Crypto rug pulls have become a major concern in the digital asset space. These scams involve developers abandoning a project and fleeing with investor funds. In recent years, the cryptocurrency world has witnessed billions of dollars lost to such schemes.

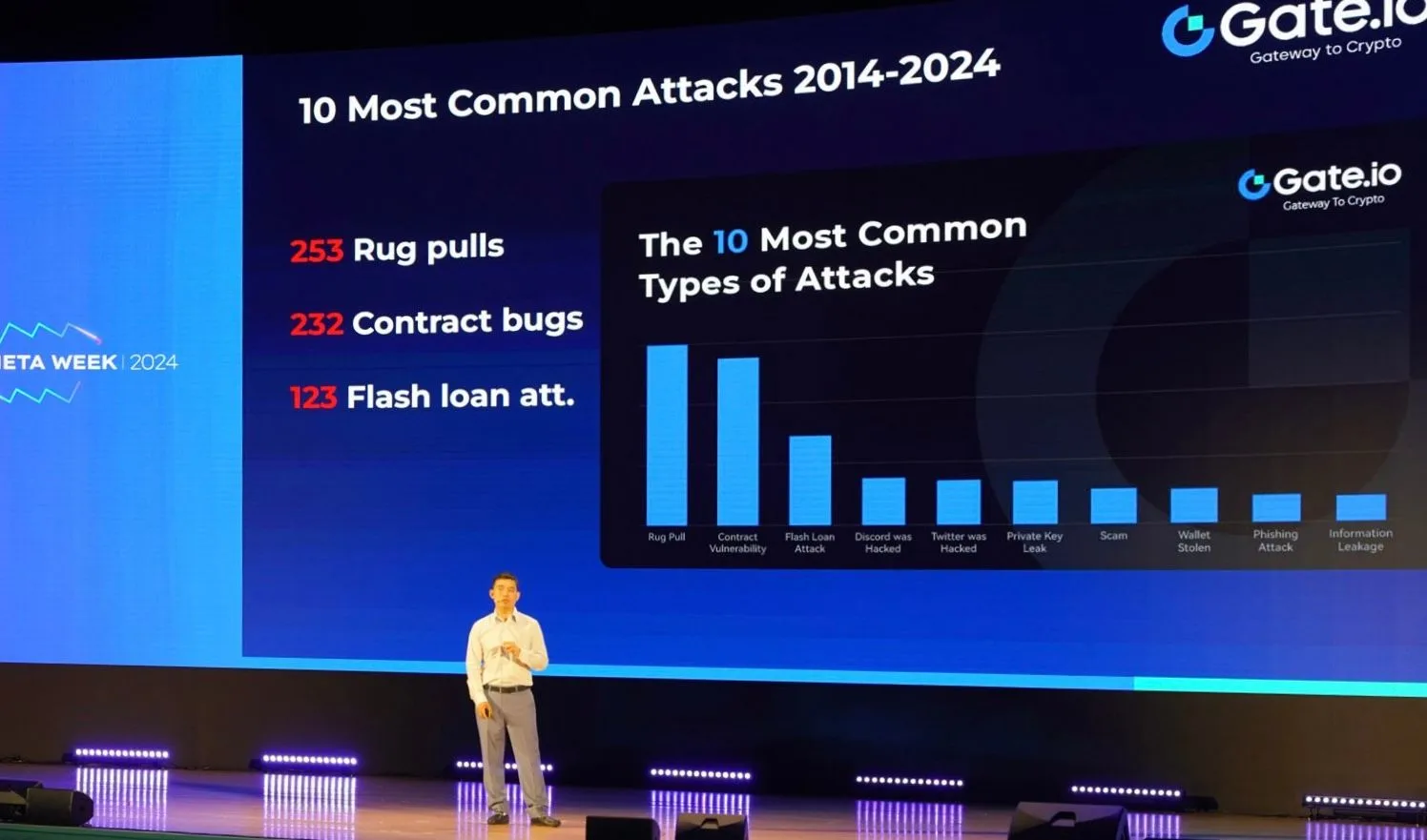

From 2021 to July 2024, over $2 billion was lost to crypto hacks and rug pulls. In 2024 alone, over $473 million worth of cryptocurrency was lost to hacks and rug pulls across 108 incidents. These staggering figures highlight the risks faced by crypto investors. Notable incidents include the Mt. Gox exchange hack and attacks by the Lazarus Group. Many losses stem from smart contract bugs or centralized points of failure.

The impact of these scams extends beyond financial losses. They erode trust in the crypto ecosystem and hinder wider adoption. The frequency and scale of these incidents have prompted calls for increased security measures and regulatory oversight in the crypto industry. Experts stress the importance of due diligence and caution when investing in new projects, as the decentralized nature of cryptocurrencies can make it challenging to recover stolen funds. They also emphasize the need for better investor education to combat this growing threat.

Understanding Crypto Rug Pulls

Crypto rug pulls are a significant threat in the digital asset space. These scams have cost investors billions of dollars and damaged trust in the crypto ecosystem. Let’s explore what rug pulls are and how they work.

Definition and Mechanisms

A crypto rug pull occurs when project creators abandon a cryptocurrency project and abscond with investors’ funds. The term derives from the phrase “pulling the rug out from under someone.”

Rug pulls often involve new tokens or projects. Scammers create hype around the token to attract investment. Once sufficient funds are collected, they drain the liquidity pool and disappear.

These scams exploit crypto’s decentralized nature. With no central authority overseeing projects, it’s easier for malicious actors to vanish with funds.

Types of Rug Pulls

Several types of rug pulls exist:

- Liquidity Stealing: Creators remove all coins from the liquidity pool, rendering the token worthless.

- Limiting Sell Orders: Scammers code the token so only they can sell it.

- Dumping: Creators sell off large amounts of tokens, crashing the price.

Some rug pulls result from smart contract bugs, while others exploit centralized control points. Infamous examples include the Mt. Gox hack and Lazarus Group attacks.

Investors lost over $4 billion to rug pulls in recent years. The Curve Finance hack in 2023 was a significant incident, highlighting that even established projects can be vulnerable.

Historical Analysis of Crypto Rug Pulls

Crypto rug pulls have caused massive financial losses and shaken trust in the cryptocurrency ecosystem. These scams have evolved over time, with some notable cases making headlines and prompting industry-wide changes.

Notable Cases

Crypto rug pulls have resulted in billions of dollars in losses. In 2021 alone, investors lost over $7.7 billion to rug pulls.

Notable rug pulls include:

- AnubisDAO: $60 million lost in 2021

- Luna Yield: $6.3 million stolen in 2021

- Thodex: $2 billion disappeared in 2021

The Mt. Gox hack is an early example of large-scale cryptocurrency theft. In 2014, this major Bitcoin exchange lost 850,000 BTC, worth billions today.

The Lazarus Group, linked to North Korea, has been behind several high-profile attacks. Their tactics often exploit centralized points of failure in crypto projects.

Curve Finance fell victim to a domain hijacking attack in 2023. This incident exposed the risks of centralized infrastructure in decentralized finance (DeFi) projects.

Smart contract vulnerabilities have also led to significant losses. For example, a code flaw caused the DAO hack in 2016, resulting in the theft of $60 million worth of Ethereum.

Reactions to High-Profile Crypto Rug Pull Cases

Crypto rug pulls have cost investors billions of dollars. Some cases stand out due to their size or impact on the industry.

After major rug pulls, exchanges often freeze accounts and work with law enforcement. In some cases, funds are recovered; for example, the Curve Finance hack saw about $20 million returned within days.

Crypto expert Nic Carter tweeted, “These hacks underscore the need for better security audits and decentralized governance.”

Projects are now focusing more on security. Many use bug bounties and multiple audits. Users are also more cautious when checking project backgrounds and using hardware wallets.

Year-Over-Year Trends

Crypto rug pulls have become more frequent and sophisticated over time. In 2022, these scams resulted in $760 million in losses.

2023 saw a surge in “flash loan” attacks, where hackers exploit DeFi protocols to manipulate token prices and quickly drain funds.

The rise of meme coins and tokens with little utility has increased “pump and dump” schemes. These often involve influencers promoting tokens before suddenly selling off their holdings. Losses from hacks and rug pulls reached $473 million in the first half of 2024 alone, underscoring the persistent threat to investors.

The Impact of Rug Pulls on the Crypto Market

Rug pulls have shaken the crypto world, causing massive financial losses and eroding trust. These scams have far-reaching effects on investor confidence and market stability.

Investor Confidence

Rug pulls have severely damaged investor faith in crypto projects. In 2021 alone, investors lost over $7.7 billion to rug pulls, making many wary of new crypto ventures. The BNB Chain has been particularly hard hit, with rug pulls accounting for $368 million in losses since its inception. While not a rug pull, the Mt. Gox hack set an early precedent for large-scale crypto losses and demonstrated how centralized points of failure can be exploited.

Curve Finance’s rug pull shocked investors and exposed vulnerabilities in smart contracts, a key component of many crypto projects.

These incidents have eroded investor confidence and slowed mainstream adoption of cryptocurrencies. Many retail investors have lost life savings, while institutional players have become cautious about entering the market.

Market Volatility

Rug pulls can trigger rapid price swings in the crypto market. When a major scam is uncovered, panic selling often follows, leading to sharp drops in token values.

The ripple effects of rug pulls extend beyond the targeted project. They can shake confidence in the entire crypto ecosystem, leading to broader market instability.

Investors may become more risk-averse after a significant rug pull, potentially slowing innovation in the crypto space as funding for new projects becomes harder to secure.

Some experts argue that increased regulation could help stabilize the market, while others fear that excessive oversight could stifle crypto’s decentralized nature.

Regulatory and Legal Implications

The rise in crypto rug pulls has garnered the attention of regulators worldwide. Governments are pushing for stricter oversight of cryptocurrency projects and exchanges. This increased scrutiny aims to protect investors but may also stifle innovation in the space.

Key regulatory developments include:

- Calls for Enhanced KYC/AML Procedures

- Proposals for Mandatory Code Audits for New Projects

- Discussions About Creating a Global Crypto Regulatory Framework

Legal experts argue that existing fraud laws may not adequately address the unique challenges posed by crypto scams. This has led to debates about the need for new legislation tailored specifically to digital assets and decentralized finance.

Quantifying the Financial Losses

Crypto rug pulls have led to massive financial losses in the cryptocurrency ecosystem. The scale of these losses varies widely, from small-scale scams to multi-million dollar heists.

Aggregate Loss Estimates

According to Immunefi, crypto hacks and rug pulls caused $473 million in losses in 2024 alone, spanning 108 separate incidents. In May 2024, $52 million was lost to these scams. The BNB Chain has been hit hard, losing $1.64 billion to hacks and rug pulls since its launch in 2017, with $368 million of that amount attributed to rug pulls alone.

In 2023, rug pulls and related scams totaled $760 million in losses, with a larger $1.7 billion stolen through various crypto crimes.

Analysis of Individual Losses

Some rug pulls stand out due to their massive scale. The Mt. Gox hack remains one of the largest, with 850,000 bitcoins stolen. At today’s prices, that’s worth billions.

The Lazarus Group, linked to North Korea, has been behind several major crypto heists, stealing hundreds of millions through sophisticated attacks on exchanges and DeFi protocols.

Curve Finance suffered a $70 million hack in July 2023 due to a vulnerability in their smart contract code, demonstrating that even established projects can have weaknesses.

Not all losses stem from code flaws; some are due to centralized points of failure, where a single person or entity controls funds. These cases highlight the risks of relying on centralized systems within a decentralized space.

Estimating Unreported Losses

The true scale of crypto rug pulls likely exceeds reported figures. Many smaller scams go unreported due to victim shame or lack of legal recourse. Experts estimate unreported losses could add 20-30% to official numbers.

Blockchain analyst Jane Smith notes, “For every major hack that makes headlines, dozens of smaller rug pulls fly under the radar.” This hidden damage erodes trust in the crypto ecosystem.

Tracking tools like DefiLlama’s hack database help but can only capture some incidents. The crypto community continues to debate how to improve transparency and support for victims.

Preventive Measures and Best Practices

Investors can protect themselves from crypto rug pulls by taking proactive steps and staying informed. Careful research and awareness of regulatory developments are key to reducing risks.

Due Diligence Strategies

Thorough research is essential before investing in any crypto project. Investors should verify the team’s background and experience; anonymous teams should raise red flags.

Examine the project’s whitepaper, roadmap, and tokenomics to identify potential issues. A clear, detailed plan is a good sign, while vague promises are not.

Social media activity and community engagement matter as well. Active, responsive teams build trust, while sudden spikes in followers or likes may signal bot activity.

Code audits by reputable firms add credibility. Smart contract vulnerabilities have led to major hacks like the DAO attack in 2016.

Regulatory Actions and Proposals

Governments worldwide are working to create rules for crypto to protect investors and prevent scams. The SEC in the U.S. has increased its focus on crypto fraud, taking action against several rug pull schemes, including charges for a $1.1 million NFT scam in 2022.

Some countries are developing crypto-specific laws; for example, Japan has implemented strict exchange regulations following the Mt. Gox incident.

Regulatory clarity could help reduce rug pulls, but it’s a complex task given crypto’s global nature. Crypto expert Andreas Antonopoulos tweets, “Regulation is not a silver bullet. Education and tools for self-custody are equally important.”

Technological Solutions and Best Practices

- Store Large Amounts in Hardware Wallets: Keep most funds off exchanges and enable two-factor authentication on all accounts.

- Be Careful with Smart Contracts: Stick to verified contracts on block explorers.

- Avoid Connecting Wallets to Unknown Sites: Be wary of phishing attempts; double-check URLs and bookmarks.

- Diversify Investments: Don’t put all your funds in one project to limit potential losses from any single rug pull.

Technological Solutions to Combat Rug Pulls

Crypto investors now have tools to protect themselves from rug pulls. These solutions aim to increase transparency and security in the crypto space.

Smart Contract Audits

Smart contract audits are a key defense against rug pulls. These audits check code for flaws that scammers could exploit. Many crypto projects now undergo audits from trusted firms before launch.

Audits look for common issues such as backdoors or centralized control. They also verify whether the code matches what the project claims to do. Good audits can spot red flags early.

Some audit firms use AI to scan code faster, catching more bugs. However, human experts still play a significant role in audits. Investors should look for projects with public audit reports to ensure that security is a priority.

Decentralized Solutions

New tools give users more control over their funds, aiming to eliminate central points of failure that enable rug pulls:

- Decentralized Exchanges (DEXs): Allow users to trade without giving up private keys, preventing direct theft.

- Multi-Signature Wallets: Require multiple approvals to move funds, making it harder for one person to execute a rug pull.

- Time-Locks: Prevent large sales for a set time after launch, giving investors a chance to spot red flags before scammers can cash out. Smart contracts can also limit the amount that can be sold at once, preventing sudden dumps that crash token prices.

Legal Consequences and Enforcement

Crypto rug pulls are illegal and unethical, and law enforcement agencies are increasingly targeting these crimes. The U.S. Department of Justice has actively pursued rug pull cases, including charging individuals involved in a $1.1 million NFT rug pull in 2022.

Challenges in Enforcement:

- Crypto’s Cross-Border Nature: Complicates legal actions.

- Anonymity of Blockchain Transactions: Can be difficult to trace.

- Lack of Clear Regulations: Hinders effective enforcement in some jurisdictions.

Despite these challenges, international cooperation among law enforcement agencies is improving, and new tools are being developed to trace crypto transactions. Victims of rug pulls often face limited recovery options and may turn to civil lawsuits with varying success rates. Vigilance and thorough research remain the best defense. While clearer legal frameworks could help prevent rug pulls and protect investors, policymakers face the challenge of balancing regulation with innovation.