Crypto Hot Wallet vs Cold Wallet – Which Is Best?

Whether you’re a seasoned investor or a newbie to the world of crypto, you’ve probably heard of crypto wallets. Big names in the cryptosphere, like Coinbase and Binance, are constantly praising the uses of wallets and the streamlined service they offer.

But do you actually need a crypto wallet? And what do hot and cold wallets mean in crypto?

Today, we’re going to look at the pros and cons of hot and cold wallets, as well as discover if you really need a wallet at all in order to manage your crypto.

Let’s get straight down to business.

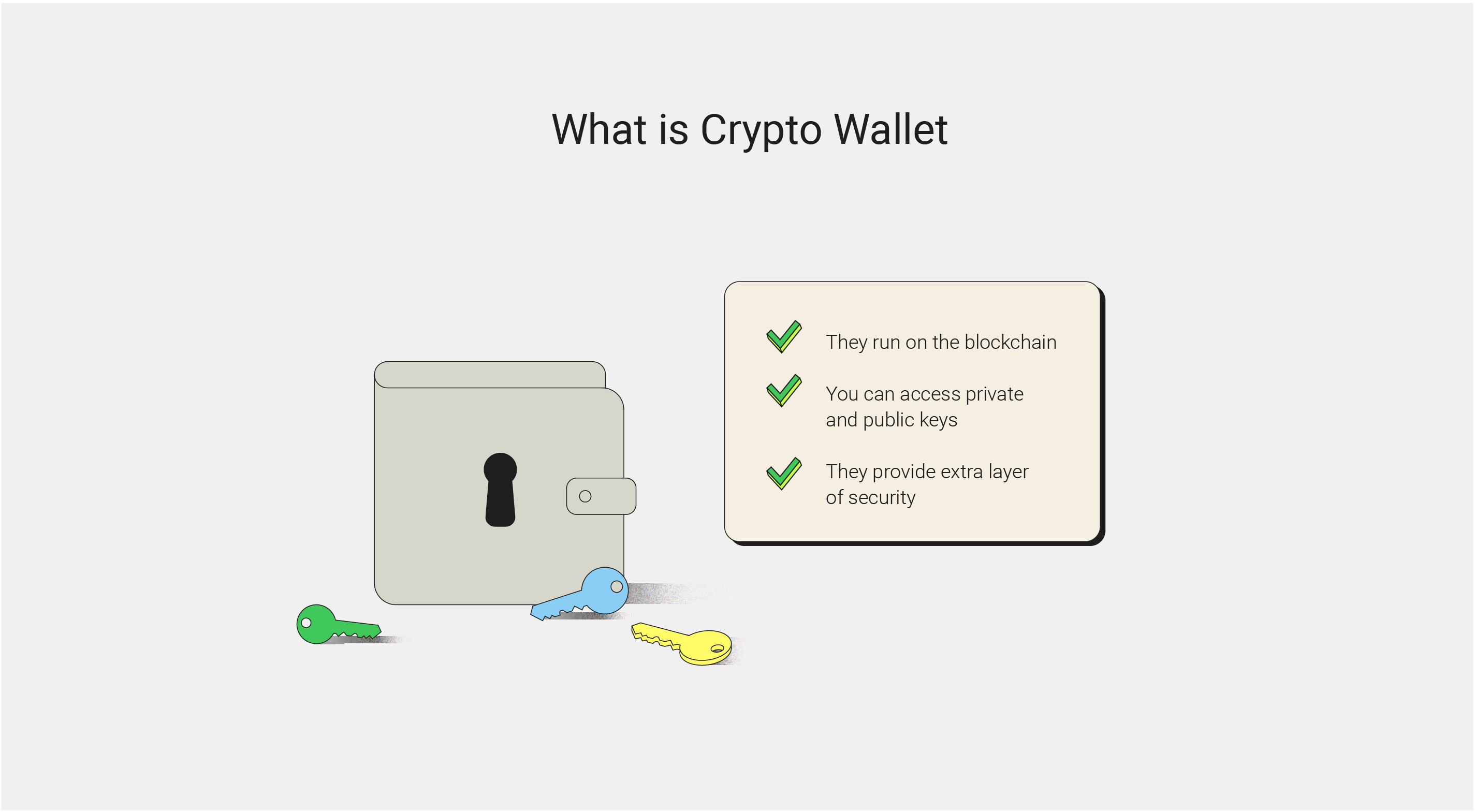

What Is a Crypto Wallet?

The first thing to know about crypto wallets is that they are not technically wallets; i.e., you do not hold any funds in your wallet. In fact, your crypto funds are always held on the blockchain. This is possible because crypto is not a physical asset and thus can exist outside the realms of centralized financial institutions.

Therefore, your wallet simply provides access to your private and public keys. These keys are what let you send and receive crypto.

As such, you can think of a crypto wallet as an iron-clad safe in which you might keep your debit card. Another analogy is that a crypto wallet is similar to your online banking portal, whereby you need a username and password to access your funds.

Either way, you like to think of it, your crypto wallet is a tool that lets you access your coins and tokens safely and securely.

There are two types of crypto wallets: hot and cold. We’ll get into that in just a moment, but first let’s answer a very important question: do you need a crypto wallet?

Do You Need a Crypto Wallet?

The simple answer is no. To buy, sell, trade, and lend any cryptocurrency, you don’t technically need a wallet to do so. You can make all of these transactions on a reputable exchange, such as Binance or Kraken.

However, crypto wallets are advisable, as keeping large amounts on an exchange will leave you open to potentially fraudulent activity.

While the best exchanges in the world use the most cutting-edge, sophisticated technology and software to protect their networks, the fact remains that they are an extremely popular and potentially lucrative source of income for hackers.

Therefore, although not expressly needed to perform transactions on the blockchain, crypto wallets have become increasingly popular over the years, as they offer an extra layer of security between you and any shady third parties.

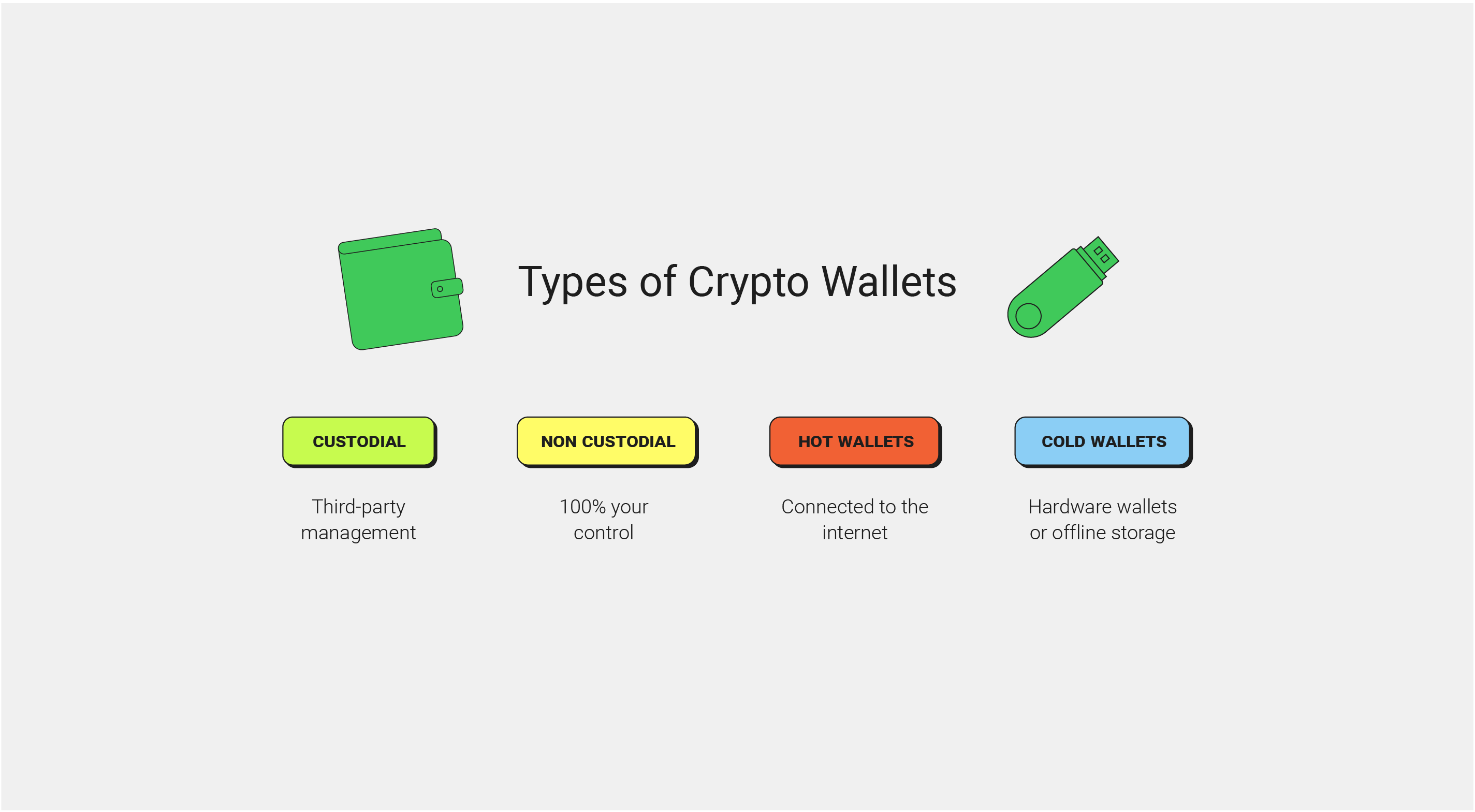

Choosing a Crypto Wallet

When it comes to choosing a crypto wallet, you can opt for a custodial or non-custodial wallet. As the name suggests, a “custodial” wallet is one that is managed by a third party. Custodial wallets are usually hosted on the internet, which makes them easier to access, but also come with restrictions and caveats set up by the wallet manager.

On the flip side, you have non-custodial wallets. These are the ones that you have 100% control over. They are more secure and come with zero restrictions. However, with this freedom comes extra responsibility, in the form of having to look after your access keys.

In the event that you lose them with a non-custodial wallet, you will never be able to access your funds again.

To learn more about custodial and non-custodial wallets, you can check out our guide to these types of crypto wallets here.

Whichever type of wallet you choose, custodial or non-custodial, you have two options: hot or cold.

What Is the Difference Between Hot and Cold Wallet Options? Let’s find out.

What Is a Hot Wallet Crypto?

Hot wallets are simply any type of crypto wallet that is connected via the internet. These are by far the most common type of crypto wallet, and they store all information, including your private and public keys, online.

This makes hot wallets easier to set up and manage. Plus, you can choose from a whole host of exchanges, such as Coinbase and Binance, which all have their own wallets. So finding a provider is a piece of cake.

As you can imagine, most custodial wallets are also hot wallets. This is because the third parties who look after your wallet are generally based online. So you can move your crypto around via your PC, laptop, smartphone, or tablet, making hot wallets the easier option by a long stretch.

Popular examples of the best hot wallet include:

- Coinbase

- Exodus

- MetaMask

- Trust Wallet

- Mycelium (mobile only)

What Is a Cold Wallet Crypto?

The opposite of a hot wallet is a cold wallet. Also known as hardware wallets, and sometimes even paper wallets, these are any crypto wallet that isn’t stored online.

Therefore, if you want to use a cold wallet to store your crypto you will have to buy some hardware. Usually, these are physical storage devices, such as USBs or hard drives.

Cold wallet crypto solutions are, by their very nature, more secure than hot wallet options. This is because they are not connected to the internet, making it pretty much impossible for con artists to hack into your crypto.

That said, even the best cold wallet comes with its own risks. For example, if you lose your hard drive or USB, your crypto could be lost forever. Unlike hot wallet providers, there is no way to recover your private or public keys if you lose your cold wallet.

Again, because your crypto is kept on a physical bit of kit, it means that all cold wallets are non-custodial. That is, of course, unless you give your cold wallet to someone to look after. But this is never advisable, as someone can easily walk off with your cold wallet and all the crypto contained within.

You may ask yourself how you can move crypto around using a cold wallet. This is where you must connect your cold wallet to the internet, making it hot for a moment, in order to send or receive crypto funds.

This is the only time your cold wallet will become temporarily vulnerable online, but the rest of the time you can rest assured that it is safe and away from prying eyes on the internet.

Some examples of cold wallets include:

- USB drive

- Compact disk (CD)

- Hard drives

- Paper

- Offline computer

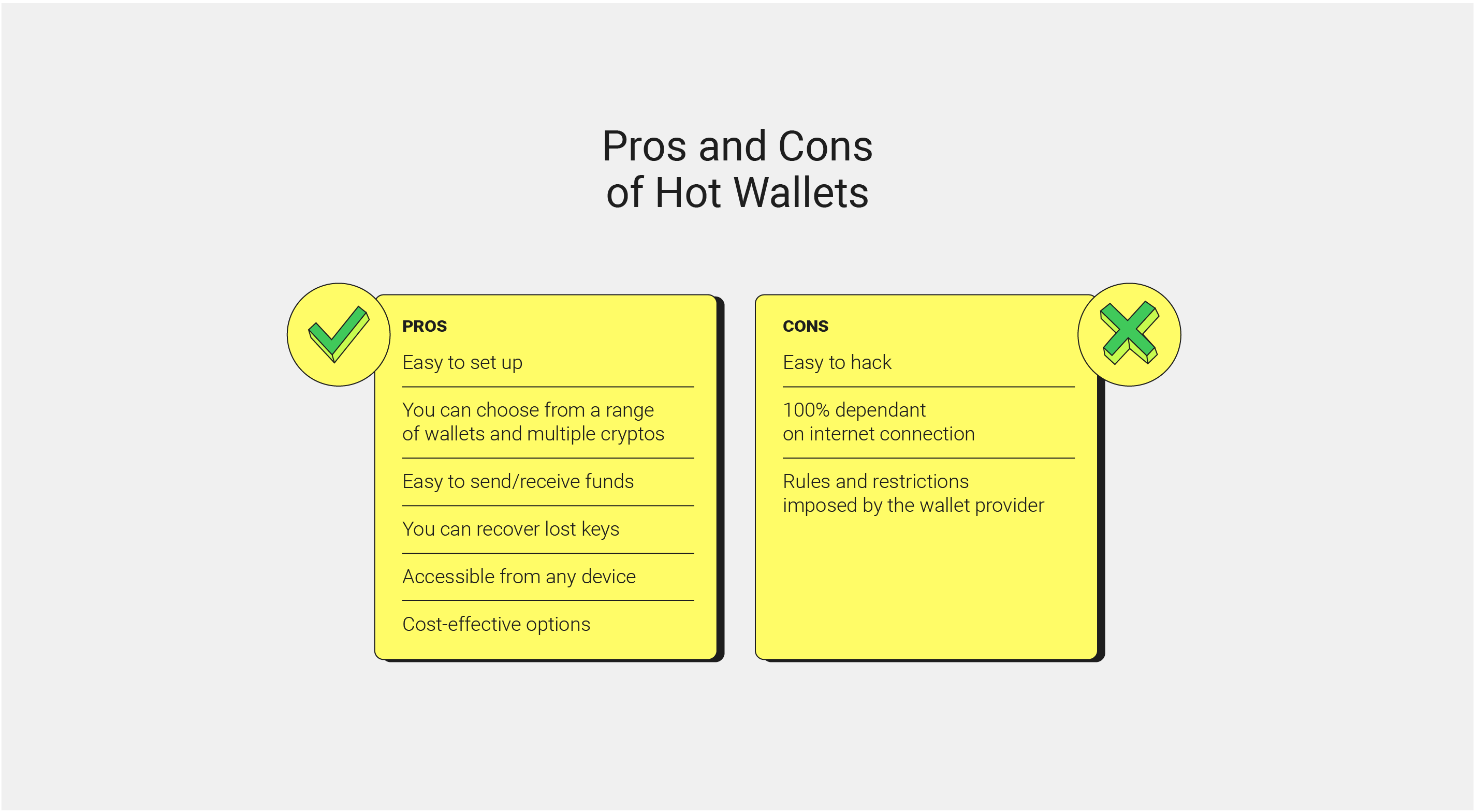

Pros and Cons of Hot Wallets

Now it’s time to compare hot and cold wallets, to see which one may be the right choice for you.

Let’s start with some of the pros of a hot wallet:

- Easier to set up

- You get to choose from a wide range of wallets that can host multiple cryptos

- Easier to send and receive funds

- You can recover your keys if lost

- You’re able to access your wallet from any device

- Hot wallets are cost-effective

And now some of the potential cons of hot wallets:

- Hot wallets are far easier to hack

- 100% reliant on internet connection

- If you choose a custodial hot wallet, you will have some rules and restrictions imposed by the wallet provider

Pros and Cons of Cold Wallet Crypto Solutions

Let’s take a look at some of the benefits and drawbacks of opting for a cold wallet, starting with the positives:

- Cold wallet crypto options are much more secure

- Almost 100% hack-proof

- Not reliant on the internet

- Inexpensive

- Better for holding large amounts of crypto

And now, let’s consider some of the possible downsides of choosing cold wallets:

- Cold wallets are harder to set up

- If you lose your key, your crypto is gone forever

- More effort to set up transfers

- You still need to use the internet when you want to make a transaction

Conclusion

As we’ve seen today, there are many options out there for those looking to use a crypto wallet. While not entirely necessary to perform transactions, crypto wallets definitely streamline the process and make your life easier.

Not only that, but they also add an extra layer of protection between you, your crypto, and any potential crypto thieves.

Although there isn’t one wallet to suit everyone, it’s quite clear that hot wallets are the easier option to set up and manage. Not to mention that the option to recover your public and private keys if lost is probably the biggest benefit of hot wallets.

However, given their vulnerability online, we wouldn’t recommend a hot wallet to someone who owns a lot of crypto. So for crypto veterans and those dealing in large sums, we recommend opting for a cold wallet crypto solution.

Just remember, cold wallets are physical pieces of equipment and, if you lose your keys, you may never see your crypto again.