First and foremost, I would like to point out that this is not financial advice. I am just a crypto enthusiast who likes to share his opinion based on my personal experience in the field. Anyone interested in investing in crypto must know that it is a risky business. Risk doesn’t necessarily mean bad. It just means you should use maximum caution. And just like any investment, high risk is usually correlated with high reward or great loss! 💰 I am just sharing tips that work for me and many others since I have been investing in cryptocurrencies for quite a while. I have lost a lot of money investing in cryptocurrency, but I took every loss and turned it into a learning experience.

I have learned that the crypto space is very risky, but it also has great potential. While nobody can predict how well a crypto asset will perform, there are some hints that can help you make a sound judgment when evaluating a project.

The criteria below could assist you in making informed decisions when you consider investing in any crypto project you come across.

Maximum and Total Token Supply

I’m starting with this first because this is one criterion many newcomers pay more attention to. Investors are taught that an asset with a low supply will perform better than one with a large supply. It makes sense somehow because a low supply of assets defines its rarity. But not all rare things are necessarily valuable. The value should come from the asset itself rather than its supply. For instance, Gold is valuable because it’s super rare on Earth, but it’s also used as an important component in many electronics or as a universal currency.

You need to delve deeper into a project so that you won’t be misled by its supply. If you find out that the fundamentals and other metrics look good, the supply shouldn’t matter much. The only thing you have to keep in mind is that it takes more investors to push up the price of tokens with a large supply.

Historic Data

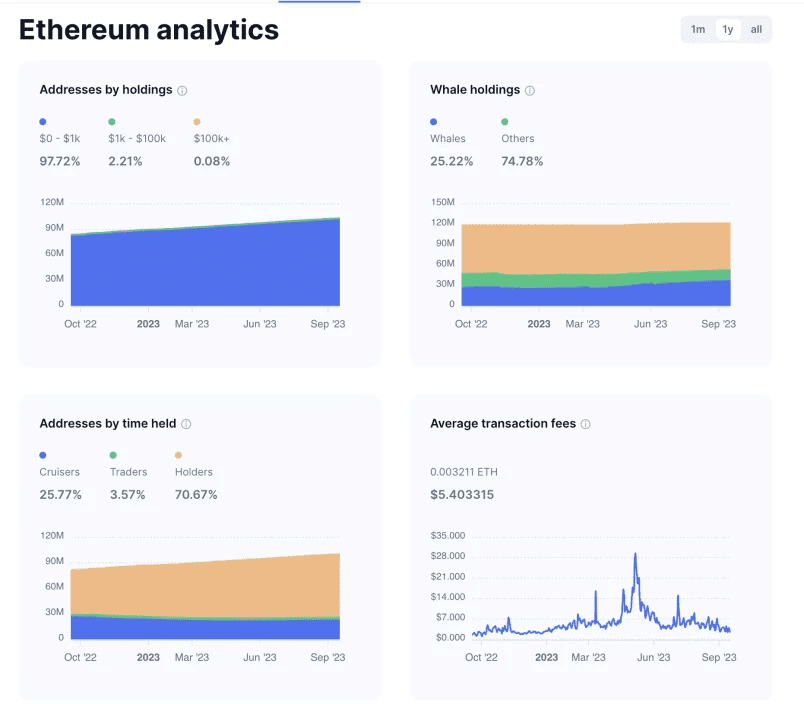

A project’s historical data can tell you more about the project. Historical data I pay close attention to includes price at launch, volume, holders, and average price. These data should exhibit a positive trend over time. A project’s historical data can help you buy at the right time, such as when there is a dip caused by FUD or during a bear market.

You can find token historical data on websites like CoinMarket Cap or CoinGecko.

The Team Behind the Project

A project that clearly discloses the team running it should be a good sign for investors. The more you know about a project team, the higher your confidence level grows. I like it when I can learn more about team members and find out about their backgrounds. My confidence grows even higher if I discover that they have worked for legitimate companies I know of. Since cryptocurrencies are tech-related, chances are you could find former or current employees from well-known companies like Google, Uber, Amazon, etc. Even if you’ve never heard of a company they previously worked for, you can search it to find out more about it. I also prefer it when I can verify the LinkedIn profiles of team members. This enhances their professionalism.

Please note that since most cryptocurrencies are open-source projects, you could come across projects that have no team to disclose, unlike a traditional company. Instead, they have a community of developers involved in the project. A famous example of this is Bitcoin. In this case, a good way is to search for community engagement on Github, Twitter, Discord, forums, and the like.

Community Engagement

A project with a strong and engaging community behind it sounds more legitimate. After all, the internet is full of strangers interacting with each other. Ask yourself why so many people from different backgrounds would love a project so much. Usually, people are attracted to projects that they think can improve people’s lives. Take Bitcoin, for instance. People who love it, including me, appreciate the fact that it has been created to decentralize the financial industry. Bitcoin is not controlled by any government or centralized entity. Instead, it’s controlled by the people. Anyone can participate in the ecosystem. Bitcoin makes it possible for the unbanked in developed nations to keep their money safe. It also protects them from losing their fortune in case their national currency gets devalued. These are just some examples, and I’m sure you get my point!

The same goes for any other projects that people tend to love. Conduct your research about a project to understand it better.

It’s also important that the project team provides constant updates about the evolution of their project. Communication with investors is crucial; otherwise, something may appear suspicious. To verify if a project is still active and engaging, I usually look for it on Twitter, Telegram, Discord, and Reddit. I pay attention to the time interval between their new posts. Some projects post every day or week, while others go months without posting anything. And when they do, it’s sometimes about an upcoming release. Come on! You’ve waited all that time, and there’s still no working product yet 👎. You get the point, right? 🙂

Your own gut feeling about the project

You are the captain of your vessel! If you feel like something is a good investment, then go for it. I always say to myself that it’s better to try than to regret it later. If I try and lose, at least I will be at peace with myself, knowing that I took the opportunity. And keep in mind that the most successful people on Earth are those who kept trying, even when they lost many times. By trying, successful people will eventually win one day! Oh… Also, don’t put all your confidence in the so-called Crypto-Influencers. Do your research and find good projects before they do. Good luck!