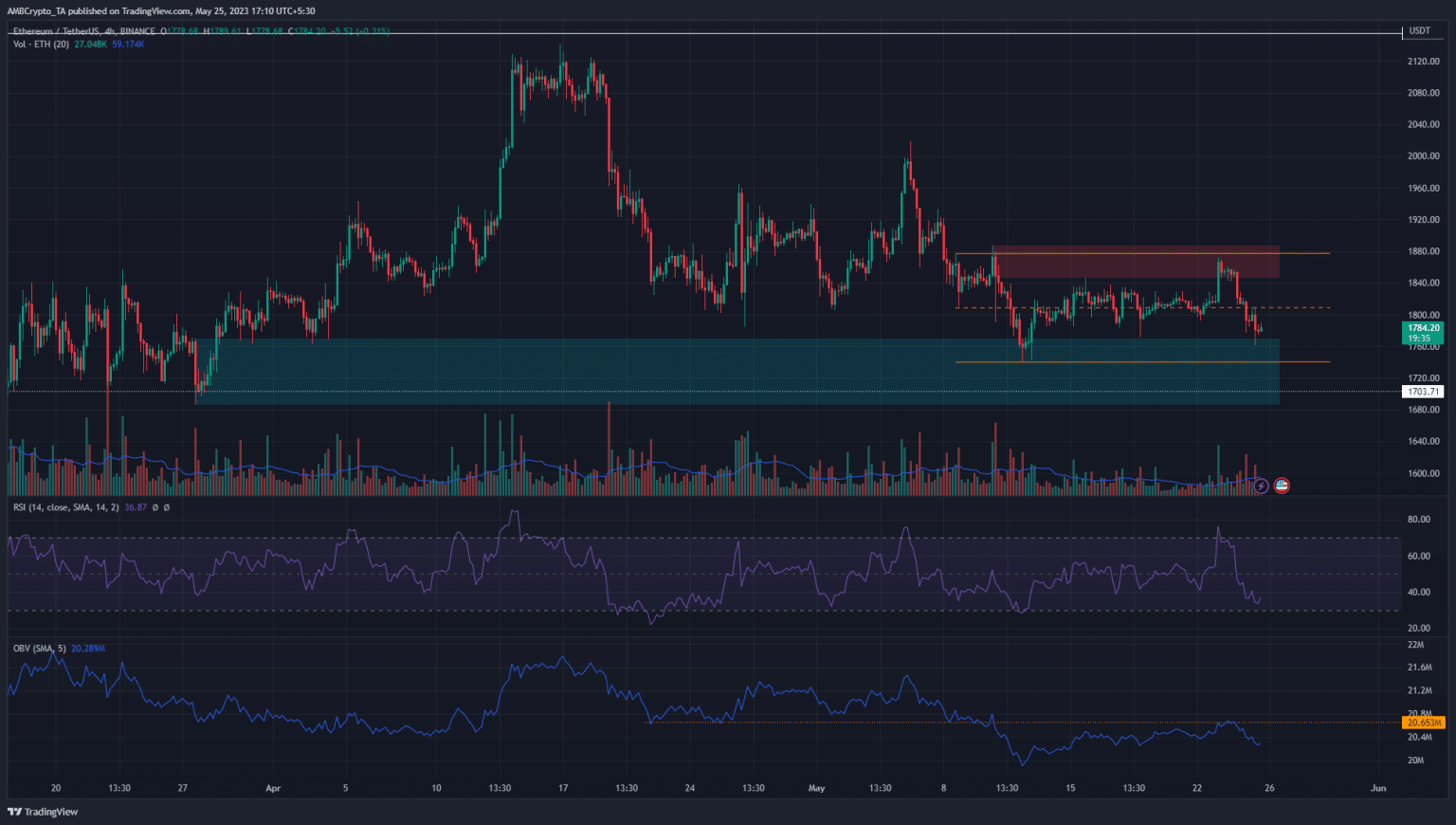

Over the past 48 hours Ethereum tested the bearish order block overhead and faced rejection at $1880- can the bulls defend the $1760 level with equal vigor?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The higher timeframe bias was bearish but there were good chances of a move upward from $1760.

- The lack of demand in May meant bulls must be cautious.

A recent analysis of Ethereum highlighted that the $1880 area represented a bearish order block and could serve as resistance. Over the past 48 hours, this zone was tested as resistance and ETH faced rejection. The higher timeframe market structure was bearish as well.

The number of ETH non-zero addresses was on the rise, and the supply held by top addresses has also increased dramatically over the past month. Yet, the supply held on exchanges was going higher as well.

Will the bulls or the bears win this extended skirmish?

A short-term range formation showed what traders and investors can look out for

Over the past two weeks, Ethereum has traded within a range that extended from $1740 to $1880. The mid-point of this range at $1810 has served as low timeframe support and resistance.

At the extremes of this range sat order blocks that the price has respected so far.

The bullish order block (cyan) stretched from $1690 to $1770, and has already been tested in May. In the coming days, another retest could occur. In May, the OBV slipped beneath a support level marked on the chart and has tested the same as resistance.

This showed that the market was dominated by the sellers. Moreover, the RSI was also in bearish territory. Together they signaled further losses were likely.

To the south, the $1700, $1632 and $1500 are likely to be significant levels. Ethereum bulls could drive a minor bounce from these levels, but the overall trend remained bearish.

To change this, ETH bulls must drive prices past $1880 and break the bearish order block.

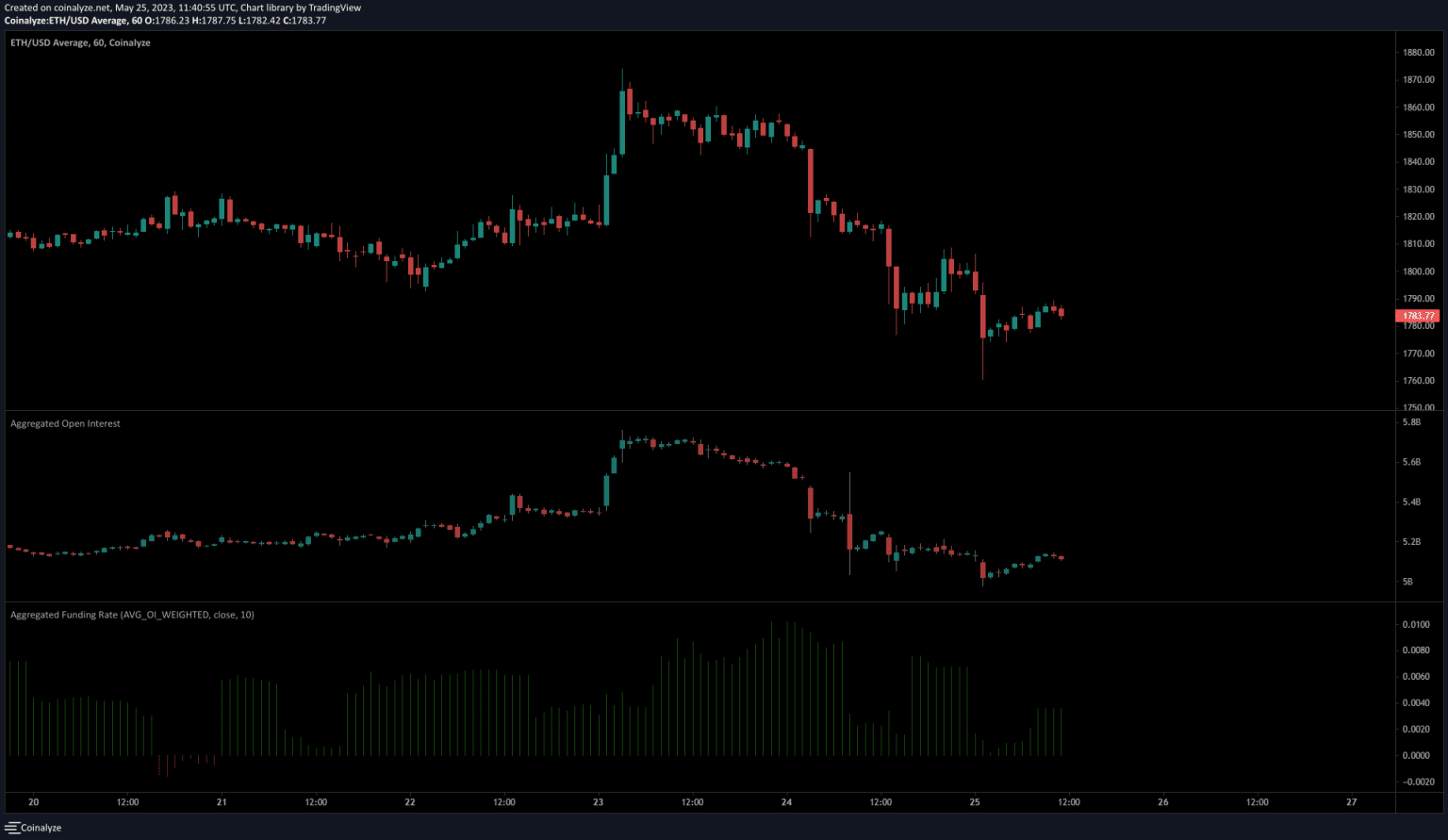

Falling funding rates hinted at shifting market sentiment

The short-term charts from Coinalyze showed that sentiment was firmly bearish. The Open Interest declined dramatically in the past two days following the retest of the $1860 area and the subsequent move downward.

The funding rate remained positive but has ticked lower alongside the fall in the OI. Together, they showed sentiment was in favor of the sellers in the near-term.

Another point that investors should consider is the fact that the $1700-$1800 region acted as stiff resistance from September 2022 to March 2023. Will the bears seize control of this zone just two months after ceding it to the bulls?

With Bitcoin also expected to find support at $24k-$25k, it was possible that Ethereum could incite panic in the market before rallying higher in the coming months.