The “Halving” is a recurring occurrence on the Bitcoin network that occurs every four years.

What does halving mean?

Every four years, the number of new Bitcoins and rewards for miners are halved. It slows down inflation and raises the cost of Bitcoin.

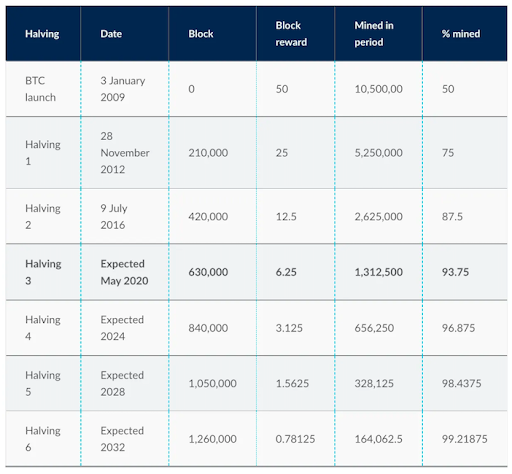

Three halvings have happened since 2009:

- Nov 28, 2012: Reward per block reduced from 50 BTC to 25 BTC.

- Jul 9, 2016: Reward per block reduced from 25 BTC to 12.5 BTC.

- May 11, 2020: Reward per block reduced from 12.5 BTC to 6.25 BTC.

This article discusses the fundamentals of Bitcoin halving, earlier occasions, and Bitcoin’s potential in the cryptocurrency industry.

What is Bitcoin halving?

A scheduled event known as the “Bitcoin halving” takes place after the mining of every 210,000 blocks, or roughly every four years. The payout for mining a new Bitcoin block is halved during this period.

By 2023, each properly validated transaction by a Bitcoin miner or other network user will earn them 6.25 Bitcoins.

When is the next Bitcoin halving?

The next halving set estimated to take place on April 26 2024 00:53:36 UTC, and reduce the block reward to 3.125 BTC. This date is based on current estimates.

What’s the significance of Bitcoin halving?

The halving of the block reward is a key feature of Bitcoin’s monetary policy, implemented to control the inflation rate, ensure the cryptocurrency’s scarcity, and increase its value over time.

Each Bitcoin halving event reduces the number of new Bitcoins produced per block, resulting in a lower supply. Bitcoin was created as a deflationary currency similar to gold. As it becomes scarcer and demand increases, the price likely increases in line with supply and demand economics.

Bitcoin halving will ultimately cap the total supply of Bitcoin at 21 million coins. This fixed supply is one of the fundamental characteristics differentiating Bitcoin from traditional fiat currencies, which can face inflationary pressures due to central bank policies.

This scarcity-driven price dynamics have historically played a role in Bitcoin’s price appreciation after each halving event. It’ll be interesting to see how future halvings impact Bitcoin’s prices.

Bitcoin halving dates history

Here’s a history of all the past Bitcoin halving dates since inception:

- 1st Bitcoin halving date — November 28, 2012 — Reward down: 50BTC to 25BTC

- 2nd Bitcoin halving date — July 9, 2016 — Reward down: 25BTC to 12.5BTC

- 3rd Bitcoin halving date — May 11, 2020 Reward down: 12.5BTC to 6.25BTC

4th Bitcoin halving date — April 26, 2024 at 11:59:22 AM UTC

Miners receive 50% less Bitcoin as a reward for their work.

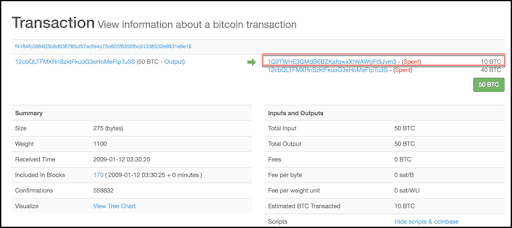

Bitcoin halving 2012 (First halving)

Before the first halving on November 28, 2012, the block reward was set at 50 bitcoins. After the event, the reward was reduced to 25 bitcoins per block.

Cryptocurrency mining software Slush Pool was the first to mine the block using a Radeon HD 5800 miner.

Here are the details of the exact block where the reward increased from 50 BTC to 25 BTC.

- Block number: 210,000

- Block reward: 25 BTC

- BTC created per day: 3600 BTC

- BTC price before the halving date: $12.35

- Bitcoin price 1 year later: $964

Bitcoin halving 2016 (Second halving)

The second halving occurred on July 9, 2016.

Prior to the halving, the new BTC per block was 25. It was reduced to 12.5 BTC per block.

- Block number: 420,000

- Block reward: 12.5 BTC

- BTC created per day: 1800 BTC

- BTC price before the halving date: $663

- BTC price a year later: $2500

Bitcoin halving 2020 (Third halving)

The third halving event occurred on May 11, 2020.

This last Bitcoin halving event reduced halving and cut the block reward from 12.5 BTC to 6.25 BTC.

- Block number: 630,000

- Block reward: 6.25 BTC

- BTC created per day: 900 BTC

- BTC price before the halving date: $8,500

- BTC price after: Peaked to $64,000 over the next several months

Next Bitcoin halving date: April 26, 2024 at 12:08:35 PM UTC

The fourth halving is estimated to occur at 840,000 based on the block time of around 10 minutes. It’ll bring the block reward down to 3.125 BTC.

- Expected date: April 26, 2024 at 12:08:35 PM UTC

- Block reward: 3.125 BTC

- BTC created per day: Estimated to be 450 BTC

- Total new Bitcoins: 656,250

- Here’s a quick recap of all the Bitcoin halving schedule (past and future) until 99% of the Bitcoins are mined.

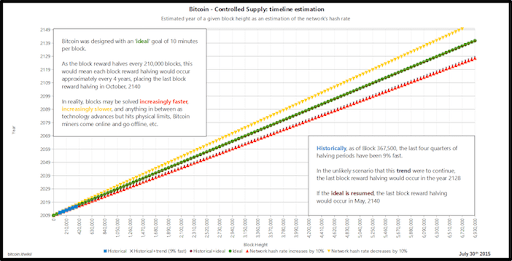

When will all 21 million Bitcoins be mined?

Given the current trajectory, Bitcoin halving is likely to repeat every four years (roughly) until the block reward becomes zero. It’s hard to say what the future price or reward trends will look like.

The Bitcoin numbers and rewards halve each event. Based on the current Bitcoin halving cycle and schedule, 100% of all Bitcoin will be mined by 2041 (the word’s still out there). However, over 98% of the total Bitcoin supply will be mined by 2032.

How does Bitcoin halving work?

Bitcoin halving reduces the rate at which new Bitcoins are created and introduced into circulation. The process is programmed into the Bitcoin protocol and controls the supply and demand of Bitcoins.

Here are some of the steps involved in a Bitcoin halving.

- Bitcoin block reward: The Bitcoin network creates a reward for miners for validating transactions and adding new blocks to the blockchain. Block rewards are the primary incentive for miners to secure the network.

- Halving schedule: The block reward is halved roughly every 210,000 blocks or four years. This interval controls the creation of new Bitcoins over time.

- Reduction of block rewards: After every halving, miners receive 50% less Bitcoin as a reward for their work.

- Scarcity and supply: Reducing the rate at which new bitcoins are circulated controls inflation and ensures that the total supply of bitcoins gradually approaches its 21 million coin limit.

How does the halving impact miners?

Miners use computational power to solve complex mathematical problems and secure the network. When the block reward is halved, miners get fewer Bitcoins for their efforts. This affects the profitability of mining operations as miners have to anticipate reduced block rewards and adjust their strategies accordingly.

How does the halving impact the cryptocurrency market?

Bitcoin halving events often generate a lot of interest and speculation in the cryptocurrency market. Anticipating lower supply and potential demand increases can contribute to price volatility.

During previous halvings, Bitcoin price experienced both pre-halving rallies and subsequent price increases in the months and years following the event. However, Bitcoin’s price is influenced by various factors and isn’t solely determined by halving events.

Does the halving always increase the price of Bitcoin?

While the halving is often associated with positive price movements in Bitcoin, it does not guarantee an immediate or automatic increase in price. Every halving leads to smaller increases in the circulating supply of Bitcoin. Supply shocks can potentially impact the configuration and scale of Bitcoin’s price fluctuations before and after each halving event.

Nonetheless, the proportion of new supply in relation to the existing supply has diminished due to the reduction in the scale of these shocks from one halving occurrence to the subsequent one.

Over time, it can be anticipated that the influence of supply shocks on Bitcoin’s price surges will become notably less pronounced. Consequently, we should foresee less substantial shifts in Bitcoin’s price from the trough to the peak that stem from halving events. The peaks in price will be of a reduced scale as the corresponding supply shocks become progressively less impactful.

Various factors, including market sentiment, overall demand for Bitcoin, investor speculation, and external events, influence the market’s reaction to the halving.

While historical trends suggest that the halving has contributed to price appreciation over the long term, short-term price movements can be unpredictable and subject to market dynamics.