To avoid paying taxes on cryptocurrency, have you considered packing your bags and moving to a tax haven for cryptocurrency? There are still a few crypto tax havens and countries where you’ll pay less crypto tax, despite the fact that the majority of countries in the globe subject cryptocurrency to Capital Gains Tax or Income Tax. Discover the best places to relocate in 2023 for crypto taxes.

11 best crypto tax free countries

While the majority of nations in the globe do tax cryptocurrencies, some do so slightly less or not at all. The top cryptocurrency tax-free nations as of August 2023 are shown below.

Germany

We’ll start by stating that while Germany has some peculiar crypto tax laws that allow investors to legally dodge crypto taxes there, cryptocurrency isn’t entirely tax free in Germany.

Bitcoin and other cryptocurrencies are not seen as capital assets in Germany; rather, they are seen as private money. This is noteworthy because if you keep your cryptocurrency for longer than a year, you won’t have to pay taxes on it when you sell, swap, or use it.

Holding onto your cryptocurrency is important because, unless the profit is less than €600, cryptocurrency held for less than a year is taxed.

So provided you HODL, your crypto is tax free in Germany. But before you pack your bags for Berlin, it’s not all good news when it comes to crypto tax.

Germany does still subject some crypto to Income Tax, including:

- Getting paid in crypto.

- Mining crypto.

- Staking crypto.

- Selling, swapping or spending crypto you’ve held for less than one year if the gain is more than €600.

Belarus

From the West to the East of Europe, Belarus is another cryptocurrency tax-free country.

Back in 2018, Belarus adopted an interesting unique approach towards cryptocurrencies. The Eastern European state consented to cryptocurrency activities in March 2018 and exempted all persons and businesses from crypto tax until 2023 instead of adopting crypto tax laws like many other countries.

As a result, all cryptocurrency-related activities, including day trading and mining, are seen as personal investments and are therefore excluded from both income tax and capital gains tax.

This unique law, which was developed to support Belarus’ digital economy, will be reviewed in 2023. Belarus is now a cryptocurrency tax haven, but this may change after the 2023 review.

El Salvador

El Salvador made international headlines as the first nation to officially recognize Bitcoin as legal money.

The country believes that by doing this, they will be able to draw more investment into its economy. To further promote this, the country also now exempts foreign investors from paying any tax on Bitcoin gains or income.

Even better, companies are required to accept Bitcoin as payment because it is recognized as legal cash in the nation. In El Salvador, you can use Bitcoin to pay for a wide variety of goods and services that you couldn’t anyplace else in the world.

Portugal

Want a sunny beach and tax free crypto?

If you want to reside somewhere where you won’t have to pay crypto taxes, Portugal is one of the best destinations in the world. Since 2018, no taxes have been paid on any cryptocurrency sales profits. Even better, cryptocurrency trading is tax free because it isn’t regarded as investment income.

Your cryptocurrency is likewise exempt from VAT and Income Tax in Portugal, provided you are not a business. Portugal therefore offers tax-free cryptocurrency investment for the great majority of investors.

Having said that, all of this might be changing, and soon! Gains from selling or exchanging cryptocurrency kept for less than a year will be subject to a flat tax rate of 28% under the draft state budget for 2023, compared to other types of income.

Singapore

There’s a reason many crypto exchanges – like KuCoin and Phemex – are based in Singapore. Singapore is a crypto tax haven for both individuals and businesses.

This is because Singapore doesn’t have a Capital Gains Tax – so individual investors and businesses are not liable for Capital Gains Tax. So when you dispose of crypto by selling it or trading it, you won’t pay Capital Gains Tax.

As well as this, because cryptocurrencies are viewed as intangible property from a tax perspective, when you spend crypto on goods and services, this is viewed as a barter trade, not a payment. So while the goods or services may have Goods and Services Tax (GST), the payment coin or token will not.

Of course, you can’t avoid all taxes. If you’re acting as a business and you accept crypto as payment – you will pay Income Tax on it. Similarly, if a company’s core service is related to crypto trading, the company would still be liable for Income Tax.

Malaysia

Singapore’s neighbor Malaysia is also a crypto tax free country.

Because cryptocurrencies are not viewed as capital assets nor a legal tender by Malaysian authorities – crypto transactions are tax free for individual investors.

This comes with a caveat though. The Malaysian Inland Revenue Board says that crypto transactions are only exempt from tax when they are not regular or repetitive. So in other words, if you’re trading like a day trader – you’ll still pay tax on your crypto.

Similarly for businesses involved in crypto – profits would be subject to Income Tax, regardless of whether the profits are in crypto or fiat currency.

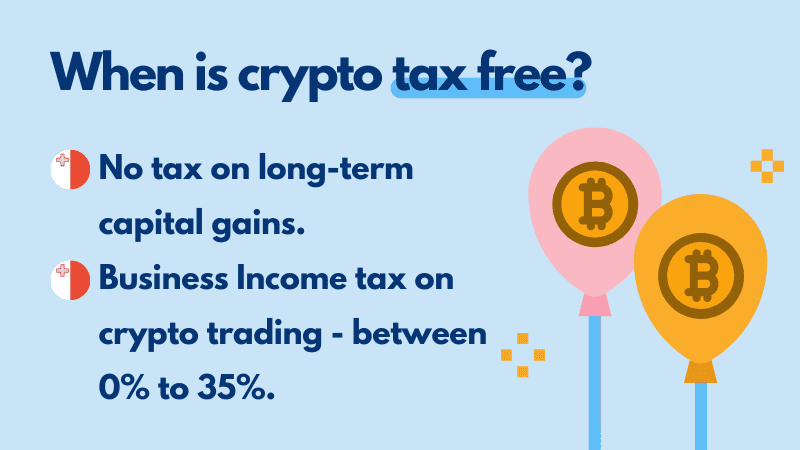

Malta

Also known as blockchain island, Malta is a crypto tax haven. The country recognizes Bitcoin and other cryptocurrencies as a ‘unit of account, medium of exchange or a store of value’.

What this means is you’ll pay no Capital Gains Tax on long-term gains from selling crypto provided it is considered ‘a store of value’. So it’s good news for hodlers.

This said, crypto trades are viewed as similar to day trading stocks or shares. As such, they attract the Business Income Tax rate of 35%! There are however structuring options within the Maltese tax system that allow you to reduce this tax rate to between 0% to 5% – it all depends on how much you earn and your residency.

Cayman Islands

It should come as no surprise the Cayman Islands are on this list. The Cayman Islands have long been known to be a tax haven for both businesses and investors outside of the crypto market and crypto is no exception to their lax tax laws.

For both crypto businesses and individual investors, the Cayman Islands is a crypto tax haven. The Cayman Islands Monetary Authority imposes no Corporate Tax on businesses and no Income Tax nor Capital Gains Tax on residents. Instead, the Caribbean paradise earns revenue through tourism, work permits and GST.

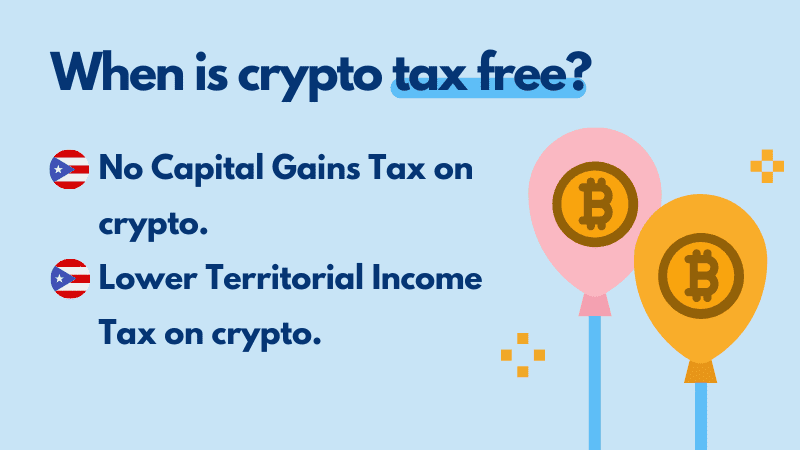

Puerto Rico

For US residents, you’ve probably heard about the Silicon Valley billionaires heading South to enjoy the luxurious Puerto Rican lifestyle – and lax tax laws.

While Puerto Rico is an unincorporated territory of the United States, it’s considered a foreign country as far as Federal Income Taxes go. So the country sets its own tax laws.

When it comes to crypto taxes, it’s great news. Puerto Rican residents pay a much lower Territorial Income Tax compared to the US Federal Income Tax rate. In even better news, digital assets acquired while you were a resident of Puerto Rico are completely exempt from Capital Gains Tax.

What this means is that it really matters when you bought your crypto as to whether you’ll pay tax on it. If you’re a US resident who acquired crypto prior to moving to Puerto Rico – you’d still need to follow the IRS crypto tax laws for that crypto. However, if you acquire crypto after establishing residency in Puerto Rico – your crypto is totally exempt from Capital Gains Tax.

Switzerland

Last up for our top tax free crypto countries list is Switzerland. Switzerland has long been considered one of the best places to live in the world when it comes to taxation – with modern policies that have earned the country the nickname crypto valley.

This doesn’t mean you won’t pay any tax on your crypto, it just means the crypto tax laws in Switzerland are very different from other countries in the world.

We’ll lead with the bad news. You’ll pay Income Tax on crypto mining, as well as if you’re a qualified day trader. You’ll also be subject to the Wealth Tax – which is levied on your total net worth each year. The Wealth Tax Rate depends upon the Canton in which you live.

In better news though, for individual investors who aren’t trading on a professional level – crypto profits are exempt from Capital Gains Tax. So selling and trading crypto is tax free for many investors.

Georgia

Georgia is one of the best crypto tax free countries in the world – for both individuals and corporations. The Georgian Ministry of Finance states that individuals in Georgia are exempt from any Income Tax on profits from selling cryptocurrency. As well as this, because Georgia does not consider crypto to be “Georgian sourced” – that is assets specific to a geographical location – crypto is also not subject to Capital Gains Tax in Georgia.

For crypto held within a legal entity – for example, an LLC – profits are subject to a relatively low 15% corporation tax (CIT).

Crypto is a tax minefield

Tax offices and governments around the world haven’t quite yet figured out how to deal with crypto and its taxation. What this means is that there’s a lot of discrepancy between how crypto is viewed and how crypto is taxed around the world. In some countries, you’ll pay multiple taxes on your crypto – while in others – like some of the countries above – you’ll pay none at all.

The vast majority of countries (excluding El Salvador) do not recognize cryptocurrencies as a fiat currency – like dollars or pounds. Instead, it’s most often viewed as a kind of asset or commodity – like a property or a stock.

This view matters because it dictates the way cryptocurrency is taxed. In most countries, cryptocurrencies will be subject to Income Tax or Capital Gains Tax – or sometimes both!

If you’re seen to be ‘earning’ crypto, you’ll pay Income Tax. Again, different countries have different views on what earning crypto includes, but in general, you’ll pay Income Tax when:

- Getting paid in crypto.

- Mining crypto.

- Staking crypto.

- Earning interest on crypto.

In fact, in some countries you’ll also pay Income Tax on hard forks and airdrops.

This isn’t the only tax you’ll pay, because even if you pay Income Tax on your crypto – you might still have to pay Capital Gains Tax later on.

Because crypto is seen as a capital asset – it’s subject to Capital Gains Tax in most countries. Any time you dispose of a capital asset, you’ll make a capital gain or loss (profit or loss). If you make a capital gain, you’ll pay Capital Gains Tax on that profit. Disposals of crypto include:

- Selling crypto for fiat currency.

- Trading crypto for another cryptocurrency.

- Spending crypto on goods or services.

- Gifting crypto – in most countries.

So if you earn crypto – say by mining – and then later sell your mined coins, you’ll pay both Income Tax and Capital Gains Tax in most countries. That’s a lot of tax!

As we hinted at in the introduction though – it’s not quite so straightforward when it comes to crypto tax. The above is a general overview, but the taxation of crypto depends on where you live. Some countries remain crypto tax havens for investors looking to avoid double taxation on their crypto.

Let’s dive into the best countries to live in to avoid crypto tax.

If you’re seen to be ‘earning’ crypto, you’ll pay Income Tax. Again, different countries have different views on what earning crypto includes, but in general, you’ll pay Income Tax when:

- Getting paid in crypto.

- Mining crypto.

- Staking crypto.

- Earning interest on crypto.

In fact, in some countries you’ll also pay Income Tax on hard forks and airdrops.

This isn’t the only tax you’ll pay, because even if you pay Income Tax on your crypto – you might still have to pay Capital Gains Tax later on.

Because crypto is seen as a capital asset – it’s subject to Capital Gains Tax in most countries. Any time you dispose of a capital asset, you’ll make a capital gain or loss (profit or loss). If you make a capital gain, you’ll pay Capital Gains Tax on that profit. Disposals of crypto include:

- Selling crypto for fiat currency.

- Trading crypto for another cryptocurrency.

- Spending crypto on goods or services.

- Gifting crypto – in most countries.

So if you earn crypto – say by mining – and then later sell your mined coins, you’ll pay both Income Tax and Capital Gains Tax in most countries. That’s a lot of tax!

As we hinted at in the introduction though – it’s not quite so straightforward when it comes to crypto tax. The above is a general overview, but the taxation of crypto depends on where you live. Some countries remain crypto tax havens for investors looking to avoid double taxation on their crypto.

Let’s dive into the best countries to live in to avoid crypto tax.