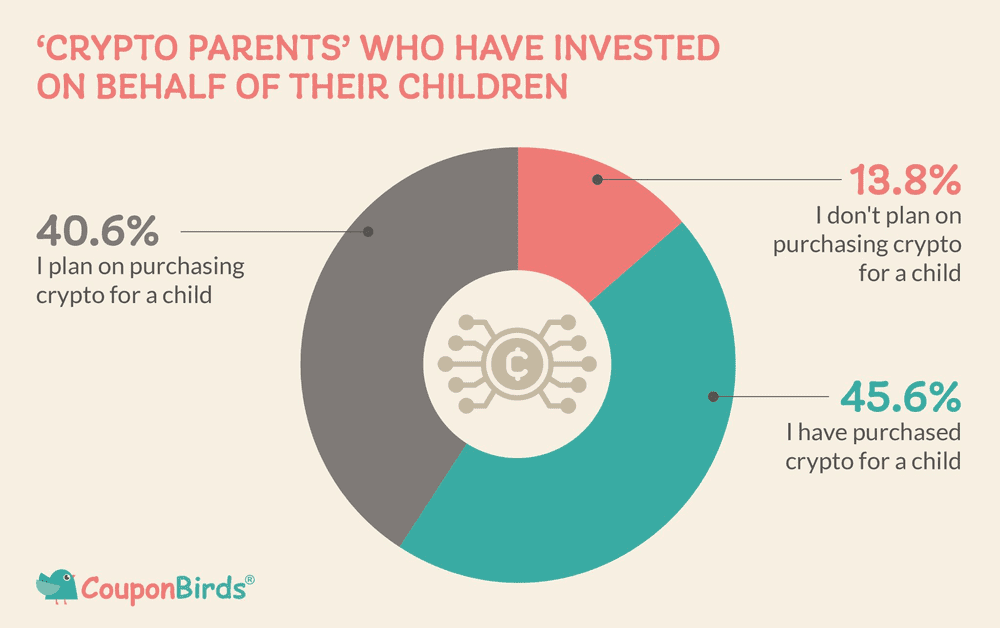

- Over 45% of U.S. parents have acquired crypto assets as an investment for their children’s future.

- Another 40% plan to invest specifically for their children.

- Parents primarily invest in crypto assets due to the belief in their future value appreciation and the depreciation of traditional currency.

- Over 80% of parents are confident that cryptocurrencies will see increased demand in the future.

In light of these findings, analysts suggest that children are becoming catalysts for promoting cryptocurrencies worldwide. Concern for their future drives parents to explore decentralized finance, even those initially uninterested in crypto trading.

Top 5 Reasons Why Parents Should Invest in Cryptocurrency Now

Long-Term Potential of Cryptocurrencies

Given the unstable global economic situation, trust in traditional monetary systems has waned. Many users are shifting towards decentralized digital finance or opting to store savings in both formats. Some crypto investment experts view crypto assets as ideal long-term investments, potentially held for at least a decade.

Financial Literacy and Education of Future Generations

Modern parents aim not only to provide for their children but also to equip them with essential skills. As cryptocurrencies become increasingly integrated into our lives, imparting knowledge about them becomes crucial for future financial literacy.

The Perfect Scarcity

Unlike traditional currencies, cryptocurrencies have a limited issuance. This scarcity incentivizes leveraging their benefits while the opportunity exists. Analysts like Frank Corva from Finder speak optimistically about investing in Bitcoin, foreseeing significant price increases by 2030 due to the finite number of coins.

Increase in Returns

Diversifying assets across various channels is prudent for passive income. Even small investments can yield returns over time, with minimal risk and secure storage.

Expansion of Horizons in the Future

While traditional strategies like investing in real estate or education endure, cryptocurrencies introduce new, unexplored prospects. Parents aspire to provide the best for their children, and the crypto industry may hold promising opportunities.

Conclusion

The reasons for integrating cryptocurrencies into a financial strategy for the next generation are multifaceted. From potential long-term growth to the opportunity for financial education, cryptocurrencies offer avenues for both financial security and educational advancement. Moreover, the limited supply of certain cryptocurrencies adds an element of scarcity that can drive value over time. As cryptocurrencies continue to integrate into our lives, their influence strengthens year by year.