Introduction to Triangular Arbitrage

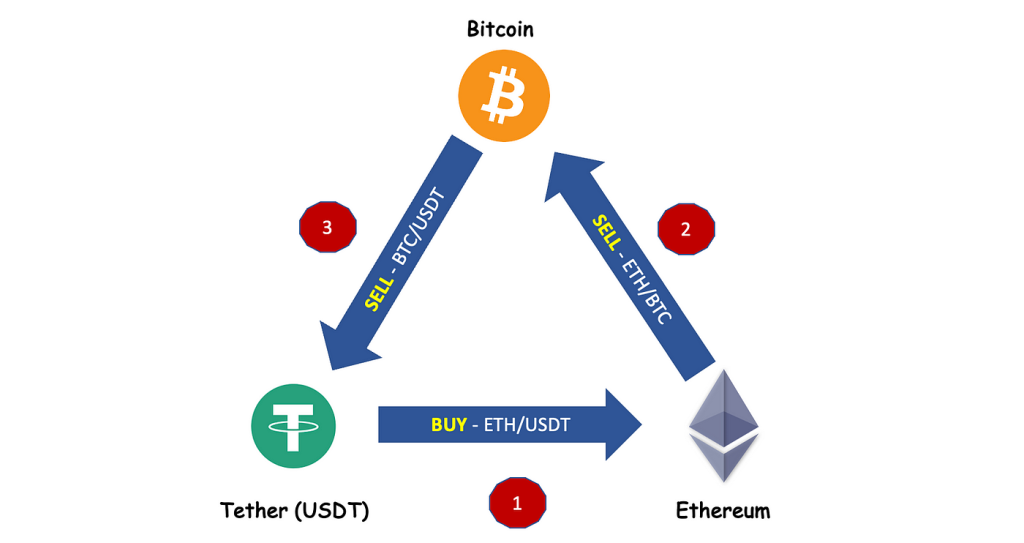

Crypto Triangular arbitrage is a trading strategy where a trader exploits differences in exchange rates between three currencies. By cycling through trades — buying one currency, exchanging it for another, and finally converting it back to the original currency — traders aim to profit from these discrepancies. This strategy is less common and often relies on sophisticated algorithms to identify profitable opportunities.

Analyzing Profitability and Risk Management in Triangular Arbitrage

Understanding Cryptocurrency Triangular Arbitrage

Triangular arbitrage in the cryptocurrency market involves trading three different cryptocurrencies to capitalize on price discrepancies. For instance, you might buy Bitcoin (BTC), trade it for Ethereum (ETH), then exchange ETH for Ripple (XRP), and finally convert XRP back to BTC. The key is to profit from the price differences between these trades.

Key Factors Influencing Profitability

- Price Discrepancies: The primary driver of profit in triangular arbitrage is the price difference between currency pairs. These differences are often small and fleeting, so speed is essential.

- Trading Fees: Transaction costs can erode profits. Successful arbitrage relies on ensuring that potential gains exceed these fees.

- Slippage: The difference between expected and actual trade prices can diminish profits, particularly in volatile markets.

- Speed: Quick execution of trades is crucial due to rapidly closing price gaps.

- Market Depth and Liquidity: High liquidity ensures trades can be executed at desired prices without impacting the market.

Triangular Arbitrage Risk Management

Navigating the Risks

- Market Volatility: Cryptocurrency markets can be highly volatile. Utilize limit orders to control trade execution prices and mitigate potential losses.

- Execution Risk: Ensuring that all legs of the arbitrage are completed without delay is crucial. Automated trading bots can help reduce this risk.

- Exchange Risk: Centralized exchanges can face downtime, hacking, or withdrawal limits. Distributing trades across multiple exchanges can reduce these risks.

- Regulatory Risks: Stay updated on regulatory changes that may impact trading practices and compliance.

- Fee Structures: Understand the fee structures of exchanges and account for these in your profit calculations.

- Technical Glitches: System failures or network issues can affect trades. Regular monitoring and having backup systems in place can mitigate these risks.

Calculating Potential Profits and Losses

Formulating Profitability

To assess the potential profit from triangular arbitrage, consider slippage and transaction fees. Use the following simple formula:

Profit=Final Amount−Initial Amount−Fees\text{Profit} = \text{Final Amount} – \text{Initial Amount} – \text{Fees}

Ensure that test trading results are positive before committing significant capital. Always have an exit strategy ready in case of sudden market changes.

Best Practices for Successful Triangular Arbitrage Using Trading Bots

Leveraging Trading Bots

Triangular arbitrage trading bots can automate the process of identifying and capitalizing on price mismatches. Key features of effective trading bots include:

- Market Identification Capability: The bot checks prices across multiple exchanges.

- Arbitrage Opportunity Detection: It measures imbalances in exchange rates to identify profitable opportunities.

- Automated Trading Execution: The bot executes trades quickly to capitalize on identified opportunities.

- Risk Management: It accounts for transaction and withdrawal fees, market volatility, and execution risks.

- Monitoring and Adjusting: The bot continuously adapts to market conditions and optimizes trading strategies.

Cheap Remote Crypto Mining for you – Click Here

Building Your Triangular Arbitrage Trading Bot

- Define Triangular Arbitrage: Understand the fundamental concept of trading across three currency pairs.

- Select a Programming Language and Framework: Choose a language like Python and frameworks such as CCXT for bot development.

- Set Up Exchange APIs: Integrate APIs from multiple cryptocurrency exchanges.

- Fetch Exchange Rates: Write code to obtain real-time rates of currency pairs.

- Calculate Arbitrage Opportunities: Develop algorithms to identify potential arbitrage opportunities.

- Implement Risk Management: Address common pitfalls like slippage and transaction fees.

- Execute Trades: Configure the bot to automate trading when profitable opportunities arise.

- Monitor and Log: Track performance and troubleshoot issues.

- Test and Optimize: Conduct backtesting and real-time tests to refine trading strategies.

- Deploy: Launch the bot on a cloud server or local machine and keep it updated.

- Compliance and Legal Issues: Ensure adherence to regulatory requirements in your jurisdiction.

- Continuous Improvement: Regularly update the bot to adapt to market conditions and improve performance.

Conclusion

Mastering triangular arbitrage in cryptocurrency trading requires a deep understanding of market dynamics, meticulous planning, and effective risk management. By leveraging advanced trading bots and adhering to best practices, you can enhance your chances of successfully capitalizing on arbitrage opportunities.