Litecoin Breakout: Key Buy and Sell Levels to Watch for Maximum Profit

Introduction: What is Litecoin?

Litecoin (LTC), often referred to as the silver to Bitcoin’s gold, is a cryptocurrency that has captured the attention of investors due to its unique characteristics and potential. This post will dive into the technical indicators and key levels to help identify ideal buy and sell signals for Litecoin.

Current Litecoin Analytics

Recent Price Performance

Over the past year, Litecoin has experienced significant price fluctuations, making it a volatile asset. By late spring 2023, Litecoin surged to around $150, only to correct back to approximately $100. This $100 level has proven to be a strong support zone, suggesting that Litecoin may be gearing up for a substantial breakout.

Hint: Perform technical analysis around the $100 support level to understand Litecoin’s potential breakout. The resilience of Litecoin at this level indicates strong buying interest, a positive sign in the face of market instability.

Technical Analysis for Litecoin

Key Technical Indicators to Watch

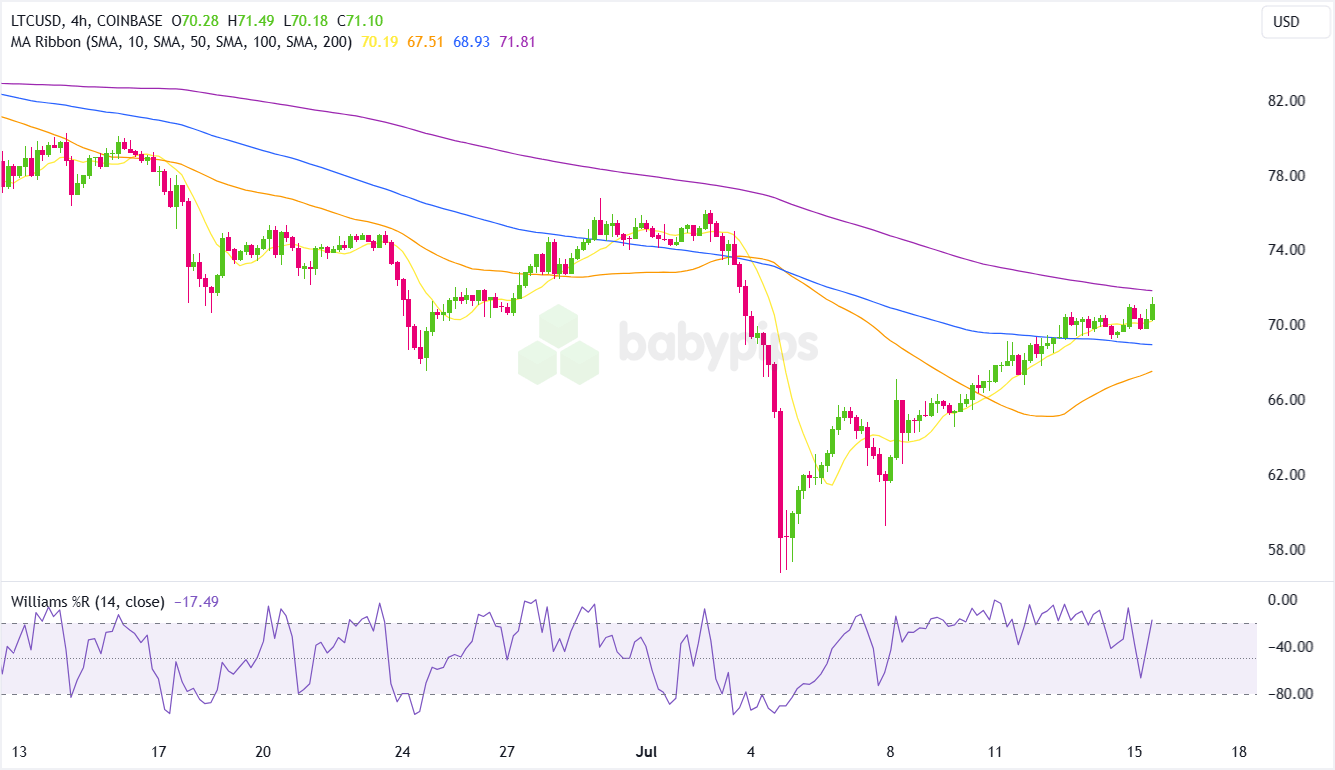

- Moving Averages: Moving averages help gauge the direction of price trends. A golden cross, where the 50-day moving average crosses above the 200-day moving average, often signals a potential upward trend. Litecoin approaching a golden cross could indicate the beginning of a new bullish phase.

2. Relative Strength Index (RSI): The RSI measures the speed and change of price movements, signaling overbought or oversold conditions. Litecoin’s RSI is nearing 60, suggesting it is not yet overbought, but traders should be cautious if the RSI approaches 70, which may signal a sell-off. Conversely, an RSI below 30 may indicate a buying opportunity due to oversold conditions.

MACD (Moving Average Convergence Divergence): The MACD indicator helps identify changes in momentum. Recently, Litecoin’s MACD line crossed above the signal line, indicating a bullish shift. Monitoring the MACD can provide clues about the sustainability of this bullish momentum.

Potential Buy Points for Litecoin

- Support Level at $100: Litecoin has found solid support at the $100 level. If this support holds and Litecoin begins to show consolidation or a rebound, it could present an ideal buying opportunity. Traders should watch for bullish price action or consolidation patterns around this area to consider entering long positions.

- Breakout Above $120 Resistance: The $120 level is a critical resistance zone. A decisive break and hold above this level could signal the end of the downtrend, making it a good entry point for further upside potential. Before investing, look for strong breakouts with increased trading volume to confirm the move.

- Fibonacci Retracement Levels: Utilize Fibonacci retracement levels to identify potential buy points. If Litecoin retraces to key levels such as 38.2% or 50%, this could signal a buying opportunity, especially if the price shows signs of a rebound.

Potential Sell Points for Litecoin

- Resistance Levels: Watch resistance zones like $150 to set sell or take-profit orders. These levels can act as barriers to further price increases, making them ideal for profit-taking.

- Overbought Conditions: An RSI above 70 indicates that Litecoin may be overbought and due for a correction. Traders should consider reducing long positions or taking profits when RSI enters this territory.

- Trend Reversal Indicators: Look for bearish candlestick patterns or a MACD crossover to signal potential trend reversals. These indicators can help traders decide when to exit or reduce exposure.

Risk Management Strategies

- Stop-Loss Orders: Implement stop-loss orders to protect investments from significant losses during market downturns. Setting appropriate stop-loss levels based on market volatility and personal risk tolerance is crucial.

- Position Sizing: Proper position sizing helps manage risk effectively. Determine your trade size based on the total capital invested and market conditions, avoiding overexposure to a single asset.

- Diversification: Diversify your investment portfolio across different asset classes to minimize risk. By spreading investments across multiple assets, you reduce the impact of a decline in any single asset’s value.

Conclusion: Monitoring Litecoin for Profit Opportunities

Litecoin is showing signs of a potential breakout, making it crucial for traders to monitor key buy and sell levels. By keeping an eye on technical indicators, support and resistance levels, and implementing effective risk management strategies, traders can better navigate Litecoin’s volatility and capitalize on potential profit opportunities. As always, staying informed and vigilant is key to success in the ever-changing cryptocurrency market.