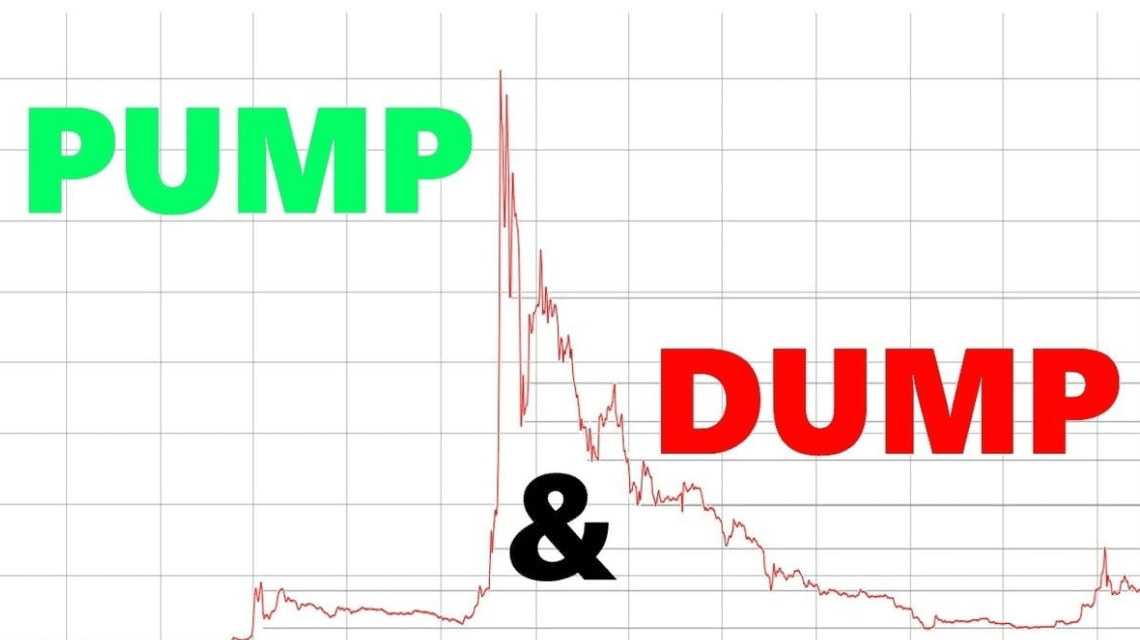

Pump and dump schemes represent a coordinated manipulation tactic wherein the value of a commodity experiences a sudden surge followed by a significant drop. In this deceptive maneuver, the term “pump” denotes the rapid price escalation, while “dump” characterizes the subsequent sharp decline.

Although pump and dumps are prevalent across various investment domains, they have garnered particular prominence within digital investment arenas, notably in cryptocurrencies like Bitcoin. This article delves into the specifics of pump and dumps within the crypto space, elucidating their mechanisms and implications for everyday traders.

What is Pump and Dump in Crypto?

Cryptocurrencies, renowned for their inherent volatility, are occasionally subjected to artificial influences leading to abrupt fluctuations followed by rapid devaluations. Pump and dump schemes within the realm of crypto entail orchestrated efforts, especially targeting assets with low liquidity, to inflate their prices swiftly for the benefit of perpetrators seeking quick profits.

How Crypto Pump and Dumps Work

The execution of a pump and dump operation typically unfolds in several stages. Initially, a group of traders is assembled through various social media platforms. Subsequently, a specific crypto asset and exchange are chosen, and the event’s schedule along with the target price are communicated within the group.

During the designated timeframe, community members engage in rapid purchases of the selected asset, causing a sharp ascent in its value. This surge attracts additional traders, further amplifying the price. Once the predetermined target price is attained, participants swiftly sell their holdings, realizing profits while leaving subsequent buyers susceptible to losses. The success of a pump and dump hinges on the cohesive adherence of the community to the plan.

Furthermore, a crucial aspect of pump and dumps involves “shilling” the asset, typically initiated after community members have secured their purchases. This orchestrated dissemination of positive information about the asset, often spearheaded by contracted influencers or community members, serves to attract more traders, thereby driving the price higher.

What is a Pump Signal?

Within the realm of pump and dumps, a pump signal serves as an advance notice detailing the specifics of the operation. It functions as an invitation for prospective buyers to purchase the asset before the external pump signal commences. This signal is disseminated through coordinated endorsements of the asset’s merits, including its sudden price surge, enticing more individuals to invest and consequently fueling further price escalation.

What are Pump and Dump Groups?

Cryptocurrency pump and dump groups primarily utilize platforms like Telegram and Discord to orchestrate their activities. These groups, varying in size from a few hundred to thousands of traders, are typically hierarchical in structure.

Administrators oversee group activities, including the dissemination of pertinent information regarding planned operations. Coaches play a pivotal role in educating new members about the group’s modus operandi, while veteran members are tasked with recruiting additional traders, often rewarded with enhanced privileges or access to privileged information.

How to Detect Pump and Dumps

Detecting pump and dump schemes amidst the inherent volatility of cryptocurrencies can be challenging. However, certain red flags warrant scrutiny, including:

Liquidity and Popularity of Asset:

Sudden, disproportionate price surges in relatively obscure assets with low liquidity may signal potential pump and dump activity.

Sudden Hype:

Abrupt spikes in social media discussions and endorsements by influencers could indicate a coordinated effort to inflate an asset’s price.

While these indicators do not definitively confirm pump and dump schemes, they align with common characteristics observed in such cases.

What are Pump Bots and How Can They Help?

Pump and dump strategies prioritize speed, emphasizing swift decision-making to capitalize on market movements. Pump bots facilitate this process by enabling traders to execute rapid buy and sell orders, often within seconds. These bots can be programmed with algorithms to automate repetitive transactions, optimizing trading efficiency.

FAQ

Are Pump and Dumps Legal?

The legality of pump and dumps remains ambiguous, as they do not equate to insider trading. However, from a financial law perspective, they constitute illegal manipulation of market prices.

How Much Profit Can You Make from a Pump and Dump?

Profitability in pump and dump schemes hinges on several factors, including capital investment, timing of purchase and sale, the success of the operation, and exit strategy. Early buyers who sell before the asset begins to depreciate stand to reap substantial profits.

Is It Possible to Join a Pump and Dump Group?

Participation in pump and dump groups may vary based on community structure. Some groups are open to the public, while others operate on an invitation-only basis.

Conclusion

While pump and dump schemes offer potential for lucrative gains, they are fraught with risks, including the possibility of significant losses if not executed judiciously. Traders must conduct thorough research, exercise caution, and adopt prudent investment strategies to navigate this volatile landscape effectively.