Cryptocurrency has come a long way since its inception in 2009. The voices of pioneers that envisioned a world of monetary self-sovereignty are rapidly being overtaken by global cryptocurrency exchanges competing to attract users. While these exchanges utilize cold storage themselves, there has been a definite shift in the landscape of how individuals store their crypto. New users often rely on the convenience and perks that come with exchanges and online custodial wallets rather than storing their crypto in cold storage directly.

So what exactly is cold storage? And what are the top 3 things people get wrong about it? Cold storage simply refers to a wallet address that is offline. This prevents the wallet from being hacked or confiscated as long as the owner remembers their private key or recovery phrase. The owner is wholly responsible for keeping their keys safe and securing them.

Misconception #1: Crypto is Stored on the Hardware Device

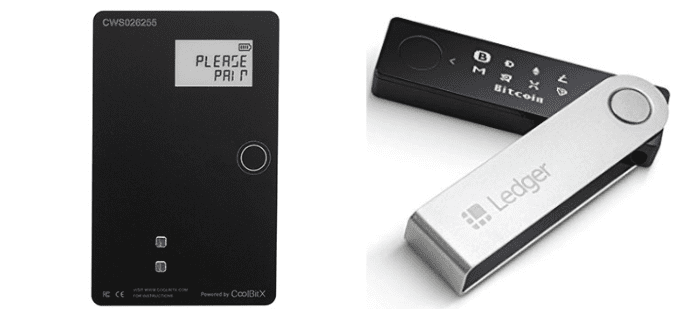

This is one of the biggest misconceptions people have about cold storage. People often believe when they are referring to cold storage that crypto is stored directly on a hardware wallet like a Trezor One or Ledger Nano model. This misconception is often repeated through incorrect or lack of clear definitions in reporting through the mainstream media.

One of the more famous horror stories is of a man in the UK named James Howells. In 2013, Mr. Howells accidentally threw out a hard drive with 7,500 Bitcoin on it. The hard drive ended up in his local council landfill and he has spent the last decade trying to retrieve it. Losing the hard drive itself would not have resulted in the loss of his Bitcoin, as it is still at the address. However, his hard drive contained his private key information, and this is why his Bitcoin is “lost in a landfill”.

It is important to understand that Bitcoin or any cryptocurrency are not stored directly in any physical location. The assets are always on the blockchain, but the private keys (which give you ownership over your crypto) are stored offline with cold storage.

Misconception #2: You Get the Same Benefits From an Exchange Using Cold Storage

Many new users who enter the cryptocurrency space may be unaware of the different wallet types and the risks that come with each one. Cryptocurrency exchanges are growing in popularity and provide an easy on-ramp for new users through their custodial wallets. It is understandable why many users opt to use them over the intricacies and risks of taking control of their crypto through a cold storage wallet.

Many new users don’t fully understand or appreciate the risks that come along with a custodial exchange wallet. There is a compromise and sacrifice that comes with their usage. Cryptocurrencies were designed to eliminate the need for trust in third-party intermediaries. Exchanges reintroduce this layer of trust which is problematic for two main reasons.

The first problematic reason for reintroducing trust into exchanges is that it centralizes control. It creates a central point of failure and creates a very attractive target for hackers to strike. If an exchange goes bankrupt, is hacked, or an owner pulls the crypto out of the exchange there is nothing to guarantee users’ crypto will be protected. Today’s exchanges are more regulated and users are more protected than ever. Industry best practice standards on insurance and cold storage management of 90%+ of crypto holdings are much more commonly observed today.

The second reason is that as the cryptocurrency space becomes more and more regulated, exchanges are being forced to adopt more and more reporting obligations on their users. Exchanges need to abide by certain laws and guidelines in the countries they operate in. The 2022 Freedom Convoy protests in Ottawa resulted in some citizens’ bank accounts being frozen or seized. The Ontario Supreme Court also ruled in favor of freezing citizens’ crypto accounts. Exchanges were obligated to freeze users’ accounts or risk having their licenses revoked.

This should be a major warning sign for users who are looking to crypto as an escape from centralized banking. Governments have revealed that they can and will use their power to exercise control over individuals’ finances. The only way to protect against this is to move crypto into a cold storage wallet outside the government’s grasp, meaning off an exchange.

Misconception #3: Hot Wallets Are Always Better Than Holding on an Exchange

Users’ next question might be to ask if a cold storage wallet is really necessary if they are storing their crypto in a hot wallet outside of an exchange, or if the exchange uses cold storage. This is more of a question of custodial vs non-custodial wallets and I’ll refer you to the old maxim “not your keys, not your crypto”.

There are two main disadvantages to using a self-custodial hot wallet vs a cold wallet. The first is that a hot wallet is connected to the internet which is a point of failure. Security is the responsibility of the user. If a user’s device where the hot wallet is stored is compromised, then the hot wallet may also be compromised.

The second disadvantage is that hot wallets may not be operating as independently as advertised. metamask recently dropped users and barred them from accessing their hot wallets in Iran and Venezuela in response to Russia’s invasion of Ukraine. This move comes in support of the direction of U.S sanctions against these countries.

Once again governments are exerting their power over who is and is not allowed to access cryptocurrencies. Regardless of whether an exchange is using cold storage for users’ funds, or if you are using your own self-custodial hot wallet, regulatory authorities have control over the exchanges and sanctions, and therefore your funds. Each option has its benefits and drawbacks.

Conclusion: Wallet Choice is a Personal Risk Assessment

It is important to remember that no wallet type is inherently good or bad. They each offer varying degrees of security and service.

For many people, particularly in the developed world where there are stable and relatively pro-crypto governments, there is nothing wrong with only using cryptocurrency exchange custodial wallets. Although Canada is a stark reminder that this can change on a dime if you are deemed an enemy of the state. But for anyone fleeing an unstable government with corrupt central banking, or times of high inflation and war, cryptocurrency security is paramount.

As we enter into a new era of unprecedented cryptocurrency regulation it may be best to start thinking about where and how you want to store your cryptocurrency.