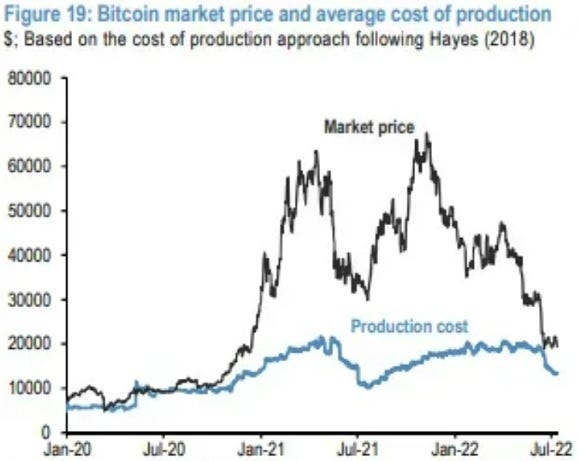

As the price of Bitcoin rose higher and higher, Bitcoin mining had the potential for great profits. As Bitcoin has fallen it has taken a lot of mining profits with it. The fact of the matter is that it costs money to mine Bitcoin and the business has always had to balance costs versus profit potential. At this point in the story of the first and still-biggest cryptocurrency, knowing Bitcoin mining overhead is useful for projecting the next Bitcoin price plateau and the coming wave of Bitcoin miner bankruptcies.

What Are The Costs of Bitcoin Mining?

According to Decrypt, the JPMorgan investment bank estimates production costs for one Bitcoin at $13,000 in July 2022 which is down significantly from $14,000 at the start of June 2022. The estimate starts with how much it takes to run the machines that mine Bitcoin for a single day. Electric costs are the most expensive part of mining followed by equipment costs. Many Bitcoin mining operations are highly leveraged so for these companies debt service is a major part of the equation as well. The most profitable Bitcoin mining operations are those whose electric rates are low and whose machines are the newest and most efficient.

What Is the Bitcoin Bottom based on the Cost of Mining?

JPMorgan suggests that a plausible bottom price for Bitcoin maybe $13,000 based on that being the current best price for mining. However, Bloomberg writes that the cost of mining a Bitcoin could be as low as $8,000 for the largest and most efficient operations. Smaller companies with older equipment, high overhead costs, and high cost of debt service are likely seeing it cost them closer to $20,000 per Bitcoin.

Is There a Fundamental Basis for the Price of Bitcoin?

We have brought up this issue in previous articles about the value of Bitcoin and other cryptocurrencies being tied to their practical uses in the worlds of non-fungible tokens, the metaverse, and decentralized finance. Adding the cost of producing each Bitcoin to the list would seem to make sense as Bitcoin becomes less of a speculative asset and more of a tool for carrying out financial transactions as was its original purpose.

Electric Rates and Power Efficiency As Determiners of Bitcoin Mining Costs

The war in Ukraine has had ramifications far beyond the battlefield. One of them has been the higher cost of energy. Bitcoin miners have set up operations in areas as different as Kazakhstan and Texas to get cheap electricity. Those operations with the funds or credit upgrade their processing equipment to further reduce energy costs. Other factors such as employee costs can be important as well which could help explain Kazakhstan as a choice versus anywhere in the USA. The rules of capitalism are coming to bear on the Bitcoin mining business due to the months-long price collapse. Only those with the most efficient operations, and the lowest debt burdens will continue to profit and not have to exhaust their stash of Bitcoin reserves while waiting and hoping for a Bitcoin price recovery.