Kylian Mbappé Warns Crypto Enthusiasts of Scam Token Promotion

Although the world of cryptocurrency is rampant with innovation and great potential, it has also

become a playing field for any number of scammers who seek to quickly scam would-be investors.

One of the most recent scandals surrounds Kylian Mbappé, the famous French footballer whose

name and image were used recently to promote a fake cryptocurrency token. The incident has

raised red flags across the crypto community and has brought into sharp focus the need for

increased vigilance among traders.

Emergence of the Fake Mbappé Token

On the night of August 28th, 2024, reports began to seep in of a new cryptocurrency token bearing

the name of Kylian Mbappé, aka the “Mbappé token” or “$MBAPPE.” It was being billed as a new

way of exciting investment, claiming to be supported by Mbappé himself. Of course, it soon

emerged that the football star had absolutely nothing to do with the token, and any promotion of

such was no more than a deceptively designed scam.

The scam token had been heavily overhyped on social media, particularly on X, previously known

as Twitter, on which a post from Mbappé’s account was said to have promoted the token. That

post would have come right under the noses of millions of followers of Mbappé, probably knowing

nothing about the fraudulent promotion of the token. It was soon found that the post was because

of a hack, and Mbappé’s team got it deleted in no time.

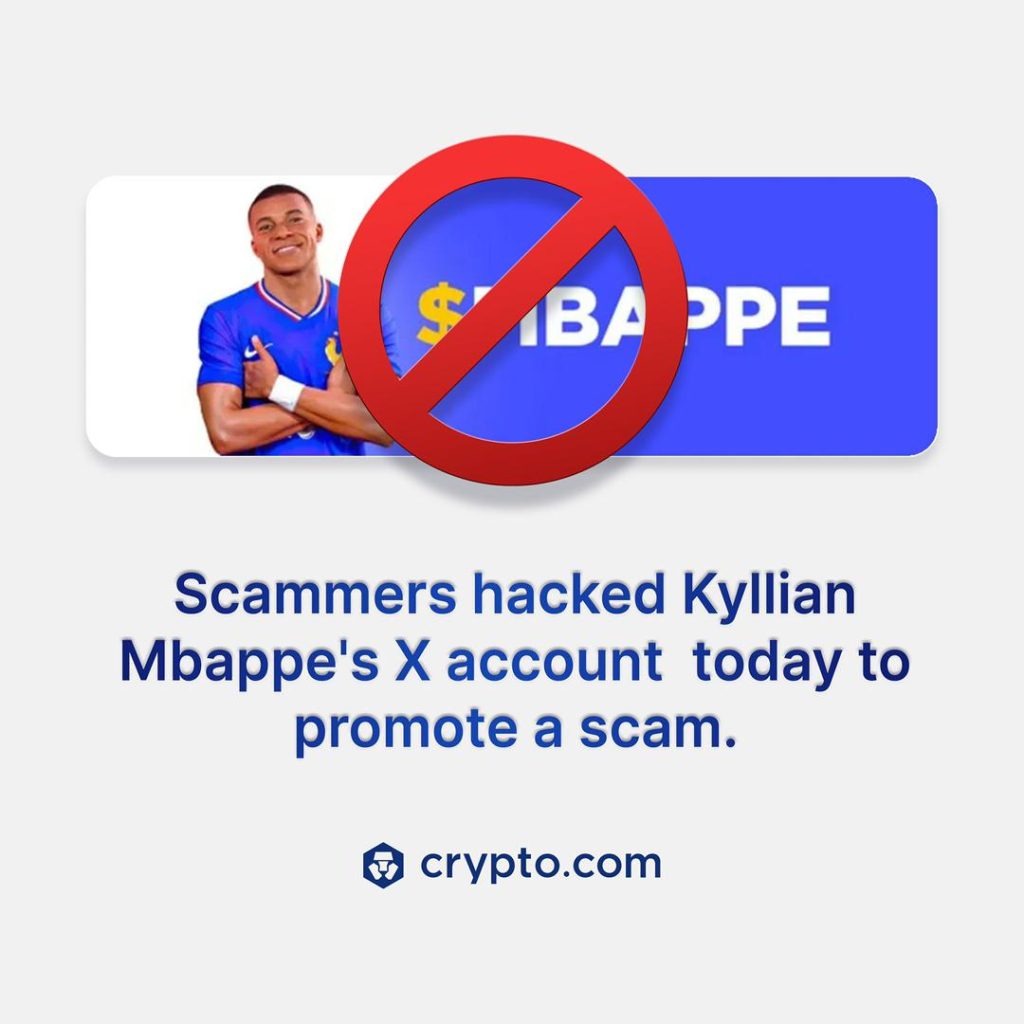

Crypto.com and Other Companies Issue Warnings Against The Scam.

With the Mbappé token in effect gaining momentum, some of the most important cryptocurrency

companies in the world began warning users. Included are Crypto.com, the 13th largest CEX

exchange globally. On August 29, Crypto.com took to X to tell its users not to invest in the

Mbappé token, citing it was a scam and for traders to avoid it.

The warning from the exchange saved many from becoming victims, but not everyone heeded it at

an opportune time. Sometimes, in the fast arena of cryptocurrency trading, quick profits make the

traders blind to the realization of the upcoming risk; no exception here either.

The Impact on Traders: Losses and Gains

Yet, despite the explicit warnings, the Mbappé token attracted a large number of traders. Many

were driven by FOMO—a fear of missing out—a kind of feeling that has become frequent in the

cryptocurrency market when investors race to buy into a token due to apprehension about possibly

missing profits. Unfortunately, for most, that very fear led to big financial losses.

While the vast majority came out as losers for having traded Mbappé tokens, some shrewd traders,

in a surprising ironic twist, actually garnered a decent chunk of change from the scam. One

trader, who reportedly turned $28 into nearly $124,000, was watched and shared by

pseudonymous trader “Yet” via an August 29 X post. According to Yet, at a market capitalization

of $80,000, the trader had spotted the Mbappé token and jumped into buy mode.

This trader cashed out at the peak, using his experience and a great sense of timing. According to

Coinstats data, he managed to cash out $126,000 worth of Solana (SOL) tokens in the run-up to the

collapse in price of the Mbappé token. While such a success story may seem impressive, this is but

a story that needs to be put into context—it’s an exception rather than a rule.

Lessons Learned and Vigilance after the Fact

The Mbappé token scam serves as a strict reminder of the dangers one always faces when dealing

with cryptocurrency. Though the potential for high returns might be attractive, the trader should be

sure to keep his wits about him when doing substantial research into an investment with any

particular token—especially those that sound a little too good to be true.

One of the key takeaways from this scam is verifying the authenticity of any crypto project before

putting your money into such projects. The use of well-known public figures, like Kylian Mbappé, in

touting scams is a tactical ploy meant to give credence to such fraudulent deals. At all times, such

endorsements should be crosschecked for authenticity on official channels.

What’s more, this incident sends the message that security becomes key within the ecosystem of

cryptocurrencies. Mbappé’s hacked social media account made it possible for scammers to reach a

wide audience and underlined how even high-profile targets can be exposed to a cyberattack. As

the crypto space keeps expanding, security measures will not only be restricted to investors but

also to platforms to avoid such incidents in the future.

The Facilitating Role of Social Media in Crypto Scams

Social media is a double-edged sword in the cryptocurrency world. Besides being a good way for

people in the crypto space to communicate and educate, it’s also a playing field for scammers. The

Mbappé token scam shows how quickly social media can be used to disseminate misinformation

and manipulate the public.

In such cases, the posting of a fake Mbappé endorsement via his compromised X account gives

credibility to the scam. Millions of followers can see it, even if it is just briefly up, and several

people may get enticed into investing in it because of a ‘rush’ feeling. This is what the scammers

depend on—the spread of information so fast that any initial wave is usually profit.

This incident highlights the need for critical thinking and skepticism when confronting

opportunities for investment in social media. Users must always question the authenticity of

endorsements and verify such endorsements from multiple sources before making any financial

commitments. Also, social media platforms have to be very proactive in detecting and removing

fraudulent content to safeguard their users against such fraud.

The Importance of Regulatory Oversight in the Crypto Space

Of course, this raises a lot of questions about the need for regulation within the cryptocurrency

market. It is, in fact, the decentralized nature of crypto that is among its core strengths. However,

this does have an Achilles’ heel: vulnerability to fraudulent schemes. Without a governing body that

could protect investors with rules and guidelines, scandals like the one involving the Mbappé token

propagate rapidly, with very little possibility of protection against them.

We have heard over the last couple of years the increased chatter that regulators and industry

leaders alike must enact more guidelines and enforcement. The belief is that this regulation would

prevent scams from happening because it punishes bad actors and increases the standard a

project would have to meet before being marketed to investors. Others are afraid that too much

regulation may stifle innovation in the budding cryptocurrency market.

One of the thorny challenges is the balance between regulation and freedom; however, some

oversight is needed to protect investors from fraud. This Mbappé token incident makes many

realize that even though still being in its infant years, the crypto industry needs to grow up

together with the risks involved if it is ever to attain legitimacy and long-term.

Cheap Remote Crypto Mining for you – Click Here

Conclusion: The Future of Crypto and Investor Responsibility

The Mbappé token scam is the sobriety of risks that may face the cryptocurrency market. If the

story of a trader who turned $28 into $124,000 headlined the news, it is an uncountable number

of traders who lost money to the scam provided a much more realistic reflection of the risks

involved.

With increased mainstream acceptance of more and more cryptocurrencies, so will the avenues to

scam or fraud be opened. Thus, investors should be responsible for financial decisions taken by

being well-informed, cautious, and validating the projects they invest in.

The Mbappé token saga Is a cautionary tale for new and experienced traders alike. So, in a market

built upon hype and speculation, it’s so easy to get taken in by various scams promising to bring in

quick riches. Events like this should help the crypto community take a step towards a better, more

secure, and more transparent environment for all participants.