In a daring foresight, Standard Chartered, the British multinational banking titan, envisions a substantial surge in Bitcoin’s worth, prognosticating a climb to $100,000 by the termination of 2024.

Witnessing Bitcoin’s remarkable resurgence throughout this year, the bank discerns the inception of what they term as the ‘crypto spring.’

This epoch of revitalized vigor in the cryptocurrency realm has instilled hope, prompting Standard Chartered to set a formidable target for Bitcoin’s forthcoming valuation.

Bitcoin Exceeds $38,200, StanChart Envisions $100K by 2024

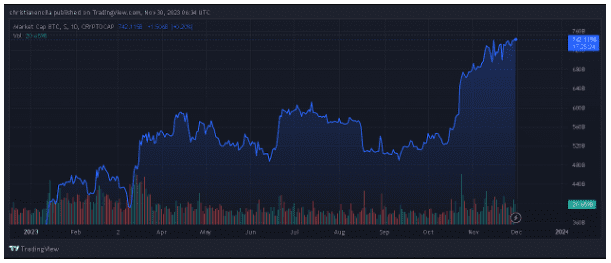

The globe’s most extensive cryptocurrency, Bitcoin, rekindled interest from institutional investors this week as its value surpassed $38,200 on November 29.

Geoff Kendrick, Head of Crypto Research at Standard Chartered Bank, reiterates the company’s bullish prognosis that Bitcoin’s price may ascend to $100,000 in 2024.

This projection extends from the bank’s April outlook for this year. The April analysis posited that several factors propelling Bitcoin beyond $100,000 are already in play, asserting that the crypto winter has concluded.

The report underscores that in March of this year, there was turmoil in the financial system, contributing to the “re-establishment” of Bitcoin’s role as a decentralized, scarce digital currency.

Kendrick and the Standard team express optimism that the US government’s approval of multiple spot Bitcoin ETFs will serve as the next impetus for cryptocurrency growth, and these advancements are anticipated sooner than initially expected.

Moreover, Standard Chartered emphasizes another factor that could drive future price hikes: the impending Bitcoin “halving,” projected to constrain the currency’s supply, set to unfold in late April 2024.

With its headquarters situated in London, Standard Chartered caters to a global clientele comprising both individual and corporate customers. Although it does not provide retail banking services in the United Kingdom, its multibillion-dollar operations spanning Asia, Africa, and the Middle East position it as one of the planet’s most substantial financial enterprises.

And it is precisely due to this pivotal role in the global financial system that Standard Chartered’s optimistic prediction for Bitcoin earlier this month becomes all the more intriguing.

Record Hash Rate and Market Maturity Validate Standard’s Rosy Prognosis

Bitcoin’s hash rate, measuring the processing power miners employ to secure the network, recently achieving an all-time high, corroborates Standard Chartered’s optimistic stance.

Simultaneously, recent on-chain data from IntoTheBlock indicates that the Bitcoin market demonstrates signs of growing maturity and stability compared to large-cap stocks and index funds.

Standard Chartered’s anticipation of a Bitcoin price surge gains validation as Bitcoin undergoes a remarkable 130 percent surge in 2023. According to the bank, everything unfolds as anticipated.

BTC’s dominance in the digital assets market remains robust, escalating from 45 percent in April to a current 50 percent share of the overall market cap.

Bernstein analysts echo Standard Chartered’s optimism, predicting that Bitcoin might soar to $150,000 by mid-2025 for similar supply-related reasons.

Institutional Investment on the Horizon: A Game-Changing Proposition

“We think that a number of spot ETFs will now be approved in the first quarter of 2024 for both Bitcoin and Ethereum, setting the stage for institutional investment,” they said.

Readers are advised that the content of this site should not be construed as investment advice. Investing involves risk, and when you invest, your capital is subject to risk.