Bitcoin Miners Offload Reserves as $100K Price Target Remains Elusive

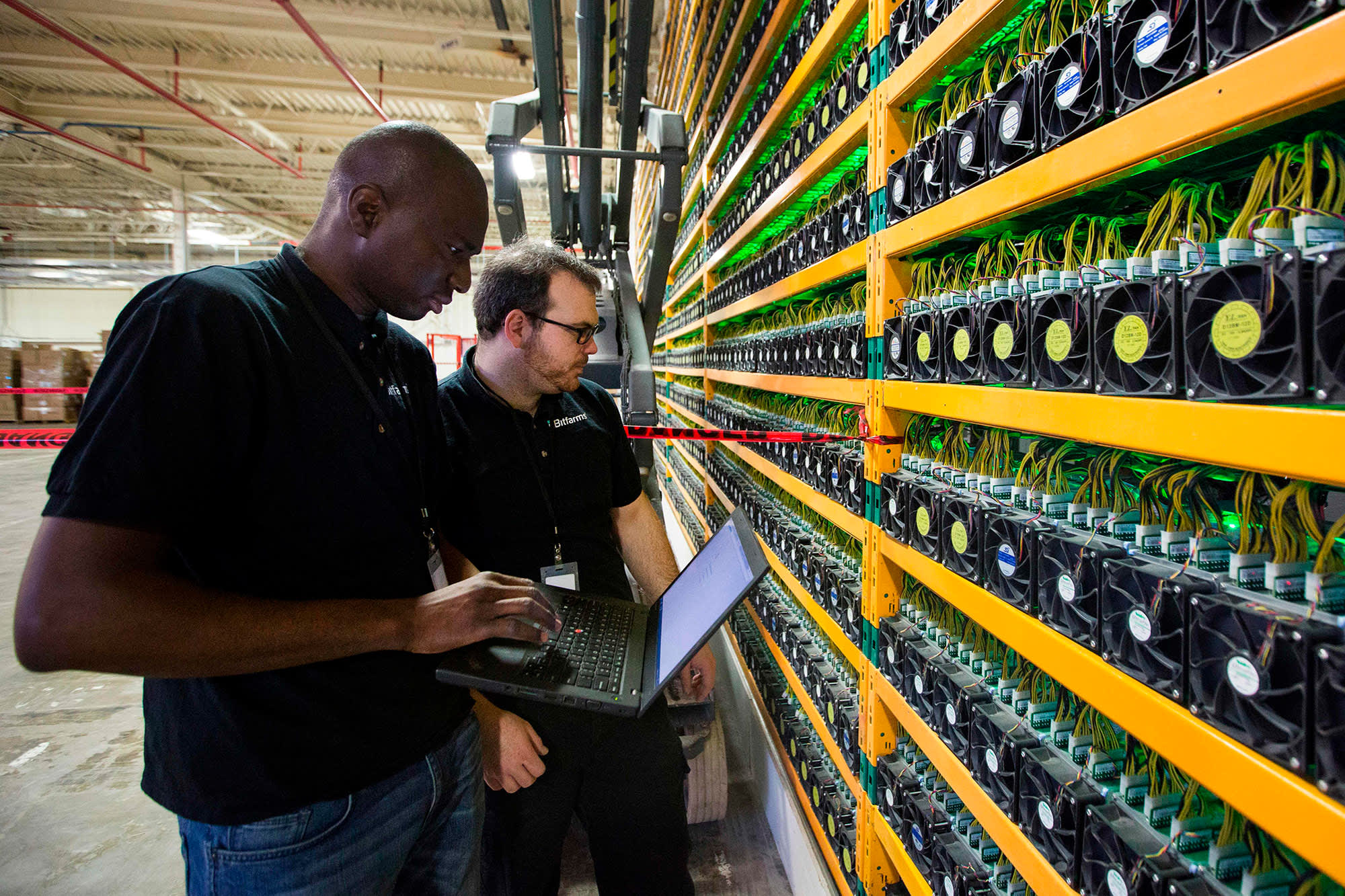

Bitcoin miners, the backbone of the cryptocurrency network, play a crucial role in confirming transactions and securing the blockchain. In return, they receive block rewards and transaction fees in Bitcoin (BTC). However, when miners choose to hold or sell their BTC, it can significantly influence market trends, often triggering either bullish or bearish sentiment.

Recently, a noticeable trend has emerged—miners are offloading significant portions of their reserves. This increased selling pressure is raising questions about Bitcoin’s ability to surpass the long-anticipated $100,000 price milestone. In this article, we’ll explore why miners are selling, the impact on Bitcoin’s price, and what key indicators suggest about the market’s future.

Understanding Miner Reserves and Their Importance

Miner reserves represent the total Bitcoin held by miners essentially, the BTC they’ve chosen not to sell. Monitoring these reserves provides valuable insight into miners’ market sentiment.

- Holding Bitcoin: Indicates confidence in a future price increase.

- Selling Bitcoin: Often signals the need to cover costs, secure profits, or hedge against potential market downturns.

Recent Trends in Miner Reserves

Data reveals that miner reserves have dropped to 1.81 million BTC, marking the lowest point this year. Several factors contribute to this sell-off:

- Profit-Taking: With Bitcoin nearing its all-time high of $99,860, many miners are cashing out to maximize profits.

- Rising Operational Costs: Higher electricity prices and equipment maintenance costs are pressuring miners to sell.

- Market Uncertainty: The psychological barrier at $100,000 has created concerns among miners about a potential price drop, prompting precautionary sales.

Impact of Miner Selling on Bitcoin’s Price

Negative Miner Netflow: A Bearish Indicator

Miner netflow measures the balance of Bitcoin sold versus retained by miners. A negative netflow indicates more BTC is being sold than held, often leading to downward price pressure. Currently, the net flow stands at -1,172 BTC, suggesting significant selling activity.

Why This Matters:

- Market Impact: Large-scale sales can overwhelm buying demand, driving prices down.

- Investor Sentiment: Miner sell-offs may signal potential risks, leading to panic selling by other market participants.

- Volatility Risks: Sudden sales can cause sharp price fluctuations, making the market unpredictable.

Historical Context: Miner Actions During Previous Peaks

In past bull markets, miners strategically sold Bitcoin during peak price rallies:

- 2017: As Bitcoin neared $20,000, miner reserves dropped significantly, contributing to a market correction.

- 2021: When Bitcoin hit $69,000, miners offloaded large volumes, intensifying selling pressure.

These historical patterns underline the importance of monitoring miner activity as a leading market indicator.

Key Technical Indicators and Bitcoin’s Price Outlook

Parabolic SAR Indicator

The Parabolic SAR indicator currently suggests an upward price trend, indicating that recent miner selling hasn’t yet reversed Bitcoin’s momentum.

- Positive Signal: When the indicator is below the price, it suggests continued growth.

- Potential Reversal: A shift above the price could signal a bearish turn.

Additional Indicators to Watch

- Relative Strength Index (RSI): Currently neutral, leaving room for upward movement if buying pressure increases.

- Moving Averages: Bitcoin is trading above its 50-day and 200-day moving averages, signaling a bullish trend.

- Support and Resistance Levels: The $100,000 mark serves as a key resistance point, while $88,986 acts as crucial support.

Future Scenarios: What Lies Ahead for Bitcoin?

Scenario 1: Bitcoin Surpasses $100,000

If Bitcoin breaks the $100,000 barrier, it could trigger a wave of bullish activity:

- Institutional Interest: Continued investments from major players could counteract miner sell-offs.

- Upcoming Halving Event: The 2025 Bitcoin halving may reduce supply and boost prices.

- FOMO Effect: Breaking $100,000 could attract retail investors, driving further demand.

Scenario 2: Price Decline Below $100,000

Prolonged miner selling combined with weak buying demand could push Bitcoin’s price lower:

- Critical Support: If Bitcoin falls below $88,986, it may lead to increased selling pressure.

- Regulatory Concerns: Negative policy developments could dampen market sentiment.

- Economic Challenges: Broader economic uncertainty may weaken investor confidence in Bitcoin.

Top Performing Bitcoin Miners

Explore top Bitcoin miners for maximum profitability.

| Model | Release | Hashrate | Power | Algorithm | Top Coin | Mining Reward | Power Cost | Daily Profit |

|---|---|---|---|---|---|---|---|---|

| Antminer S21e XP Hyd 3U | Jul 2024 | 860 TH/s | 11180 W | SHA-256 | Calculating... | Calculating... | 45.01 USD | |

| Auradine Teraflux AH3880 | Mar 2025 | 600 TH/s | 8700 W | SHA-256 | Calculating... | Calculating... | 30.97 USD | |

| Antminer S21 XP+ Hyd (500Th) | Jul 2025 | 500 TH/s | 5500 W | SHA-256 | Calculating... | Calculating... | 26.65 USD | |

| Antminer S21 XP Hyd (473Th) | Nov 2024 | 473 TH/s | 5676 W | SHA-256 | Calculating... | Calculating... | 24.98 USD | |

| Antminer S19 XP Hyd 3U | Jan 2025 | 512 TH/s | 10600 W | SHA-256 | Calculating... | Calculating... | 24.91 USD | |

| MicroBT WhatsMiner M63S++ | Dec 2024 | 478 TH/s | 10000 W | SHA-256 | Calculating... | Calculating... | 23.20 USD | |

| Bitdeer SealMiner A2 Hyd | Mar 2025 | 446 TH/s | 7360 W | SHA-256 | Calculating... | Calculating... | 22.59 USD | |

| Antminer S21e XP Hyd (430Th) | Nov 2024 | 430 TH/s | 5590 W | SHA-256 | Calculating... | Calculating... | 22.51 USD | |

| MicroBT WhatsMiner M63S+ | Aug 2024 | 424 TH/s | 7208 W | SHA-256 | Calculating... | Calculating... | 21.38 USD | |

| MicroBT WhatsMiner M63S | Nov 2023 | 390 TH/s | 7215 W | SHA-256 | Calculating... | Calculating... | 19.38 USD |

Conclusion: Navigating the Market Amid Miner Sell-Offs

The current wave of miner selling presents challenges for Bitcoin’s price trajectory. While technical indicators suggest resilience, the $100,000 milestone remains a significant psychological and market hurdle. Factors such as institutional investment, upcoming halving events, and market sentiment will play critical roles in determining the next steps for Bitcoin.

For investors, staying informed about miner activity and technical trends is essential. As always, thorough research and professional consultation are key to navigating this volatile market successfully.