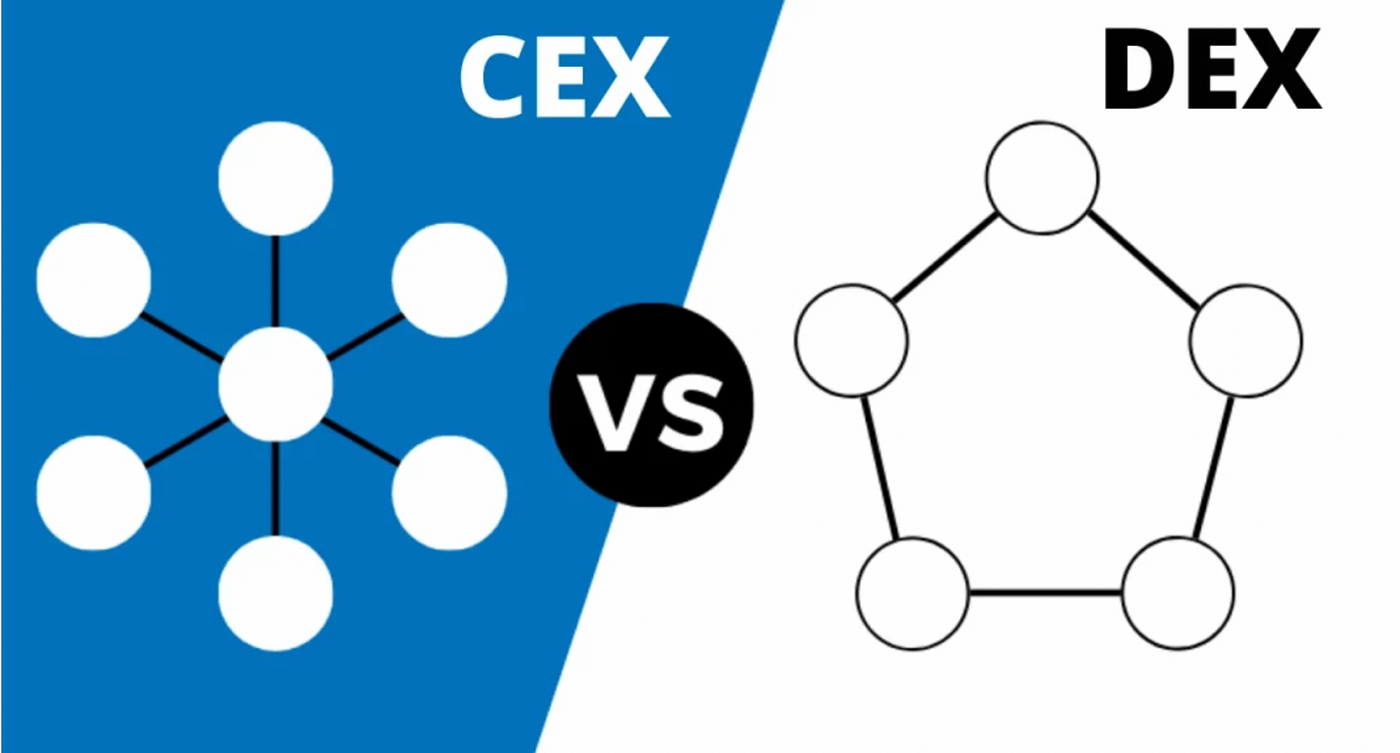

If you are new to the crypto space, you must have come across the word centralization or decentralization and probably wonder what they mean. We are going to give an explanation about them both and also give you their advantages.

A decentralized wallet gives you actual ownership of your assets but burdens you with the responsibility of keeping the seed phrase safe. While having a centralized wallet is like having a bank account — if you lose your seed phrase, you will be able to regain access to your assets.

Summary

Centralized advantages

You can restore the password and regain access to your funds.

More secure storage of assets.

Transactions inside the wallet’s ecosystem usually are almost instant and free.

Allows holding assets from different blockchains.

Usually, centralized wallets are more trusted due to the KYC and AML.

Decentralized advantages

Assets can not be blocked (except in some situations). Only you own your assets.

No need for KYC, your wallet is not personalized, and it is only the number on the blockchain.

All of the DeFi platforms are available.

There is no downtime. Everyone can make transactions anytime.

Outline

1. Centralised wallets

1.1 KYC and AML

1.2 Security

1.3 Transaction speed and costs

1.4 Support of multiple blockchains

2. Decentralised wallets

2.1 There is no KYC

2.2 Access to DeFi platforms

2.3 24/7 availability

Centralized wallets

The centralized wallet can also be called a custodial wallet. Custodian is a financial institution that holds customers’ assets on their behalf. In terms of blockchain — they have the private key or store your assets in their wallets and permit you to use them. The primary role of the custodian is to keep assets safe from loss and theft, clear and settle operations properly and provide the owner with an easy interface to interact with his assets.

KYC and AML (Know Your Customer and Anti Money Laundering)

Usually, custodians require documents to create an account and deposit assets. This happens because they will:

Need to identify the actual owner in the case of the loss of the credentials.

Be responsible for all illegal money that will be processed through them.

Comply with the government and tax laws not to be banned. Also, they may disclose information about your account to the government, which will charge you taxes.

Security

Security advantage comes from the custodian’s responsibility to keep assets safe, multiple information security tools, and security politics which decrease the probability of theft. Compared to the decentralized, when the user is the only person responsible for keeping his computer secured and private key or seed phrase safe.

Transaction speed and cost

Usually, Centralised wallets belong to the crypto exchanges, which allow to trade and send cryptocurrencies inside their platform. Technically, all of the assets on the platform belong to the platform, so when users send or trade assets — the platform only changes the numbers in its database with no transaction fees on the blockchain.

Support of multiple blockchains

As I have mentioned earlier, a centralized wallet usually is controlled by exchange, so they let trade crypto not only inside one blockchain. It is provided by multiple wallets that belong to the exchange on different blockchains, so they act as a crypto bridge. For instance, users can deposit to a centralized wallet USDT on Ethereum (ERC20) and withdraw to Binance Smart Chain (BEP20). Furthermore, they can trade cryptocurrencies from different blockchains, for instance, BTC and ETH.

Decentralized wallets

Decentralized wallets are non-custodial wallets, meaning they do not hold any assets. Such a wallet is an interface for Blockchain with an easy-to-understand UI that enables users to create and import wallets and display and manage crypto assets stored on the chain.

It is good to know that no one can turn your wallet offline or put assets on the flash drive and store them there, all of the assets are stored on the chain, and the private key allows you to sign the transaction to manage assets.

Decentralized wallets can be the following:

Software wallet (hot wallet) — a program that holds your private key in your memory on the computer. The transaction can be made by pressing a button in the wallet’s interface.

Hardware wallet (cold wallet) — a physical device that holds your private key and enables transactions upon pressing the button.

The asset issuer can block them on your wallet. For instance, USDT can be blocked by its issuer — Hong Kong company iFinex Inc.

There is no KYC

There is no KYC because there is no counterparty who will be able to check documents. These wallets allow the creation of alphanumeric sequences with no name, so they are anonymous.

But as all the transactions are on the chain — there is an opportunity to build a tree of relations. Some of the owners disclose their wallets, or the exchanges are doing it, so it is possible to find links between friends, relatives, and other counterparties and identify the wallet’s owner. A dangerous thing here is that you will be under suspicion if someone sends you gal activities.

Access to DeFi platforms

I think this is a significant advantage because their platforms allow doing almost everything at the moment. Users can borrow money, earn returns, purchase NFTs and use them.

24/7 availability

or not. This is almost always true, especially when you consider Bitcoin or Ethereum. But some networks may be unavailable due to the vast number of requests per second (Solana is a typical example).