Mercury Fintech Raises $200M for Solana Treasury in $3.5B Move

Mercurity Fintech Holding Inc. (NASDAQ: MFH) has received a $200 million equity line of credit from Solana Ventures to implement a Solana treasury strategy. This move puts MFH among the biggest institutional investors, increasing their treasury exposure to Solana. MFH joins other Solana-aligned enterprises, like Sol Strategies, which recently applied for a Nasdaq listing. Solana’s price increased 5.46% to $191.70.

Solana Treasury Strategy: $200M Credit Line from Solana Ventures

According to the official news release, the transaction will assist in establishing a Solana treasury strategy. The credit arrangement will allow MFH to build a sizable holding in SOL, the Solana blockchain’s native coin.

The business intends to leverage these assets to produce long-term return in the Solana ecosystem through staking, validator operations, and decentralized finance protocols. MFH will also invest in tokenized financial products and real-world asset initiatives based on Solana.

Strategic Alignment with Solana’s Ecosystem

According to Wilfred Daye, Chief Strategy Officer at MFH, the firm is establishing itself within Solana’s developing network to have access to real-time payments, tokenized assets, and efficient decentralized services. He cited Solana’s speed, cost-effectiveness, and regulatory traction as important reasons for the move.

MFH has not provided a particular date for the Solana treasury buildup but has indicated that the money would be used progressively. The move places MFH within a group of companies creating the next phase of institutional crypto participation, focusing on Solana.

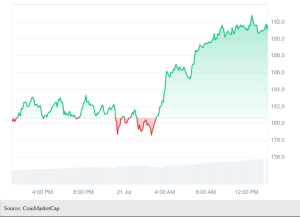

Market Impact: Solana Price and Volume Surge

Solana prices grew by 5.46% in the last 24 hours, reaching $191.70. The surge increased its market value by over $103 billion. Additionally, trading volume surged sharply, increasing by 69.44% to $8.69 billion.

Institutional Adoption of Solana Continues

MFH’s move adds to the rising number of institutional entities using Solana as a long-term treasury asset. It follows in the footsteps of DeFi Development Corp, which recently raised its Solana holdings to more than $103 million.

ReserveOne, an experienced digital asset management organization, previously revealed ambitions to construct a $1 billion SPAC crypto treasury with Solana and Bitcoin. Kraken and Blockchain.com were among the investors that supported the asset manager’s ambitions.

Sol Strategies, a Solana Treasury business, applied for Nasdaq listing with the US Securities and Exchange Commission last month under the ticker STKE.

Ready to Start Mining Safely?

VoskCoin offers an affordable, verified, and transparent cloud mining solution for both beginners and experienced miners:

✅ Start Mining Today with VoskCoin

✅ Real ASIC Miner | Verifiable Payouts | Verifiable Payout Reviews

VoskCoin Mining Profitability

Co-rent Real ASIC Hashrate from the VoskCoin Mining Farm.

Contract Profitability

| What You Mine: | N/A |

|---|---|

| Coin Price: | N/A |

| Total Mining Power: | N/A |

| Mining Duration: | N/A |

| Daily Mining Reward: | N/A |

| Total Mining Reward: | N/A |