Bitcoin halving is a fundamental mechanism designed to regulate the influx of new Bitcoin into circulation. It’s an integral part of the protocol’s design, aimed at maintaining a deflationary model with a capped supply of 21 million coins. The halving event occurs approximately every four years, cutting in half the reward miners receive for validating transactions and securing the network. In this article, we’ll delve into Bitcoin Halving 2024 and its anticipated impact on the price of BTC.

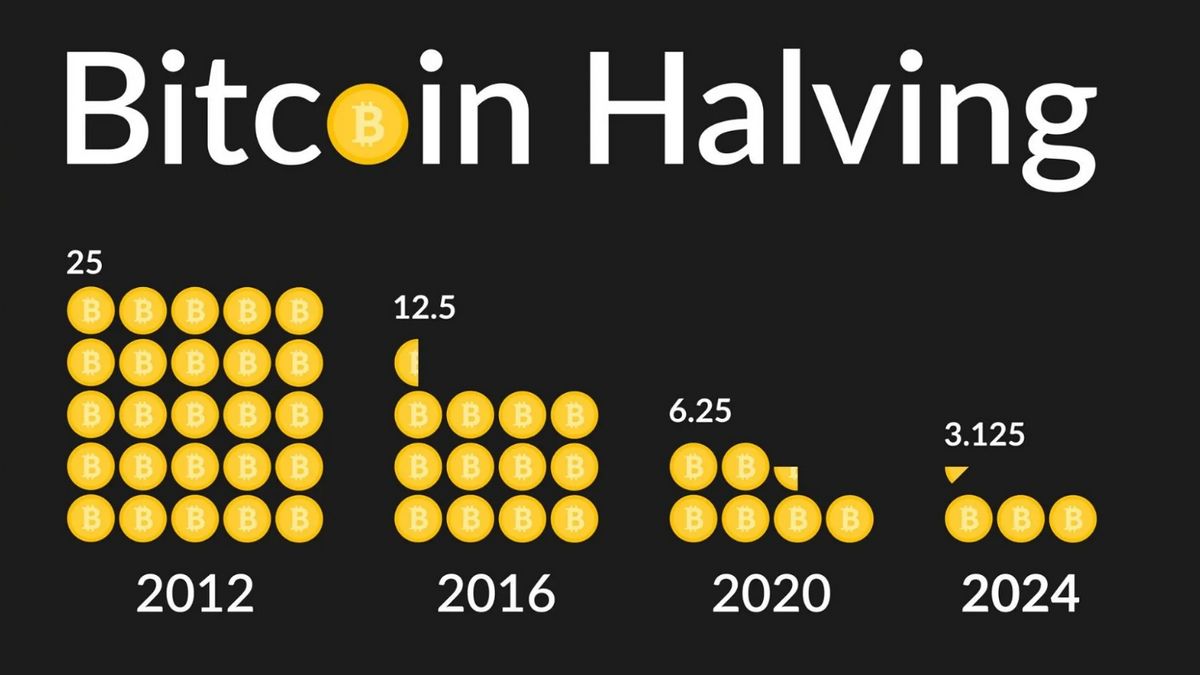

The intended 21 million coin cap is projected to be reached by 2140, marking the end of the rewards program. Afterward, network users will pay miners’ fees for transaction processing, ensuring their continued motivation to maintain the network. The last three halvings took place in 2012, 2016, and 2020, each reducing the block reward for mining.

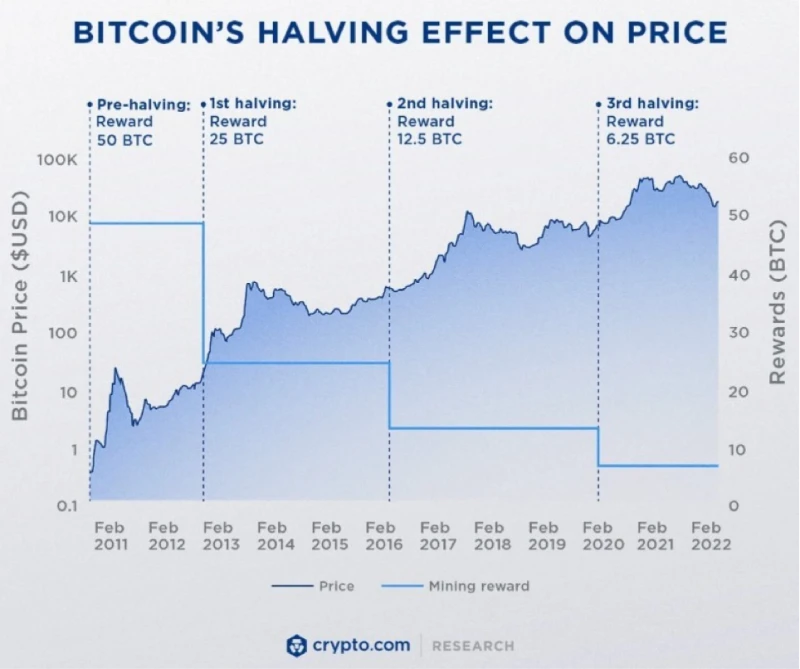

Bitcoin’s Price Tends to Increase Post-Halving

Assuming the network utilizes Proof-of-Work (PoW), a blockchain protocol incorporates a halving event from its genesis block. This recurrent event, defined by just two lines of code, serves to counteract inflation by maintaining scarcity. The reduction in the pace of Bitcoin issuance theoretically correlates with an increase in price if demand remains constant.

Historical Overview of Bitcoin Halvings

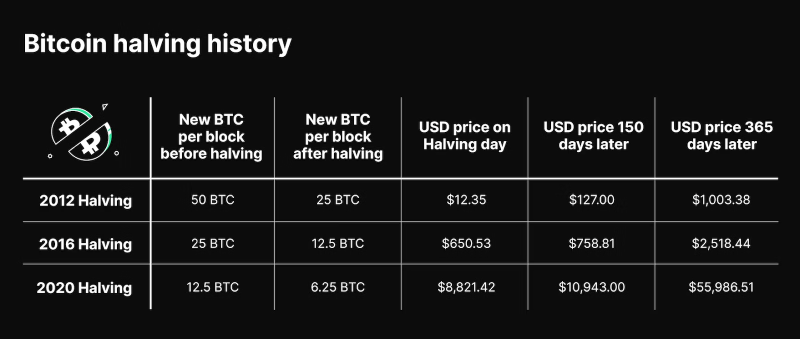

The first halving occurred on November 28, 2012, when BTC was priced at approximately $12. By the following year, Bitcoin had surged to nearly $1,000. The second halving, on July 9, 2016, saw Bitcoin’s price drop to $670, but by July 2017, it had soared to $2,550. In December 2017, Bitcoin reached its previous all-time high of over $19,700. At the time of the most recent halving in May 2020, BTC was valued at $8,787. By November 2021, it had reached an all-time high of about $69,000.

Bitcoin halvings historically alter the dynamics of supply and demand, leading to changes in the cryptocurrency landscape. The reduction in block rewards often results in increased scarcity of existing Bitcoins, potentially driving up their value. Post-halving, there’s typically a surge in Bitcoin volatility and a prevailing optimistic sentiment in the market. As fewer Bitcoins are available for mining, the remaining ones become more enticing assets for investors. Other contributing factors to post-halving surges include increased media attention, anonymity features, and expanding real-world use cases for Bitcoin.

Bitcoin Halving History

When Is the Next Bitcoin Halving?

The most recent halving occurred on May 12, 2020. While the exact date of the next halving isn’t confirmed, it’s scheduled for April 2024.

Bitcoin Halving 2024: What to Expect?

The upcoming halving poses challenges for Bitcoin miners. With the block reward set to halve from 6.25 to 3.125 BTC per block, miners’ revenue is effectively reduced by half. Additionally, rising costs, notably the hash rate, which represents the overall processing power required for mining, add to miners’ challenges. The recent spike in hash rate, partially due to Bitcoin’s price increase and increased mining efficiency, underscores the growing difficulties faced by miners. Many miners may soon find themselves in a precarious situation with falling revenue and escalating costs.

On the surface, increased investor attention on specific ETF products bodes well for Bitcoin’s price. However, this optimism is dampened by decreasing miner reserves. Miner outflows surged following the ETF approval, with nearly $1 billion in Bitcoin sent to exchanges shortly after ETF trading began. The ongoing selling by miners, likely to capitalize on the price surge, may have contributed to Bitcoin’s recent price decline following the ETF approval.

Market Predictions for BTC Price and Expert Opinions

Analyzing price dynamics preceding and following the last three halving events reveals significant growth for Bitcoin. If Bitcoin maintains similar performance, experts predict its price could reach $220,000 by 2025. However, several unique factors distinguish this upcoming halving. The increasing involvement of institutional investors, along with growing general user interest and adoption of cryptocurrencies, could drive demand and potentially increase Bitcoin’s value. Predictions from various sources suggest Bitcoin could surpass $100,000 and even reach $300,000 by 2028.

Impact of Bitcoin Halving 2024 on the Crypto Ecosystem

Over time, halving events emphasize Bitcoin’s inherent scarcity, attracting users who view it as ‘digital gold.’ The slower rate of new Bitcoin creation, coupled with increasing demand, can potentially drive prices higher. Additionally, the need for miners to maintain profitability may spur advancements in sustainable energy sources and mining technology, potentially addressing concerns about Bitcoin mining’s environmental impact. The halving event serves as a recurring reminder of Bitcoin’s distinctive economic model, stimulating interest and adoption among new users.

Conclusion

The Bitcoin halving event remains highly anticipated in the cryptocurrency world due to its significant impact on the market. The reduction in new Bitcoin supply is expected to follow the established pattern, but unique factors set this halving apart. With increased investor awareness and institutional interest, along with advancements in technology and infrastructure, the 2024 halving may bring new surprises and outcomes for the crypto market.