This guide will review and compare the most popular Bitcoin debit cards for buying goods and services or even paying bills. Our assessment will evaluate at the top Bitcoin debit card (also called crypto debit card) on the market that can be loaded with Bitcoin, cryptocurrency, stablecoins and even fiat currency.

Best Crypto Trading Platform

based on our reviews, these are the top Bitcoin debit cards.

- BlockFi Card (best for credit card)

- Binance VISA Card(best for cashback)

- Coinbase Card (best for beginners)

- Crypto.com VISA Card (best for rewards)

- NEXO Card (best for cash purchase)

- Uphold (best for ease of use)

- Wirex (best for Europe)

- BitPay (best for USA)

What Is A Bitcoin Debit Card?

A Bitcoin debit card is a prepaid debit card that is funded using a Bitcoin wallet and can be topped up with Bitcoin (or other cryptocurrencies) using an exchange or cryptocurrency provider. The debit card is linked to either Mastercard or VISA card which is popular payment companies that can be used at thousands of merchants worldwide. The Bitcoin held on the card is converted to fiat currency (e.g. USD, GBP, EUR, AUD etc.) which is processed like a normal bank card transaction to spend on everyday items, goods, services and even pay bills with Bitcoin.

Best Debit Cards For Crypto: Reviews 2021

1. Coinbase Card

Coinbase is a cryptocurrency exchange headquartered in San Francisco, California that is widely considered as one of the best crypto exchanges in the US with over 20 Billion total trading volume. The exchange offers various products and services to become a trusted partner in crypto financial services such as its own Bitcoin debit card called the ‘Coinbase Card’.

The Coinbase debit card works by linking the physical card directly to a Coinbase wallet to spend crypto or USDC funds. The stored cryptocurrency is converted to USD, GBP or EUR before completing a purchase or ATM withdrawal at any location around the world where VISA cards are accepted.

Coinbase cardholders can earn rewards on purchases made with the card. For new cardholders, there is the option to select between receiving 4% XLM or 1% BTC on all purchases made. The rewards are not paid out automatically and can take between 1 and 5 days after the completed transaction to be deposited into the wallet.

The card can also be linked to Google Pay to provide a fast, secure way to spend cryptocurrency and is regulated by the Financial Conduct Authority (FCA) for the issuing of electronic money and payments. Its ease of use and high-security features make it our choice as the best card overall for beginners.

Coinbase Card Pros:

- Card can be used at any location where VISA cards are accepted

- Debit card can be linked to a mobile app to select which Coinbase wallet to use for purchases

- Security features such as instant card freeze

- Can obtain a virtual card and link to Google Pay

- Reporting on purchase history, transaction receipts and instant notifcations

Coinbase Card Cons:

- Card. isonly available in the US, Europe and the UK

- Cashback rewards are not paid automatically

- 9% fee on all transactions is high

- Card issuance fee in the UK and EU

2. BlockFi Credit Card

BlockFi is a leading platform that is fast becoming the centre of finance in the digital age. Customers can do more with their coins such as earning crypto interest on cryptocurrencies and stablecoins, borrow cash and buy or sell crypto with a 0.25% rebate in bitcoin on eligible trades. The most popular feature is the BlockFi Interest Account (BIA) that lets customers earn up to 7.5% APY on crypto.

BlockFi Credit Card Pros:

- World’s first Bitcoin credit card

- Earn 1.5% back in bitcoin on every purchase

- Introductory sign-up bonus 3.5% Bitcoin rewards rate

- No fees to use the card, annual or foreign transaction fees

- Earn compound interest on the Bitcoin cashbacks received

BlockFi Credit Card Cons:

- Must have a credit rating score of “good” to “excellent”

- Credit cards may not be suitable for all individuals

- Available to residents in USA only

3. Binance VISA Card

Binance is a digital currency exchange that was founded in July 2017 after a successful ICO that raised 15 million. Binance is widely regarded as the best cryptocurrency trading platform for altcoins in the world as is constantly ranked #1 based on traffic, liquidity, trading volumes reported for its spot and derivatives markets. The company has launched its own Binance card which is a VISA debit card that allows users to convert digital currencies into fiat at supported merchants.

The Binance Card is powered by Swipe and works like a traditional debit card. However, instead of loading the card with fiat currency, the card holds digital assets like BTC, BNB, SXP, and BUSD which can be linked to the Binance Spot Wallet to replenish funds.

The cryptocurrency held on the Binance card is converted to local currency automatically at the point of sale machine anywhere VISA is accepted worldwide. A major drawback with the Binance Card is the 0.9% transaction fee on purchases at the point of sale machine and using ATM’s to withdraw fiat currency.

The amount of crypto cashback rewards that can be earned with the Binance VISA debit card depends on the amount of BNB coins staked in a Binance wallet. The only downside with the Binance Debit card is the amount of BNB tokens to stake to unlock the maximum cashback bonus of 8%.

At least 6,000 BNB tokens which is the equivalent of $USD 270,000 at current prices need to be staked on the exchange which is a significant investment for the highest cashback offer. However, the exchange has recently offered the option to earn 1% cashback rewards for free without staking any Binance Coins.

Binance Card Pros:

- Backed by a highly-trusted and reputable company

- Supported at more than 60M merchants worldwide

- Card is free to apply and link to Binance Wallet

- No annual, monthly admin or processing fees

- Earn up to 8% cashback on purchases

Binance Card Cons:

- Must stake >6,000 BNB coins for 8% cashback

- Limited number of cryptocurrency assets on card

- Up to 0.9% fee for transactions and ATM withdrawals

4. Crypto.com VISA Card

Crypto.com is a global digital asset service that offers a wide range of products on a beginner-friendly and intuitive mobile app. Its users can buy, trade, sell, store, earn, loan and pay bills using cryptocurrencies using its VISA Debit Card. Similar to Binance, customers that spend cryptocurrencies held on the card can earn cashback rewards on purchases up to 8%.

There are no setup charges or annual fees to use the Crypto.com pre-paid card to pay for goods and services. To apply for the Crypto.com VISA debit card, applicants must download the Crypto.com App, complete identity verification (KYC), purchase CRO tokens and stake the tokens.

Depending on the amount of CRO tokens staked within a Crypto.com wallet, MCO VISA cardholders will receive different percentage cashback between 1% and 8% as follows:

Obsidian VISA Card: 2% to 8%

Icy White/Frosted Rose Gold VISA Card: 1.75% – 5%

Royal Indigo/Jade Green VISA Card: 1.5% – 3%

Ruby Steel VISA Card: 1% – 2%

Customers that do not stake CRO tokens can still apply and use the Crypto.com card to earn a 1% cashback on purchases. However, are not eligible for additional benefits and card rebates.

Crypto.com Card Pros:

- Can be topped up with crypto and fiat

- Supported at more than 60M merchants worldwide

- Wide range of crypto accepts can be transferred

- No annual, monthly admin or processing fees

- Earn up to 8% cashback on purchases

Crypto.com Card Cons:

- Must stake >5,000,000 CRO tokens for 8% cashback

- 2% charge to withdraw cash from ATM

5. Nexo Card

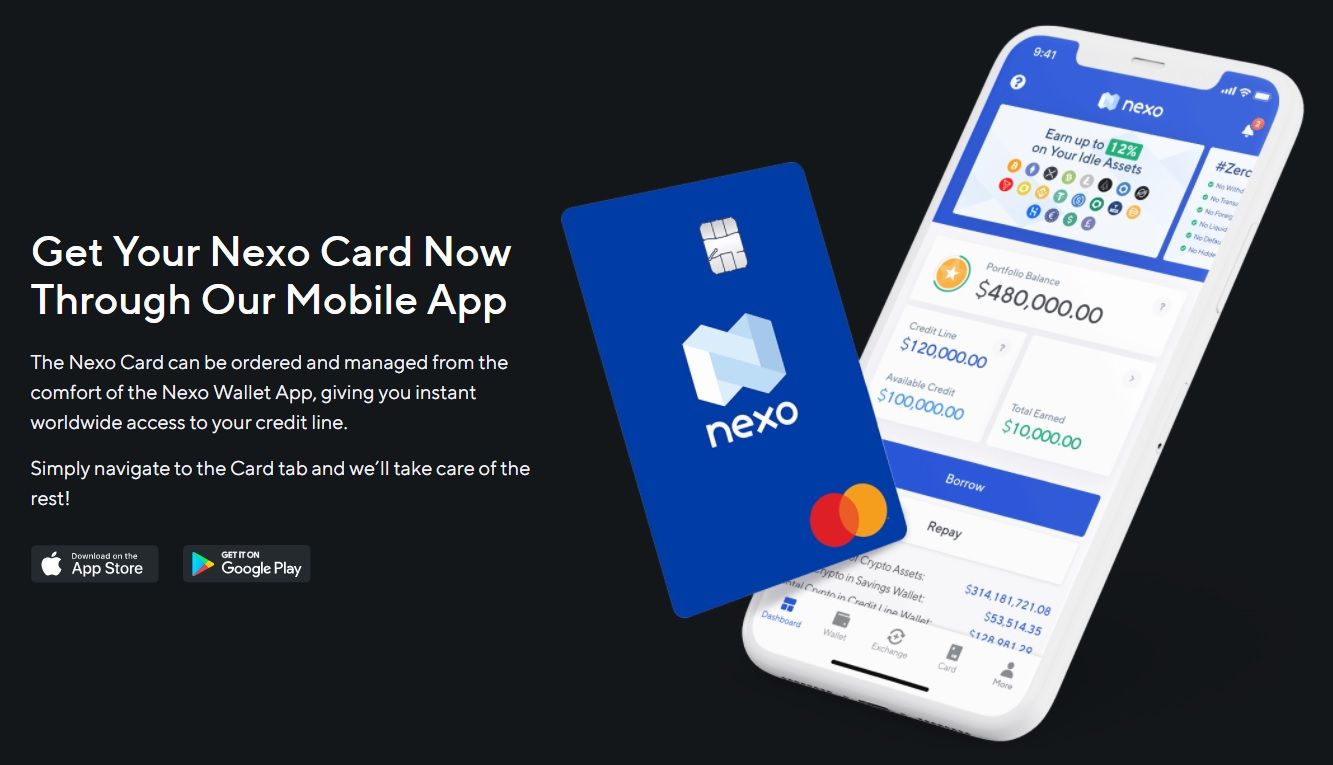

Nexo has unveiled a Bitcoin debit card for its users to spend the value of their crypto holdings like a traditional debit card. The card works slightly differently to the other crypto debit cards and is linked to the available balance from a line of credit. The card is funded when a user takes out a line of credit using a crypto-backed loan product.

The major advantage of using borrowed money is that customers can spend the value of digital currencies without selling Bitcoin.

The Nexo card is integrated with worldwide payment provider Mastercard allowing the debit card to be used at 40+ million merchants globally. Transactions made by the debit card are processed in the local fiat currency, allowing no foreign exchange conversion fees.

Purchases made using the Nexo card offer a flat 2% instant cashback bonus. Unlike Binance and Crypto.com, the cashback is paid out on all transactions without having to stake any coins. Cardholders can choose to earn cashback rewards in Bitcoin or the platform’s native Nexo tokens. Once a transaction is completed, the bonus is automatically paid directly to the Nexo account which can be invested to earn interest.

Nexo Card Pros:

- Spend the value of Bitcoin without having to sell the asset using Nexo’s instant crypto-backed loans

- Physical or virtual card is supported at more than 40M merchants worldwide

- Easily managed through the Nexo App with flexible repayment options

- 2% cashback with all purchases, automatically paid in BTC or Nexo tokens

- No monthly, annual fees or foreign conversion fees

Nexo Card Cons:

Debit card cannot be freely topped up with Bitcoin or cash

6. Uphold Debit Card

Uphold is a multi-asset digital exchange that allows its customers to buy, trade, transfer, store and sell cryptocurrency, U.S. Stocks, precious metals and currencies in a single unified platform. Founded in 2015 and operating in more than 184 countries worldwide, Uphold has facilitated more than US$4+ billion in cryptocurrency transactions. Uphold has released its own debit card to allow its users to have the ability to pay for purchases using the asset of their choice (crypto, fiat or commodities).

The Uphold debit card works like a normal debit card where payments for goods and services are made using funds from a bank account. Uphold users can complete payments using the asset of their choice (crypto, fiat currencies or precious metals) that are stored in their Uphold wallet. The benefits of the Uphold debit card include a earn 1% cashback and 2% crypto rewards on purchases.

There are some fees to be aware of which include a one-off issuance fee of $9.95 and a $2.50 charge for withdrawals. Compared to other cards in this article, there are no payment surcharges or foreign transaction fees. The spending limits on the card are quite generous at $10,000 per day and $1,500 for cash withdrawals on a daily basis.

Uphold Debit Card Pros:

- Supports 46 cryptocurrencies and 23 national currencies

- Can choose to pay with crypto, stocks, currencies or metals

- Earn 1% back in USD for every USD transaction and 2% back in crypto

- No foreign transaction or domestic purchase fees

- Limit of up to $10,000 per day on purchases

Uphold Debit Card Cons:

- Card is available to customers in the United States only

- Issuance fee of $9.95 to obtain the debit card

7. Wirex Card

Wirex is a well-known and reputable cryptocurrency app and payment card that gives complete control to its users to spend and receive crypto and traditional currency using a single card. The multicurrency Mastercard is the perfect companion for international travellers as it supports 16 fiat currencies and 10 cryptocurrencies such as Bitcoin, Ethereum and XRP.

The company was the first to launch a crypto-backed bank card in 2018 and has scaled the product to over 3.1 million customers worldwide. A major benefit of using the Wirex Bitcoin debit card is the ability to interchange fiat and cryptocurrencies stored on the card to use for everyday spending and bills and its high daily spending limits.

Wirex Card Pros:

- Supports 16 fiat currencies and 10 crypto assets such as Bitcoin (BTC)

- Wirex card is available to use in over 130 countries

- FCA regulated and licensed in multiple jurisdictions such as UK, Europe, Japan, Singapore etc.

- Bitcoin and crypto spend limit up to $50,000/day

- 24/7 customer service with live chat support

Wirex Card Cons:

Wirex card has a 1% cryptocurrency top-up fee

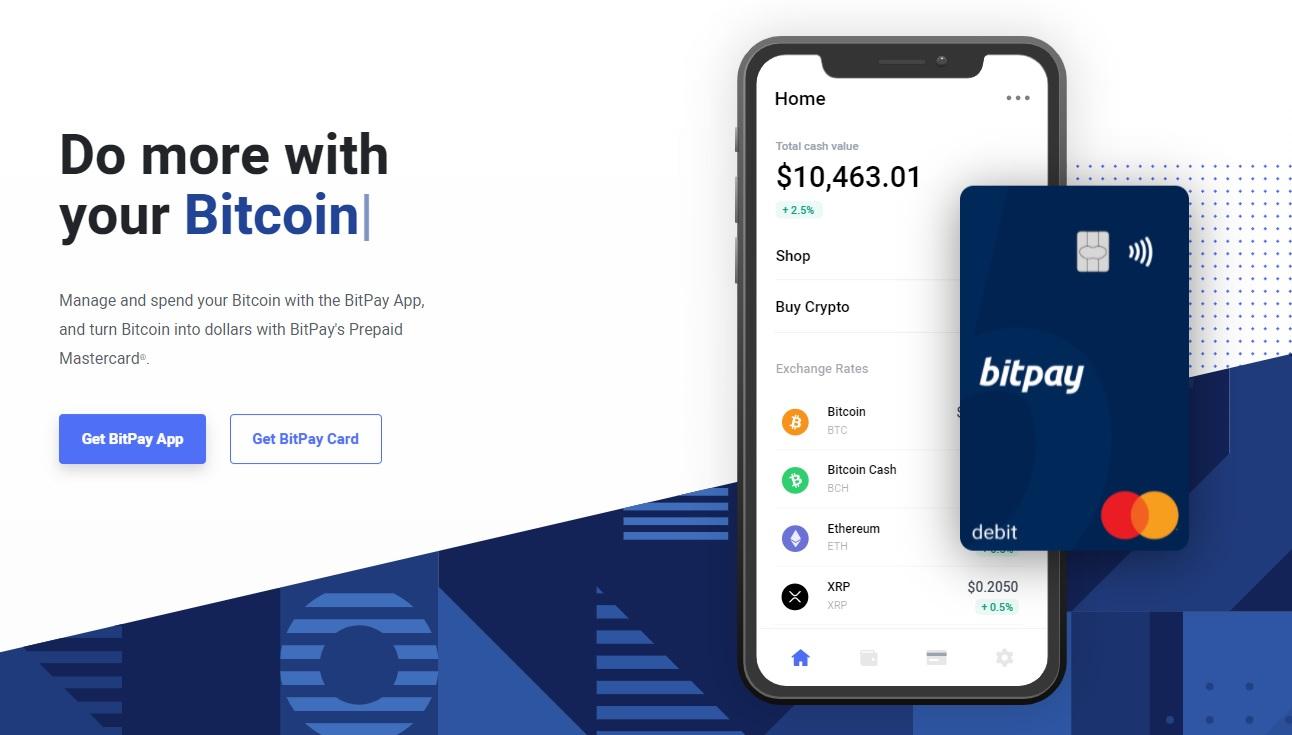

8. BitPay Card

BitPay was founded in 2011 and is considered a pioneer in the Bitcoin and blockchain industry. The company aims to transform how businesses and people transfer and store money around the world. The launch of BitPay’s prepaid Mastercard allows its users to load Bitcoin on the card and convert it into fiat currency (e.g. USD) to spend at millions of merchants worldwide. There are 8 supported cryptocurrency assets which include BTC, ETH, BCH, GUSD, BUSD, PAX and USDC.

Cardholders can pay with contactless, PIN or even withdraw cash up to $6,000 per day from a compatible ATM. The debit card is linked to the BitPay App which can be downloaded for iOS and Android devices to view balances and re-load funds. The card costs $10 to order and has other fees including a foreign conversion and ATM surcharge, which is the only downside compared to the other products in this article. BitPay also provides a virtual card that can be used for online transactions in lieu of the physical card.

BitPay Card Pros:

- Accepts the major cryptocurrency assets and common stablecoins such as GUSD, BUSD and USDC

- Mastercard can be used for purchases in-store and online e-commerce shops

- Includes an in-built chip for enhanced security

- No credit checks required to obtain the debit card

- Available in all 50 states in the USA

BitPay Card Cons:

- Card costs $10 to order from the BitPay App

- 3% fee on international fiat currency conversions

- Card available to US customers only

- No Bitcoin cashback or rewards

Customers with a funded BlockFi account are eligible to join the waitlist to pre-order the world’s first cryptocurrency credit card to earn Bitcoin for free with all purchases. The card works in the same way as a traditional bank credit card which can be used to buy goods, services and pay bills. The key benefits of the BlockFi Credit card compared to traditional cards or crypto debit card are:

Earn 1.5% back in bitcoin on every purchase

Earn 2% back in bitcoin on every purchase over $50,000 of annual spend

Earn 3.5% back in bitcoin during your first 3 months of card ownership

No fees to use the card. No annual fee. No foreign transaction fees

Bitcoin rewards that are accrued from making purchases with the credit card are paid out monthly to the customers BlockFi account. This means crypto investors that use the credit card can earn interest on the Bitcoin cashback earned that is compounded daily. Overall, the Bitcoin Credit Card from BlockFi is an excellent personal financial tool that will benefit all their customers to earn bitcoin while making everyday purchases. The ability to earn additional compound interest on the cashback bonuses in a BlockFi Interest Account is a complete game-changer.