Bitcoin Hits $109.7k, but Traders Doubt Momentum

Bitcoin surged closer to its all-time high today, but multiple data factors indicate that professional traders are not fully on board. Bitcoin climbed beyond $109,000 on Wednesday, after briefly retesting the $105,200 support level earlier that day. The increase coincided with data indicating monetary growth in the eurozone and hints of weakening in the US job sector.

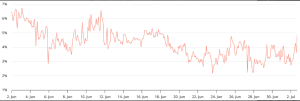

BTC 1-month futures annualized premium. Source: laevitas.ch

Traders Remain Cautious Despite Price Surge

Despite its trading only 2% below its all-time high, traders are hesitant to turn optimistic, according to BTC derivatives measures. This cautious posture has prompted some investors to question the rally’s viability.

BTC Futures Premium Signals Doubt

As of Wednesday, 2nd June, 2025, the BTC futures premium stayed below the 5% neutral level. The tiny uptick from 4% on Monday extended a trend that began on June 11, when the indicator previously touched positive territory, coinciding with Bitcoin’s previous challenge over $110,000.

Macroeconomic Factors Behind Bitcoin’s Movement

Although it is impossible to pinpoint a single cause for Wednesday’s advance, the eurozone’s record-high broad money supply (M2) in April is likely to have played a substantial role.

The Monday stats indicate a 2.7% year-over-year increase, consistent with the US monetary base trajectory. Meanwhile, a report by the ADC indicates that US private payrolls declined by 33,000 in June.

Economic Uncertainty Impacts Trader Sentiment

Some major market players believe that the low demand for leveraged long positions in Bitcoin indicates increased economic crisis concerns, particularly in the context of an increasing global trade war. US President Donald Trump has threatened to hike import duties on Japanese goods by more than 30% if no agreement is reached by the July 9 deadline.

According to the Financial Times, Eurozone diplomats have urged EU Trade Commissioner Maroš Šefčovič to take a stronger position during his visit to Washington this week. European cities have allegedly advocated for a drop in the existing 10% reciprocal tax; however, internal debates remain over whether to react.

Options Market and Tether Discount Signal Investor Anxiety

To evaluate whether the lack of interest in Bitcoin derivatives is restricted to futures, look at the BTC options markets. If traders expected a steep drop, the 25% delta skew would exceed 6%, since put (sell) options would command a premium over call (buy) options.

BTC 1-month options delta skew (put-call) at Deribit. Source: laevitas.ch

The Tether discount relative to the official US dollar exchange rate in China often indicates concern, since it represents investors exiting crypto marketplaces. The current 1% discount is the most since mid-May, demonstrating a lack of faith in Bitcoin’s recent advances.

ETF Outflows Reflect Market Tensions

Crypto traders are getting anxious about the result of the tariff battle with the US President, Donald Trump, particularly in the aspect of Tuesday’s $342 million net outflow from spot Bitcoin exchange-traded funds (ETFs). As a result, low activity in the derivatives market reflects larger macroeconomic uncertainties.

Ready to Start Mining Safely?

VoskCoin offers an affordable, verified, and transparent cloud mining solution for both beginners and experienced miners:

✅ Start Mining Today with VoskCoin

✅ Real ASIC Miner | Verifiable Payouts | Verifiable Payout Reviews

VoskCoin Mining Profitability

Co-rent Real ASIC Hashrate from the VoskCoin Mining Farm.

Contract Profitability

| What You Mine: | N/A |

|---|---|

| Coin Price: | N/A |

| Total Mining Power: | N/A |

| Mining Duration: | N/A |

| Daily Mining Reward: | N/A |

| Total Mining Reward: | N/A |