Cryptocurrency mining is a popular way for investors to make money with their money. However, if you’re mining, particularly on a large scale like many miners are now, you’ll need to pay tax on your cryptocurrency mining activity. This tutorial will cover everything you need to know about cryptocurrency mining taxes, such as what it is, how the tax office views it, whether you’ll have to pay income tax or capital gains tax (or both! ), and how different nations across the world levy taxes on cryptocurrency mining.

What is crypto mining?

The blockchains which host Bitcoin and other cryptocurrencies run due to bitcoin mining, also known as crypto mining. It governs the creation of new Bitcoins as well as the processing and confirmation of network transactions. As it develops and maintains the blockchain ledger, it is a crucial component of the blockchain infrastructure.

Let’s clarify the terminology you need to understand because there is a lot of it surrounding Bitcoin mining.

Bitcoin mining terminology

- Public distributed ledger: This is the record of all transactions in a given blockchain network.

- Block: Blocks are an individual unit of the blockchain. Each block will have a record of the previous block, the confirmed transactions and a nonce.

- Block reward: this is the reward miners get for successfully mining a block.

- Hash: A hash is a function that transforms any data into a fixed size.

- Node: Any computer connected to the Bitcoin network is known as a node.

- Nonce: A nonce is a 32-bit field in a Bitcoin block – miners adjust the value of this to achieve a hash equal to or less than the current target hash value.

- Proof of work: This is the actual process of mining – computers solve a complicated mathematical puzzle known as proof of work

- SHA-256: This is a hash function that ensures all the various blocks are secure and they cannot be altered.

Now let’s put it all together.

How are Bitcoins mined?

New blocks are being validated and confirmed by bitcoin miners for the bitcoin network. They are solving the proof of work puzzle in order to accomplish this. To produce a 64-digit hexadecimal hash that is equal to or less than a target hash in SHA-256, the computers, or nodes, are competing against each other. Once this has been completed successfully, the new block is added to the open distributed ledger after being validated by a master node. A block reward is subsequently provided to the miner. To manage the work, miners employ both mining hardware and software.

How to mine Bitcoin

To mine Bitcoin you’ll need:

- A computer – and a good one at that. You’ll need a PC with a powerful GPU as a minimum, but the reality is to be competitive you’ll likely need a dedicated Bitcoin mining rig, also known as an ASIC miner (Application-Specific Integrated Circuit).

- Power supply – preferably low cost, Bitcoin mining uses up a lot of electricity!

- Mining software – there are lots of options around for Bitcoin mining software. The one you’ll pick will depend on your experience, technical knowledge and whether you’re joining a mining pool. Common options include CGMiner, MultiMiner, BFGMiner and Awesome Miner.

Of course, there are other ways to mine Bitcoin at home, which you can learn about in our how to mine crypto at homeguide.

What crypto can you mine?

Bitcoin isn’t the only cryptocurrency that can be mined. Any blockchain network using proof of work will need miners. Other cryptocurrencies to mine include:

- Dogecoin

- Litecoin

- Bitcoin Cash

- Bitcoin SV

Up until September 15 2022, Ethereum was also proof of work, but has now merged with the beacon chain to become a proof of stake blockchain. However, investors can still mine Ethereum Classic.

How to mine cryptocurrency

BCH, DOGE, LTC and more all work in a similar way when it comes to mining. They all use the proof-of-work process, so you’ll need similar equipment including:

- A GPU or ASIC rig in most instances. This isn’t always the case as you can mine less intensive coins like DOGE with less powerful PCs.

- Power supply – whatever you mine you’ll use up a lot of electricity. In some instances like with lower value coins, it’s definitely worth using a crypto mining calculator to ensure it’s worth your while to mine if you have high electricity costs.

- Dedicated mining software – each different coin uses a slightly different proof-of-work process, so each coin will have different software for mining. Like with Bitcoin mining software, there’s a lot of options out there – so do your research to find the best suited to your experience and technical capabilities.

Crypto mining vs liquidity mining

You might have heard the phrase liquidity mining thrown around, but this shouldn’t be confused with crypto mining. We’ve got a great guide on liquidity mining and how it’s taxed – but in short, liquidity mining is a means of making passive income from your crypto assets. It’s where crypto investors add funds to various DeFi protocol’s liquidity pools in order to earn liquidity pool tokens .They’re not minting new tokens or processing transactions – they’re being rewarded for providing liquidity to a given DeFi protocol.

How much do crypto miners make?

For Bitcoin miners – anytime a miner successfully adds a new block to the blockchain, they’re rewarded with 6.25 Bitcoins. This will halve to 3.125 Bitcoins in 2024. At the time of writing, Bitcoin is worth $48,000 – so 6.25 Bitcoins is no small sum!

However, it’s not easy to mine Bitcoin anymore. Proof-of-work difficulty is increasing to compensate for increasing hardware speed. On top of this, the crypto mining space is more competitive than ever with huge mining farms to contend with.

The equipment to mine is more expensive too – making it an inaccessible investment for many. While other crypto networks like Dogecoin offer more accessibility as the entry costs and computational power needed aren’t as high – miners make less, especially when you subtract running costs. Starts to sound a lot less appealing doesn’t it?

This is why many miners have joined mining pools. A crypto mining pool is a group of miners who combine all their computational power to increase the likelihood of them successfully mining a block before someone else. Bitcoin mining pools remain the most popular option, offering more accessibility and better rewards.

The amount you’re making in mining and indeed the way you go about your mining activities all matter – because the taxman wants to know about both.

Crypto Mining Taxes

So the first question you’re probably going to ask is, is crypto mining taxed?

Yes. Crypto mining is taxed.

How is crypto mining taxed?

It depends on where you live, the scale of your mining activities and the amount you’re earning from crypto mining.

Each tax office has a slightly different take on crypto mining tax. In most countries, you’ll pay tax on crypto mining. Either Income Tax or Capital Gains Tax – and in some countries, both.

This all depends on the scale you’re conducting mining activities at. Many tax offices allow hobby miners to earn crypto tax free, so it’s only when they later sell, spend, trade or gift those mined coins that they’ll pay Capital Gains Tax. But if your crypto mining activities are more business-like due to the scale you’re mining at and the profits you’re making – you’ll pay Income Tax on mined coins at the time you receive them.

It’s not all bad news for miners seen to be operating as a business. Though you’ll pay Income Tax, you’ll often be able to deduct expenses relating to mining like equipment, electricity costs and more.

Let’s take a look at how different tax offices around the world view mining including the US, the UK, Australia and Canada. Skip ahead to find yours.

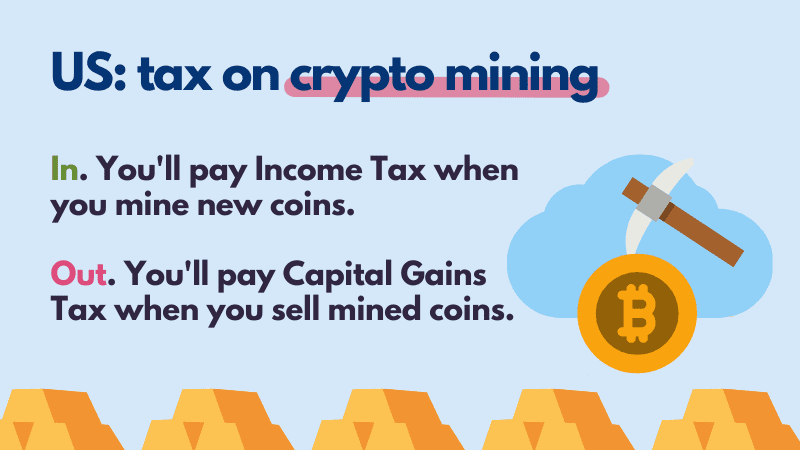

Crypto mining taxes USA

The IRS has taken a hard stance when it comes to crypto mining tax. Regardless of the scale you’re mining at, you’ll pay Income Tax on new coins you receive through mining.

You’ll pay Income Tax based on the fair market value of the coin in USD on the day you received it. This will be taxed at the same rate as your Federal and State Income Tax rates.

You’ll also pay Capital Gains Tax when you later sell, spend or swap mined coins. You’ll use the fair market value of the coin on the day you received it as your cost basis.

If you are self-employed and your mining activities constitute a trade or business – your income from crypto mining will also be subject to Self-Employment Tax to cover social security and Medicare contributions.

Because of this hard stance from the IRS on crypto mining – many US crypto miners choose to establish their mining operation as a business by incorporating it or setting up a sole proprietorship.

Crypto mining expenses USA

Once a mining operation is established as a business – you can deduct your mining costs as business expenses. Most crypto miners know running a successful mining operation is expensive. But treating it as a business can write off some of these expenses from your tax bill.

Some of the business mining expenses you can include are:

- Equipment expenses like a mining rig.

- Costs of repairs to equipment.

- Electricity costs.

- Office space, if applicable, or a home office deduction.

You should always consult with a qualified accountant for advice on the best way to approach your mining activities from a tax perspective.

How to report crypto mining taxes to the IRS

You need to report your crypto mining income to the IRS as part of your annual tax return. You report your income from mining on Form Schedule 1 (1040), or Form Schedule C (1040) if you’re self-employed or running a mining business.

You’ll report any capital gains from selling, swapping or spending mined coins on Form Schedule D (1040) and Form 8949.

Crypto mining taxes UK

HMRC has clear guidance for UK crypto miners. You’ll pay Income Tax on your mined coins, as well as Capital Gains Tax when you later sell, spend, swap or gift them.

Hobby miners and mining businesses do have slightly different tax treatment though so let’s break it down.

For hobby miners, you’ll pay Income Tax based on the fair market value of your crypto in GBP at the time you receive it. You’ll also pay Capital Gains Tax when you later ‘dispose’ of your coins by selling, trading, spending or gifting them (excluding to your spouse).

However, you might also be seen as conducting business activities depending on your:

- Degree of activity

- Organisation

- Risk

- Commerciality

So if you’re using a home computer and mining – you’re likely to be seen as a hobby miner. But if you’ve got a selection of dedicated computers or multiple mining rigs set up – you’re more likely to be seen as a business by HMRC.

If your crypto mining is classified as a business, then mining income will be added to trading profits and subject to Income Tax. You’ll also pay either Capital Gains Tax or Corporation Tax on Chargeable Gains when you later spend, swap, sell or gift your mined crypto depending on how your business is registered.

Crypto mining expenses UK

If you’re operating as a business, you do get a couple of perks from a tax perspective as you can deduct costs against your profits, lowering your Income Tax bill. Allowable expenses include equipment costs, maintenance costs and electricity costs.

How to report crypto mining tax to HMRC

For hobby miners, you report your crypto mining income as miscellaneous income and It’s not subject to National Insurance Tax. You’ll report this on your Self Assessment Tax Return (SA100) in box 17. For any capital gains from selling, swapping, spending or gifting mined coins, you’ll report this in the Self Assessment Capital Gains Summary (SA108).

Crypto mining taxes Australia

The ATO is clear that Australian crypto miners will be taxed based on whether their crypto mining activities are seen to be that of hobby mining or business mining.

Hobby miners don’t pay Income Tax on their mined crypto. They’ll only pay Capital Gains Tax when they later sell, spend, swap or gift their mined coins.

Business miners will pay Income Tax on their mined crypto at the point they receive it. They’ll also pay Capital Gains Tax when they later sell, spend, swap or gift mined coins.

So what’s the difference between the two?

A hobby miner is someone who mines as an interest or a pastime and not in a business like manner and without the intent to make profit. They might have a small-scale operation at home, but the amount of equipment and tech they’ve invested in is minimal. The intention is to accumulate mined coins – not immediately sell them for a profit. This makes the mined coins a capital acquisition rather than a form of income.

Meanwhile, someone with extensive equipment operating out of a dedicated space who is mining and selling a lot of coins for a profit would be considered to be a crypto mining business.

Crypto mining expenses Australia

If you are seen to be a crypto mining business, it’s not all bad news. Although you’ll pay Income Tax and Capital Gains Tax on your mined coins – you can deduct expenses related from mining to reduce your tax bill. Allowable expenses include your electricity and equipment costs.

How to report crypto mining taxes to the ATO

For hobby miners, you’ll report your crypto mining activities to the ATO as part of your Annual Tax Return.

Income from crypto – including from crypto mining – should be declared on question 2 of the Tax Return for Individuals (NAT2541).

For any capital gains from selling, swapping, spending or gifting your mined coins – you’ll need to fill out the Tax Return for Individuals Supplementary Section (NAT 2679).

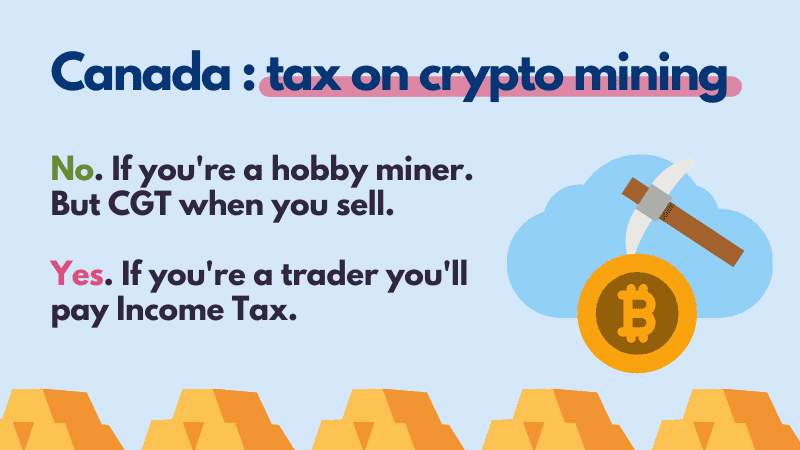

Crypto mining taxes Canada

The CRA is clear that crypto mining tax varies depending on whether you’re seen to be making business income or if you’re a hobby miner. Let’s look at both.

If you’re mining as a hobby, you won’t pay Income Tax on mined coins. You’ll only pay Capital Gains Tax when you sell, swap, spend or gift mined coins later on.

However, because Canada uses the adjusted cost basis method – they’re very clear that all proceeds from selling, swapping, spending or gifting mined coins will be subject to Capital Gains Tax. In other words, because you got the coins for nothing, your cost basis is zero and the entire proceeds from disposing of your mined coin(s) is considered a capital gain.

Meanwhile, if your mining activities constitute business income, the tax on your crypto mining is different. The coins you receive are considered inventory and you’ll need to use one of two methods to value it:

1. Valuing each item at either its acquisition cost or its fair market value at the end of the year, whichever is lower.

2. Valuing the entire inventory at its fair market value at the end of the year (the price you would have to pay to replace an item or the amount you would receive if you sold an item)

Whichever method you use, this will then become part of your business income and be taxed as such.

Crypto mining expenses Canada

If you’re operating as a crypto mining business, you can deduct expenses related to your crypto mining activities to reduce your tax bill. Allowable expenses include equipment like mining hardware, power costs, mining pool fees and maintenance costs. You will need good records for all of these expenses to be able to deduct them.

How to report crypto mining taxes to the CRA

For hobby miners, you’ll report your crypto as part of your Income Tax Return T1. For capital gains from selling, swapping, spending or gifting mined coins, you’ll report these on the Schedule 3 Form.

FAQs

More questions? Here’s some of our most frequently asked…

Can you still mine bitcoin?

Yes. You can still mine Bitcoin, but you’ll need top of the line equipment for it to be profitable. There’s around 1.7 million Bitcoin left to mine and the last Bitcoin is forecast to be mined in 2140.

How much does it cost to mine bitcoin?

It all depends on the equipment you buy and how much it costs to run. You’ll likely need a dedicated ASIC to mine Bitcoin profitably and these can set you back thousands.

Is mining cryptocurrency legal?

For the most part, yes – although it depends where you live. A few countries have banned crypto including Algeria, Bangladesh, China, Egypt, Iraq, Morocco, Nepal, Qatar and Tunisia.

How hard is it to mine Bitcoin?

Pretty difficult! Bitcoin has a difficulty curve which means it gets harder and harder to mine – so you need a very powerful rig to mine Bitcoin successfully nowadays. Most miners join Bitcoin mining pools to help them increase their chances of a reward.