Bitcoin Hash Price Reaches New Low: Is It a Strong Buy Signal?

Bitcoin, the largest cryptocurrency by market capitalization, has been struggling in recent weeks. After failing to sustain its upward momentum, Bitcoin slipped below the crucial $60,000 mark in August, currently trading around $59,131. This drop has sparked speculation that Bitcoin may be nearing a market bottom, signaling a possible buying opportunity for investors. On-chain metrics offer some support for this viewpoint.

Understanding Bitcoin’s Hash Price and Its Implications

The Bitcoin hash price is a key metric to gauge the market’s potential. It represents the one-day revenue earned by Bitcoin miners for each terahash per second of computational power. To calculate the hash price, the total daily revenue that miners make is divided by the hash rate of the network. Essentially, the hash price indicates the profitability of Bitcoin mining, showing how much a miner can expect to earn from their efforts to maintain the network.

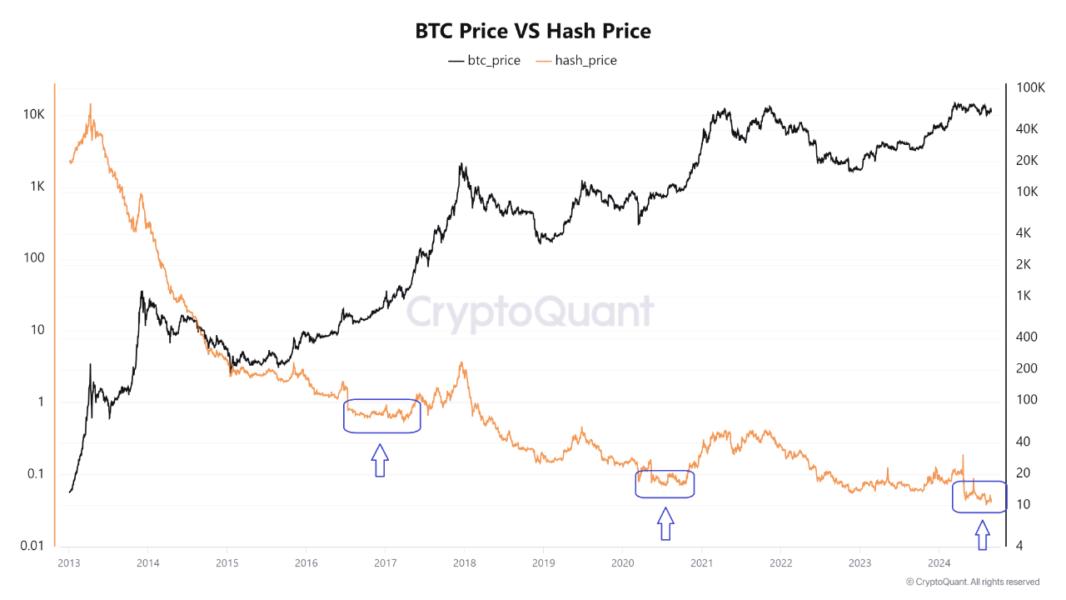

A pseudonymous analyst recently pointed out that Bitcoin’s hash price could signal a potential buying opportunity, noting that when the hash price hits low levels, it often coincides with Bitcoin reaching or nearing its bottom. Historically, low hash prices have aligned with Bitcoin price bottoms, which are then followed by rebounds.

Current State of Bitcoin Hash Price

Recent data shows that Bitcoin’s hash price has plummeted to below $0.1, the lowest level since 2023. This steep decline suggests that the difficulty in producing new Bitcoin has dropped significantly, possibly indicating that the market is near its bottom. Typically, a low hash price has signaled the end of bearish phases, with subsequent recoveries in the hash price reflecting rising Bitcoin prices.

Low hash prices mean miners earn less per unit of computational power, potentially reducing mining activities if sustained. However, it also suggests that Bitcoin may be undervalued at its current price, presenting a buying opportunity for investors who anticipate a market rebound.

Market Cycles: Bitcoin’s Bear vs. Bull Phases

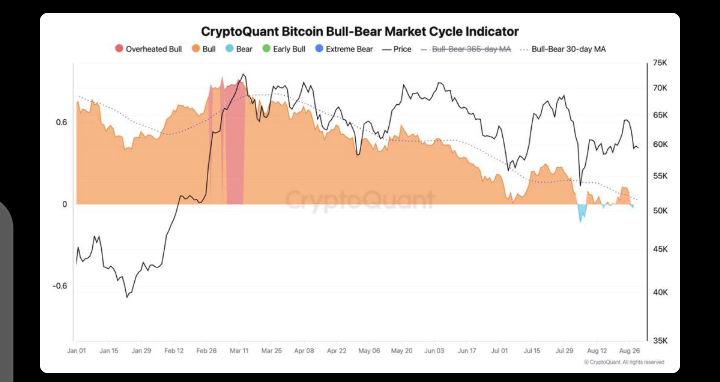

Broader market indicators, alongside hash price analysis, provide insights into Bitcoin’s overall market cycle. According to Julio Moreno, head of research at CryptoQuant, Bitcoin is currently in a bear phase. This market cycle indicator has fluctuated between bull and bear phases in recent weeks, reflecting the market’s volatility.

Moreno warns that if Bitcoin prices drop below the $56,000 level, it could trigger a more significant correction, pushing prices even lower. This highlights the importance of closely monitoring key support and resistance levels.

The Broader Implications of Bitcoin’s Hash Price and Market Cycles

The relationship between Bitcoin’s hash price and market cycles can provide clues about the current market state and potential future trends. Hash price serves as a proxy for miner sentiment and profitability, which can influence Bitcoin’s market direction. A low hash price indicates less profitability in mining, which could reduce the number of active miners, limiting the supply of new Bitcoins and potentially driving up demand and prices.

Possible Scenarios for Bitcoin Value in the Short Term

Given the current market conditions, several scenarios could unfold for Bitcoin in the coming weeks, depending on the market’s response to the current hash price and ongoing bear phase:

- Scenario 1: A Bounce from the Current Bottom

Bitcoin may stabilize around current levels, potentially rebounding if investor sentiment improves and demand increases. This scenario aligns with historical patterns where low hash prices preceded significant price recoveries. - Scenario 2: Prolonged Decline, Market Correction

If Bitcoin fails to hold key support levels, particularly the $56,000 mark, it could lead to a deeper market correction. Negative investor sentiment, external factors like unfavorable macroeconomic events, and regulatory challenges could exacerbate this decline. - Scenario 3: Prolonged Consolidation

Bitcoin could enter a phase of consolidation, trading within a narrow range as the market waits for clearer signals. This period of balance may persist until a significant catalyst prompts a more decisive movement in price.

Key Factors to Watch in the Coming Weeks

To navigate these potential scenarios, investors should monitor several key factors:

- Hash Price Movements

Significant changes in hash price could indicate shifts in miner behavior and market sentiment. A rise in hash prices may suggest optimism about future price movements. - Market Cycle Indicators

Watch for shifts between bull and bear phases, particularly about key support and resistance levels. - Macroeconomic Developments

Economic trends, such as interest rates, inflation, and global financial stability, will influence investor sentiment and market dynamics. - Regulatory Environment

Regulation changes could significantly impact Bitcoin’s trajectory. Investors should stay informed about regulatory developments affecting market access and investor confidence. - Investor Sentiment

As reflected in trading volumes, liquidity, and social media activity, market sentiment will be crucial in determining Bitcoin’s price movements.

Cheap Remote Crypto Mining for you – Click Here

Conclusion: Time to Buy Bitcoin?

Whether now is the right time to buy Bitcoin depends on individual risk tolerance, investment horizon, and market outlook. The low hash price and historical patterns suggest Bitcoin might be near a market bottom, offering a potential buying opportunity for long-term investors. However, the ongoing bear phase and the risk of further price declines warrant caution.

Investors should consider their financial situation and investment goals before making decisions. Those with a long-term perspective and high-risk tolerance may view current conditions as a chance to accumulate Bitcoin at lower prices. At the same time, those with a shorter-term focus or lower risk tolerance might wait for more concrete signs of market recovery.

In the ever-volatile and unpredictable cryptocurrency market, preparedness, and informed strategies are essential for navigating the changing landscape.