So, you’ve been observing the cryptocurrency charts, and seeing the endless rise (with some dips) of Bitcoin’s price and Ethereum’s price, all while thinking to yourself, “Imagine if I had just invested RM1,000 into Bitcoin a few months ago.”

You also might have heard people talk endlessly about Bitcoin, Ethereum and a whole bunch of other currencies, uttering magical-sounding jargon like “blockchain”, “seed phrases” and “miners”.

At this point, you might have thought to yourself, “Okay, this is too much to take in.”

Well, that’s why Luno is here to explain the world of cryptocurrencies, in terms that you can understand, one article at a time.

Understanding Bitcoin and cryptocurrencies

Broadly speaking, cryptocurrencies are like normal currencies. The only difference is that they exist digitally.

Crypto comes from the word cryptography, or digitally encrypting data as a form of verification, by way of something called the blockchain.

A simple way to think of it is as using codes to enclose a hidden message, which can only be uncovered by someone on the other end who has the keys to unlock the code.

Now, diving down that rabbit hole can spawn a whole series of other articles, but for now, let’s leave it by saying that cryptocurrency is a digital form of currency that does not rely on banks or other central authorities (such as governments or Central Banks) to issue them or determine their value.

Cryptocurrencies are decentralised, which means that everyday people can deal directly with each other, otherwise known as peer-to-peer, instead of having to rely on a traditional centre of exchange.

For now, you can think of crypto as a digital form of currency that can be used to buy and sell goods and services. You can also think of Bitcoin as “digital gold”, in that it is limited in supply and it is divisible into smaller units (called satoshis) without diminishing its value.

On top of that, Bitcoin has the added advantage of being able to work as a method of payment.

Cryptocurrency is an entire universe, and there are thousands of publicly traded cryptocurrencies out there, from Bitcoin to Shiba Inu and the blue-eyed boy of Elon Musk, Dogecoin.

If you’d like to have a look at just how vast this space is, pay a visit to Coingecko and have a look around at the various cryptocurrencies and their market caps. All these coins have their own names, use cases and teams behind them.

A very simplistic way to look at this industry is to think of cryptocurrencies as cars, and each coin as a particular brand of car. For example, Bitcoin being a Rolls-Royce, Ethereum being a Mercedes, and so on.

What determines the price of Bitcoin?

As at the time of writing, Bitcoin, the most popular cryptocurrency by far, has the largest market capitalisation of all cryptocurrencies, coming in at approximately US$929 billion.

So, what makes Bitcoin so highly priced?

Well, fundamentally, Bitcoin’s price boils down to supply and demand. Since BTC has a maximum supply of 21 million BTC, and new Bitcoin generated gets less over time, an increase in demand causes Bitcoin’s price to rise.

Also, since supply and demand varies on different exchanges, geographical regions, as well as various fiat currency exchange rates, it can also be said that Bitcoin does not have a global price.

In fact, most Bitcoin price trackers calculate an average estimate or base their figures on the most recent trades of Bitcoin on key cryptocurrency exchanges. Therefore, the prices you see on a particular exchange, Luno for example, is unique to that exchange only, as demand will vary among exchanges.

The reducing supply and increasing demand, alongside the global community and a massive industry built on its foundations, keeps driving BTC prices up as the years pass.

Today, although Bitcoin’s price fluctuates now and then for various reasons, it still remains the undisputed largest-valued asset in the cryptocurrency space.

Is it too late to buy Bitcoin?

So, you’ve decided that you want to take your first steps into the world of cryptocurrency, but you’re feeling a little hesitant. After all, you’ve seen Bitcoin’s price (BTC to MYR) skyrocket from a mere RM20,000 in 2019 to levels of RM200,000 and beyond in 2021.

If you look at Bitcoin’s price in US dollars, it’s standing at around US$46,000 today. Looking at the runner-up, Ethereum’s price (ETH to MYR) has gone from RM1,000 in 2020 to RM13,000 and beyond.

Looking at these figures, you probably can’t help but wonder if you’ve missed the crypto boat, or if this is far too volatile to invest in?

Well, there is a long way to go in terms of development and maturity, and until that happens, the markets will continue to be somewhat volatile.

However, the ship has not sailed on cryptocurrencies as there are so many exciting innovations in the space every single day, making the future possibilities with crypto rather exciting.

(NOTE: Investing in cryptocurrency is inherently risky due to the volatility mentioned earlier, so, only invest what you can afford to lose.)

Is Bitcoin legal in Malaysia?

In Malaysia, five cryptocurrencies have been approved by the Malaysian Securities Commission (SC), namely, Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC) and the latest addition, Bitcoin Cash (BCH).

There are only four registered Digital Asset Exchanges (DAX) operating in Malaysia. If you want to buy crypto, it is recommended that you do it via these four:

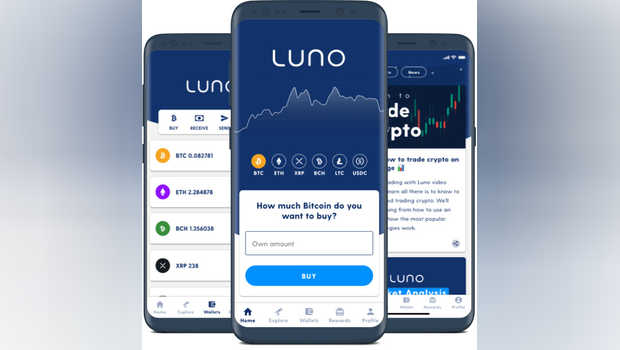

1. Luno

2. MX Global

3. Sinegy

4. Tokenize Technology

Do take note however, that Binance is not one of these. As you’ve probably heard, the Securities Commission of Malaysia has enforced actions against Binance for operating illegally in Malaysia, which means you’re not supposed to use the Binance website or app here.

How to buy Bitcoin in Malaysia with Luno

Alright, so what you need to prepare is your Luno account (if you haven’t signed up, you can do so here!), your bank account, and some funds in MYR.

Here are the steps :

1. Open up your Luno app, click on “Wallets”, choose MYR.

2. Click “Deposit”, type in the amount of MYR you want to deposit (at least RM10), then make an instant transfer via FPX. After a minute or two, you should then see your MYR balance in your Luno app!

3. Go back to “Wallets”, click “Buy” and select BTC.

4. Choose between a “Once-off payment” or a “Repeat buy”.

5. Once you’ve selected your payment frequency, select “MYR wallet”, input the amount of Bitcoin you want, and click “Next”.

6. You’ll then see the amount of BTC you are buying, the rate of BTC to MYR, and final confirmation on the amount you are spending. If you are happy with all three, click “Confirm”.

Congratulations! You’ve made your first purchase of Bitcoin and should be able to see it reflected in your Luno app!

It’s the beginning of an exciting new adventure. We hope you found the experience enjoyable, and are ready to take the next steps on this exhilarating journey with Luno!