Bitcoin Miners Face 11-Month Profit Low Amid Rising Mining Difficulty

Introduction

Bitcoin mining, once a lucrative industry, is currently facing its worst revenue period in 11 months. This decline, recorded in August 2024, can be attributed to increased mining difficulty, decreased transaction volume, and the ongoing effects of Bitcoin’s halving. This article explores these factors, the miners’ responses, and what it means for the future of Bitcoin mining.

August 2024: A Bleak Month for Bitcoin Miners

Revenue Decline

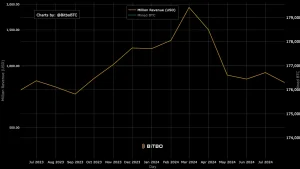

In August 2024, Bitcoin miners earned $827.56 million, marking a 10.5% decline from July’s $927.35 million. This decline follows a peak revenue of $1.93 billion in March 2024. Despite the drop, August’s revenue was still 5% higher compared to August 2023. Bitcoin’s price increase from $25,000 in September 2023 to $57,315 in August 2024 partly explains this increase.

Mining Difficulty Increase

Record High Difficulty

Mining difficulty reached a record high of 89.47 trillion in August 2024, up from 86.87 trillion in July. This increase makes it harder for miners to solve the complex algorithms required to mine new Bitcoin, raising operational costs and reducing profit margins. Miners collectively mined 13,843 BTC in August, down from 14,725 BTC in July.

Cheap Remote Crypto Mining for you – Click Here

Plummeting Transaction Volumes And Fees

Transaction Fee Decline

Transaction volumes have decreased, with median fees dropping to just 2% in August. The daily confirmed transaction average also fell to 594,871, down from a peak of 631,648. Lower transaction fees, coupled with reduced block rewards, impact overall mining profitability.

The Impact of the Bitcoin Halving

Halving Effects

The April 2024 halving reduced the block reward from 6.25 BTC to 3.125 BTC. This reduction in block rewards forces miners to rely more on transaction fees. However, with low transaction volumes and fees, miners struggle to maintain profitability. Future halvings will further pressure miners to enhance operational efficiency or diversify revenue streams.

Adaptation and Innovation among Miners

Diversification Strategies

To cope with these challenges, some miners are repurposing their hardware for AI computing, tapping into new revenue streams. This shift highlights the mining industry’s adaptability, though not all miners can afford such transitions. Small-scale miners may face significant financial strain due to these changes.

Bitcoin Mining in the Future

Future Challenges and Opportunities

The future of Bitcoin mining involves adapting to a more challenging environment, with increased block reward reductions and rising mining difficulty. Renewable energy adoption and advancements in layer-2 solutions could impact mining profitability. Miners must innovate and adapt to stay competitive and profitable.

Conclusion

August 2024 was a challenging month for Bitcoin miners, with significant revenue declines due to increased mining difficulty, reduced transaction volumes, and the recent halving. Despite these obstacles, innovation and adaptation offer pathways for future success. Miners must continue to evolve and embrace new technologies to navigate the shifting landscape and maintain profitability.