Institutional Bitcoin Adoption Surges 587% Since 2020: What’s Next for BTC?

Introduction

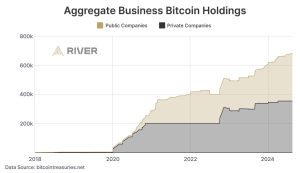

Since 2020, institutional Bitcoin adoption has surged by an astonishing 587%. Public companies are increasing their Bitcoin holdings, contributing to significant changes in market dynamics. This article delves into the trends, key resistance levels, and what the future holds for Bitcoin (BTC).

Public Companies Increase Bitcoin Holdings by 580% Since 2020: What’s Next for BTC?

Bitcoin, the world’s largest cryptocurrency, has experienced remarkable growth in institutional adoption over the past four years. As of September 2024, publicly traded companies hold approximately 683,000 BTC, showcasing a growing corporate interest in Bitcoin as a long-term store of value and inflation hedge.

Key Drivers of Institutional Bitcoin Adoption

Confidence in Bitcoin as a Store of Value

The increasing presence of Bitcoin in corporate treasuries reflects changing sentiment. Companies such as MicroStrategy, Tether, BitMEX, and Xapo, which collectively hold 559,000 BTC, are leading this charge.

Resilience to Market Volatility

Despite market fluctuations, institutional adoption of Bitcoin has remained resilient. With corporate interest rising, Bitcoin continues to gain traction, raising questions about future market movements.

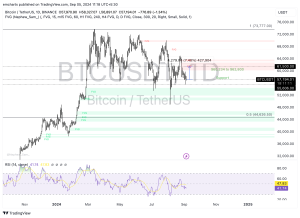

Bitcoin Faces Key Resistance Between $58,300 and $61,500

As of September 5, 2024, Bitcoin is trading at $57,096, slightly down from its previous high. Analysts are closely watching resistance levels between $58,300 and $61,500, where strong resistance could impact future price movements.

Cheap Remote Crypto Mining for you – Click Here

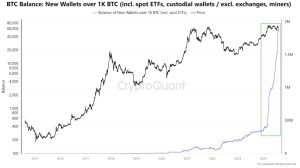

Whale and Institutional Accumulation Fuel Bitcoin’s Growth

Increased Whale Activity

Wallet addresses holding over 1,000 BTC have steadily risen in 2024, indicating that large investors and institutions are confident in Bitcoin’s long-term potential. Whale addresses are at their highest levels since Bitcoin’s inception, providing strong support for price growth.

Institutional Buying During Market Dips

Public companies and institutional investors continue accumulating Bitcoin during market corrections, further stabilizing prices and driving long-term value.

Bitcoin’s Path to $61,500 and Beyond

Analysts predict that Bitcoin could break through the key resistance level of $61,500. A flip of this level to support could lead to further price increases, potentially pushing Bitcoin to $62,800. This could trigger a wave of institutional buying, driving Bitcoin prices even higher.

What If Bitcoin Faces a Correction?

Should Bitcoin face a correction, immediate support levels are expected around $55,606. While corrections are part of Bitcoin’s natural price cycles, long-term holders and institutional investors remain bullish, viewing any dips as buying opportunities.

Institutional Adoption Continues Despite Market Volatility

Bitcoin’s adoption by institutional investors continues to rise, regardless of market volatility. Public companies like MicroStrategy have been at the forefront of this movement, holding large amounts of BTC despite price fluctuations.

Why Companies Are Choosing Bitcoin

Hedge Against Inflation

With high inflation and monetary expansion, companies are looking to Bitcoin as a hedge to protect cash reserves from devaluation.

Diversification of Corporate Treasuries

Bitcoin offers a unique opportunity for corporate treasuries to diversify away from traditional assets such as stocks and bonds.

Improved Regulatory Clarity

Clearer regulatory guidelines have made Bitcoin more attractive to institutions, along with the availability of Bitcoin ETFs and other financial products that make it easier for companies to gain exposure.

The Future of Bitcoin in Corporate Treasuries

Going forward, institutional adoption of Bitcoin is expected to grow. As more companies add Bitcoin to their balance sheets, demand will continue to rise, driving prices higher and potentially reducing volatility over time.

Conclusion

Institutional Bitcoin adoption has surged over 580% since 2020, with major companies like MicroStrategy, Tether, and BitMEX leading the charge. As more firms continue to add Bitcoin to their reserves, the long-term outlook for Bitcoin remains bullish. With increasing demand and key resistances in place, Bitcoin’s future looks brighter than ever.