Stuck with Bitcoin but eager to dive into Web3? Don’t let KYC requirements hold you back. Discover how to swap BTC for ETH while sidestepping the hassle of ID verification.

The world of cryptocurrency offers vast opportunities. Despite increasing regulatory scrutiny, it remains closer to the Wild West than the traditional banking sector. Authorities are continuously seeking ways to regulate decentralized blockchains, but progress is slow.

Blockchains, as public ledgers, provide a significant level of transparency and traceability. However, savvy users can still maintain anonymity, enjoying the benefits of the crypto economy. To advance in this space, you need sharp wits, a thirst for learning, and the courage to explore beyond mainstream crypto into Web3 and DeFi.

If Bitcoin (BTC) is your primary crypto asset, you may want to swap some of it for a Web3-compatible currency like Ethereum (ETH). Alternatively, you can use services bridging BTC and DeFi, such as wrapped Bitcoin. While this option has benefits, it also comes with downsides, including security and counterparty risks, limited functionality, and price discrepancies.

Another method involves buying crypto with fiat currencies, which often requires undergoing KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures. Alternatively, you can convert BTC to ETH via ATMs or physical exchange kiosks, though this may also involve some level of KYC/AML verification depending on your jurisdiction.

Ultimately, the choice is yours. Regardless of the method you select to enter the DeFi space, always be mindful of the risks involved. Cryptocurrencies are volatile, and poor decision-making can impact your budget or even compromise your online security.

Stay vigilant against suspicious activities, and remember that scams, schemes, and malicious plots targeting your wallet are not uncommon in the crypto space.

Ready to proceed? Let’s review the basics and then explore how to swap Bitcoin for Ethereum while avoiding KYC hassles.

What is Bitcoin (BTC)?

Bitcoin (BTC) is the first cryptocurrency to achieve top status in the decentralized space and has maintained this status ever since. It operates on a peer-to-peer network, where nodes (computers in the Bitcoin network) verify transactions using cryptography and record them on the blockchain—a widely-used type of distributed ledger technology.

Unlike traditional currencies, BTC is not controlled by any central authority. Instead, consensus among nodes is reached through mining—a resource-intensive process of discovering new blocks, verifying transactions, and adding them to the Bitcoin blockchain.

Invented in 2008 by an individual or group using the pseudonym Satoshi Nakamoto, Bitcoin was released as open-source software in 2009. Initially used as a niche digital currency, it has evolved into a store of value and investment and continues to progress towards mainstream payment status.

On September 7, 2021, El Salvador became the first country to adopt BTC as legal tender. Unfortunately, its authorities impose KYC procedures for regular transactions. Despite BTC’s growing popularity, its use remains restricted in many jurisdictions due to its pseudonymous nature.

Check out the market cap BTC chart from CoinMarketCap.

market cap BTC chart from CoinMarketCap.

What is Ethereum (ETH)?

Ethereum is the second-largest cryptocurrency by market capitalization and has made a significant impact in the decentralized world with its innovative features and concepts. Unlike BTC, ETH operates on a platform that supports smart contracts—self-executing contracts with terms directly written into code. This capability allows ETH to facilitate more than simple transactions and enables decentralized applications (dApps) to run on its blockchain.

Ethereum’s network relies on a consensus mechanism among its nodes but employs a different approach compared to BTC. Initially based on proof-of-work (similar to Bitcoin), Ethereum is transitioning to a proof-of-stake consensus mechanism, designed to be more energy-efficient and scalable.

Conceived by Vitalik Buterin and launched in 2015, ETH has evolved from a digital currency into a robust platform for innovation in decentralized finance (DeFi), non-fungible tokens (NFTs), and beyond. ETH’s continuous upgrades enhance its performance and expand its capabilities.

Today, Ethereum is at the forefront of the blockchain revolution, enabling investments on decentralized exchanges (DEX) and participation in the decentralized economy.

Check out the ETH chart from CoinMarketCap.

How is Ethereum Different from Bitcoin for DEX and DeFi Investments?

Bitcoin primarily serves as a digital store of value and medium of exchange. BTC’s DeFi capabilities are relatively limited, although it has second-layer solutions like the Lightning Network and sidechains (e.g., Liquid Network) designed to enhance its functionality. While BTC’s DeFi ecosystem has been growing, it remains less extensive compared to Ethereum’s.

In contrast, Ethereum is the leading blockchain for DeFi. It supports a vast ecosystem of DeFi protocols, including lending, borrowing, and decentralized exchanges (DEXs). ETH’s support for smart contracts is the key factor distinguishing it from BTC. These contracts enable developers to create custom financial instruments, such as tokenized assets, prediction markets, and insurance products.

Due to its robust smart contract capabilities, ETH is the foundation for most DEXs and powers the majority of the DeFi ecosystem. ETH-supported protocols include:

- Lending and Borrowing: Platforms like Compound, Aave, and MakerDAO allow users to lend their assets or borrow against them.

- Stablecoins: Ethereum-based stablecoins (e.g., USDC, DAI) provide stability and are widely used in DeFi.

- Automated Market Makers (AMMs): DEXs like Uniswap, SushiSwap, and Balancer enable seamless token swaps using liquidity pools.

- Yield Farming: Users can earn rewards by providing liquidity to DeFi protocols.

While there are several ETH alternatives with smart contract capabilities, such as Solana, Binance Smart Chain (BSC), Avalanche, Polkadot, Cardano, and Terra, ETH remains the primary force in the DEX and DeFi space. It’s advisable to consider ETH when researching BTC to ETH conversions while avoiding KYC requirements.

No-KYC Crypto Exchanges for Exchanging Bitcoin for Ethereum

Several options are available for exchanging BTC for ETH anonymously online. You can also trade BTC for ETH offline via ATMs or exchange kiosks, or by finding a person willing to swap Ethereum and arranging a meeting.

Another method to avoid KYC is to earn ETH through online work or microtasks. There are platforms, including Telegram, where you can do this without revealing your identity. However, your ability to remain anonymous will depend on the amount of ETH you wish to acquire, how you use your crypto, and how you cash out.

Convenience is another crucial factor. Finding a BTC to ETH exchange service with a favorable rate in your city can be cumbersome. Converting BTC online is often easier, allowing you to check prices, compare providers, and conduct transactions swiftly.

Let’s explore BTC to ETH converters that promise no KYC hassles.

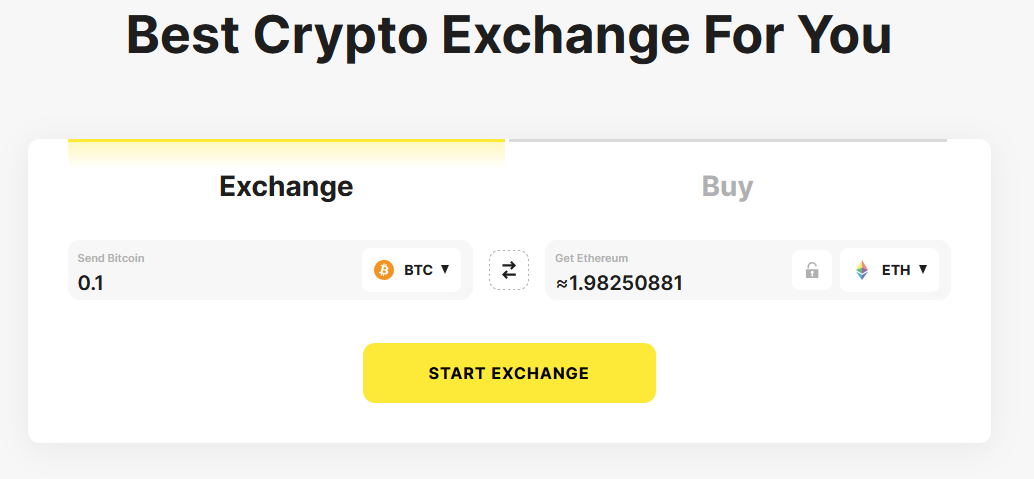

StealthEX

ETH chart from CoinMarketCap

StealthEX is a cryptocurrency exchange platform that supports BTC to ETH conversions (and vice versa) without requiring account creation. It operates as a non-custodial exchange, meaning users retain control of their funds throughout the transaction. The platform features a BTC to ETH converter on its homepage for easy access.

StealthEX typically does not require KYC verification for smaller transactions, allowing potential BTC to ETH exchanges without providing personal identification. However, the platform may implement KYC procedures for suspicious activity, although such instances are rare.

For the most current information on StealthEX’s KYC policy and transaction limits, check their official website or terms of service before proceeding with a swap.

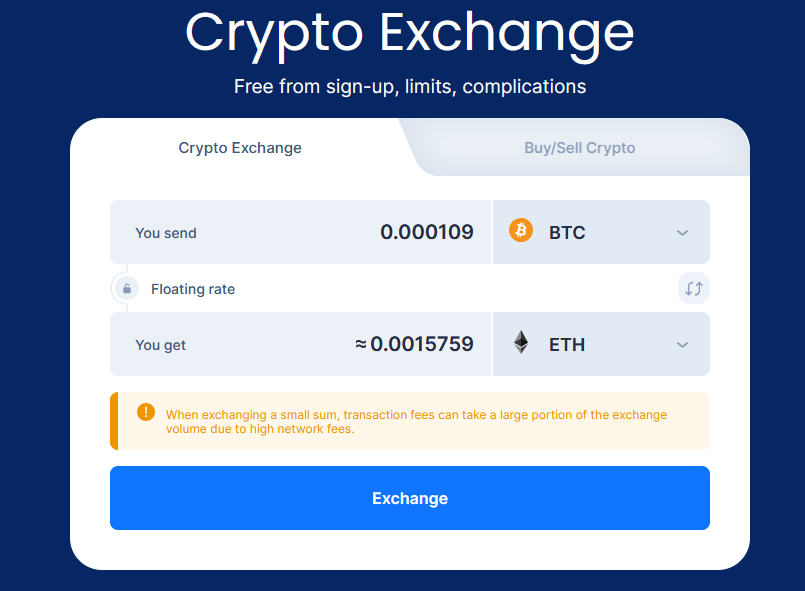

SimpleSwap

SimpleSwap is another convenient crypto exchange that allows users to swap BTC for ETH or other cryptocurrencies without KYC for most transactions. The platform offers an anonymous service where users do not need to create accounts or store deposits.

However, KYC procedures may be conducted if transactions are flagged as suspicious by the system or its partners. This process may require personal information, legal documents, and proof of address or funds.

Before exchanging BTC through SimpleSwap, review any updates to their KYC terms and conditions.

ChangeNOW

ChangeNOW is a non-custodial crypto exchange platform supporting instant BTC to ETH swaps. The platform is transparent about its KYC policy. In March, it announced the launch of “no-KYC fiat-to-crypto exchanges up to 700 EUR.”

ChangeNOW emphasizes privacy and speed, making it popular among users who value anonymity and efficiency. It supports a wide range of cryptocurrencies and offers a user-friendly interface.

The website shows the current BTC price in ETH. Simply press the arrows button to get the ETH conversion rate for today. A great choice for beginners!

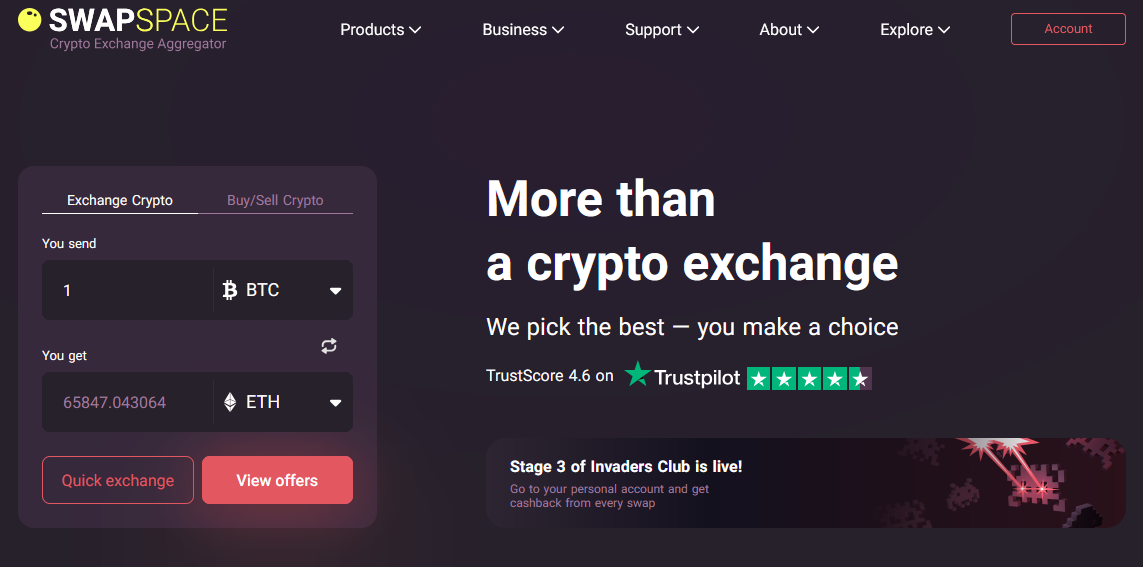

SwapSpace

SwapSpace is an aggregator in the instant exchange space. Instead of operating its own marketplace, SwapSpace compares conversion rate data from various exchanges to provide users with the best possible deal.

SwapSpace generally does not require KYC verification for most transactions. However, the underlying exchanges partnered with SwapSpace might have different KYC requirements.

To find no-KYC options through SwapSpace, ensure you check the specific exchange used for your BTC to ETH transaction.

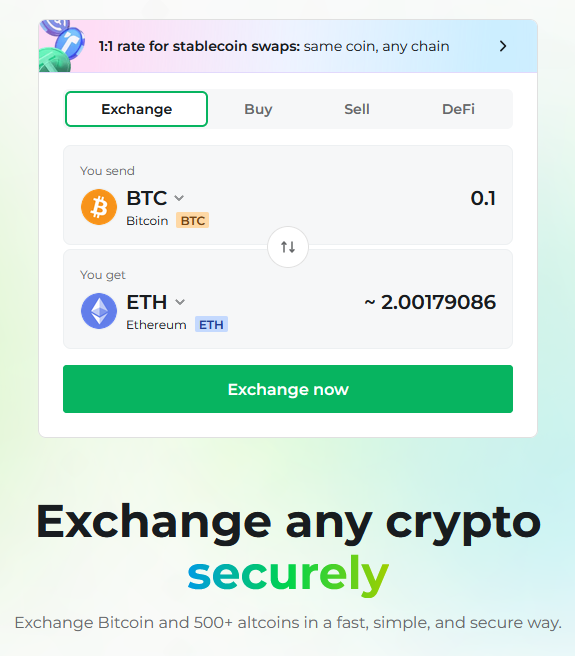

Changelly

Changelly is a popular cryptocurrency exchange known for fast and straightforward swaps. As a non-custodial exchange, it does not hold onto your funds, reducing security risks. Typically, Changelly allows BTC to ETH conversions without requiring KYC checks.

However, the platform may request KYC from users whose transactions are flagged by its risk-scoring algorithm. This might occur if a user creates multiple accounts with disposable emails or if the algorithm detects mixers or black market wallet addresses.

How to Swap BTC for ETH: Convert Bitcoin Securely with Instant Exchange Platforms

Instant exchange platforms, like those described above, offer a streamlined process for converting Bitcoin to Ethereum without the complexities of traditional exchanges. Here’s a general breakdown of the process:

- Choose your preferred platform.

- Check the BTC to ETH exchange rate and compare it with other options.

- Specify the amount of BTC you want to convert to ETH.

- Provide your Ethereum wallet address (where you want to receive the converted Ethereum).

- Confirm the transaction details and initiate the swap.

- Send Bitcoin: The platform will generate a Bitcoin address for you to send the specified amount of BTC.

- Receive Ethereum: Once the Bitcoin transaction is confirmed on the blockchain, the platform will automatically convert BTC to ETH and send it to your provided Ethereum wallet address.

Additional Tips:

- Instant exchange platforms typically charge a fee for their services. Be aware of the costs involved.

- Exchange rates can fluctuate, so compare different platforms before making a swap.

- Use a secure wallet and double-check the provided addresses to avoid errors.

- While instant exchange platforms aim for speed, transaction times can vary based on network congestion.