In 2023, Solana (SOL) emerged as a formidable competitor in the crypto market, with its price skyrocketing tenfold in the aftermath of the FTX collapse. Currently processing over 50,000 transactions per second (TPS) and maintaining transaction costs below $0.001, Solana’s performance has caught significant attention.

According to Visa’s recent deep dive, “It (Solana) holds promise for payments due to its speed, scalability, and low transaction costs, making it a good candidate for efficient blockchain settlement rails using stablecoins like USDC. The Solana blockchain network incorporates a number of key features and novel innovations that are worth unpacking for anyone interested in payment technologies.”

Let’s explore the factors contributing to Solana’s meteoric rise and assess its investment potential.

Solana (SOL): Overview

Solana was founded to provide financial independence, possibilities, and security to everyone. The Solana ecosystem exemplifies decentralization perfectly. Here are the main use cases for Solana:

1. Staking:

The primary use case of the Solana Network’s native token SOL is staking. Users can stake SOL directly onto the Solana network or delegate it to active validators, supporting the integrity of the network.

2. Decentralized Application Development:

Solana facilitates the construction of decentralized applications (dApps), making it an ideal choice for developers. Its smart contract programmability attracts developers seeking to build on a robust platform.

3. Non-fungible Token Development:

Solana is a preferred choice among NFT designers. With the ability to mint over 21 million NFTs, Solana plans to introduce executable NFTs, enhancing its appeal in the NFT market.

4. Play-to-Earn Game Development:

Solana supports the future of Play-and-Own games, giving users control over their data. This feature is expected to drive the evolution of Play-to-Earn games on the Solana blockchain.

5. Decentralized Finance (DeFi):

Solana has become a significant player in the DeFi environment, offering decentralized exchanges, digital wallets, and automated contract systems. Its ecosystem supports the creation of asset management software and open-order book exchanges.

6. Decentralized Autonomous Organizations (DAOs):

Solana’s fast transaction throughput and low fees make it excellent for DAOs. As of today, the Solana ecosystem hosts 140 DAOs, each playing an active role in the network.

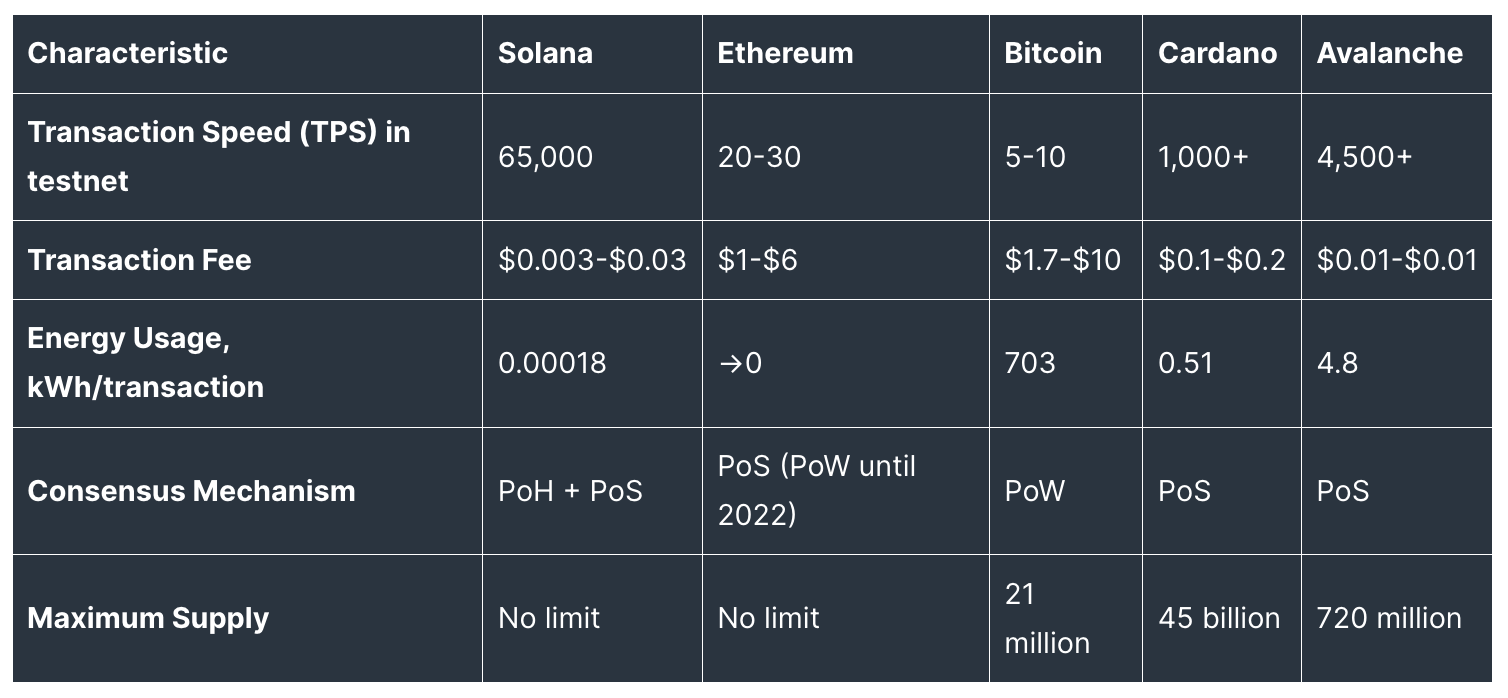

Solana supports a minimum of 50,000 TPS, significantly surpassing Bitcoin and Ethereum. This speed, combined with low transaction fees typically costing between $0.003 and $0.03, sets Solana apart from other cryptocurrencies.

Solana’s Market Performance and Historical Data

2020: Solana started small, with a token value of $0.74 in April and $0.85 in June.

2021: Solana began the year at $4.23, surged to $13.31 in February, and reached an all-time high of $260.06 in November, before settling at around $172.51 by year-end.

2022: The token fell to $93.4 in January, dropped to $85.57 in February, and then recovered to $120 in March. SOL fluctuated around $36-$35 in July, with another peak of $260.06 in November.

2023: SOL started 2023 at around $20, reaching $112.56 by December.

2024: In March 2024, Solana peaked at $202.12. Over the past month, the SOL price has fluctuated between $125-$175, with Solana price prediction suggesting it could reach $1,800 by 2030.

SOL Price Chart

CoinMarketCap, July 3, 2024

Solana’s Technological Advantages

Solana offers several technological advantages, including:

Horizontal Scaling:

Solana’s horizontal scaling mechanisms maintain excellent performance as the network grows, unlike other blockchains that slow down with increased usage.

Stateless Architecture:

Solana’s stateless architecture lowers the amount of data each validator must keep and process, improving scalability and efficiency.

Cost-efficiency:

Solana’s low transaction fees make it economically feasible for startups and small businesses, encouraging diverse and innovative solutions within the ecosystem.

Enhanced Security:

Solana’s advanced consensus mechanism, Tower BFT, and decentralized architecture ensure swift, secure consensus and transaction integrity, preventing malicious attacks and maintaining trust and transparency.

Solana’s Strategic Partnerships

Solana has partnered with several prominent companies, enhancing its DeFi and developer ecosystem. Key partnerships include:

Chainlink:

A leading decentralized oracle network, enhancing Solana’s commitment to the DeFi space.

Serum:

A decentralized exchange (DEX) leveraging Solana’s speed and scalability for fast, cost-effective digital asset trading.

ChainSafe:

A blockchain technology company contributing to Solana’s developer tools, enabling more developers to create dApps on Solana.

Other partners include Saber Labs, Bonfida, Raydium, Mercurial Finance, and MatricaLabs.

Is Solana a Good Investment?

Solana’s transaction speed and low fees make it a promising ‘Ethereum killer.’ Its Proof-of-History (PoH) and Proof-of-Stake (PoS) mechanisms validate transactions efficiently, reducing energy consumption and environmental impact compared to Proof-of-Work (PoW) blockchains like Bitcoin.

Solana’s rapid market share acquisition in the NFT space and its support for 260 dApps enhance its investment appeal. Its low energy consumption, about 658 joules per transaction, further solidifies its position as a greener alternative to Bitcoin.

Investing in Solana: Risks and Challenges

Solana’s success is often compared to Ethereum’s dominance in blockchain smart contract platforms. Key factors influencing Solana’s future price include supply and demand balance, network utility, continuous protocol development, regulatory concerns, market volatility, and technological risks.

Investors must consider their risk tolerance, investment horizon, and confidence in Solana’s technological and market potential. Consulting a financial expert before investing is advisable.

Solana vs. Competitors: Analyzing Strengths and Market Positions in the Crypto Landscape

The competition in the crypto field is intense, and Solana’s popular competitors include Ethereum, Avalanche, Cardano, and Polygon. While Ethereum, Avalanche, and Cardano are independent projects, Polygon is a Layer-2 network that operates on top of Ethereum, creating a symbiotic relationship with Ethereum.

Solana vs. Competitors

Solana and Ethereum: Different Approaches to Blockchain

Solana and Ethereum are like two motors that use the same fuel—cryptocurrency—but in different ways. Ethereum has transitioned from Proof-of-Work (PoW) to Proof-of-Stake (PoS) with Ethereum 2.0, aiming for a greener, more energy-efficient blockchain. In PoS, validators use their ETH as collateral to validate transactions and maintain network security. This upgrade is designed to reduce energy consumption and improve scalability.

Solana, on the other hand, was built with PoS from the ground up and incorporates Proof-of-History (PoH), which timestamps transactions to verify their order and passage of time. This results in a supercharged engine that executes transactions at lightning speed. Solana’s hybrid PoS and PoH model ensures rapid processing, making it one of the fastest blockchain networks available. Both networks offer unique advantages, positioning them as potentially profitable investments depending on market conditions and technological developments.

Comparing Solana and Avalanche

Solana and Avalanche both present attractive features, yet their market performances and technical indicators paint a complex picture. Solana boasts solid fundamentals and a strong ecosystem, but it is currently dealing with downward momentum. This is partly due to market volatility and broader economic factors affecting cryptocurrencies.

Avalanche, meanwhile, stands out for its customizability and potential for interoperability, allowing it to create and manage multiple subnets tailored to specific use cases. This flexibility could offer significant upside, especially if Avalanche rebounds from its current lows. Its unique consensus mechanism, which blends PoS with Avalanche consensus, provides high throughput and low latency, appealing to developers seeking efficient, scalable solutions.

Solana vs. Cardano: Technical and Community Differences

As leading smart contract platforms, Cardano and Solana take markedly different approaches to scaling, consensus, governance, and other key mechanisms. Cardano emphasizes a research-driven, peer-reviewed approach, resulting in a layered architecture that separates transaction settlement from computation. This design aims to enhance security and scalability over time.

Solana, however, focuses on high transaction speeds and throughput, currently facilitating significantly higher rates than Cardano’s estimated 1,000 TPS limit. Solana’s single-layer structure supports its rapid transaction processing but introduces variability in real-world conditions based on factors like hardware capabilities and network congestion.

Community-wise, Cardano has a reputation for its strong, supportive community and academic partnerships, while Solana’s community is known for its focus on innovation and rapid development. Both platforms appeal to distinct audiences and applications, with Solana attracting projects that require high-speed transactions and Cardano appealing to those prioritizing security and a robust academic foundation.

Conclusion

Solana is a unique platform that has established itself as a leader in the cryptocurrency market. Its outstanding technology, efficient infrastructure, and growing community make it a preferred choice for developers, investors, and users. Solana may prove to be a solid investment as it continues to expand and develop. Always conduct thorough research before investing in Solana or any other cryptocurrency.