In the world of cryptocurrencies and blockchain technology, legal issues can often be as complex as the technology itself. One such case has recently captured the attention of the crypto community and financial enthusiasts alike. The U.S. Commodity Futures Trading Commission (CFTC) has filed a lawsuit against Voyager Digital and its former CEO, alleging fraud and misconduct. In this detailed analysis, we’ll delve into the intricacies of this lawsuit, exploring the key players, the allegations, and the potential implications for the cryptocurrency market.

Background

Voyager Digital: A Brief Overview

Voyager Digital, a prominent player in the cryptocurrency space, is known for its user-friendly crypto trading app and platform. Founded in 2018, the company quickly gained recognition for its efforts to simplify crypto trading for mainstream users. Under the leadership of CEO Stephen Ehrlich, Voyager Digital positioned itself as a bridge between traditional finance and the world of digital assets.

The CFTC’s Regulatory Authority

The U.S. Commodity Futures Trading Commission, or CFTC, is a federal agency tasked with regulating the futures and options markets. It plays a crucial role in ensuring the integrity of these markets by enforcing regulations and taking action against entities that violate trading rules. The CFTC’s oversight extends to the cryptocurrency market, as digital assets often fall under the category of commodities.

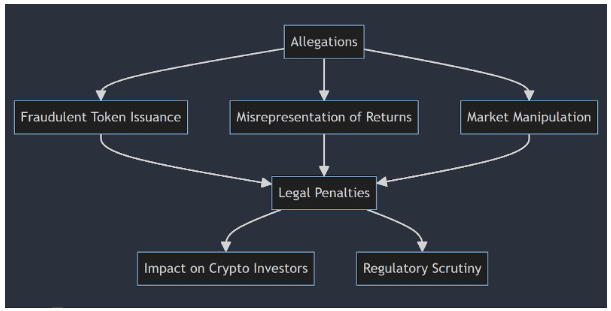

The Allegations

Fraudulent Token Issuance

The heart of the CFTC’s lawsuit against Voyager Digital revolves around allegations of fraudulent token issuance. The CFTC claims that Voyager Digital, under the leadership of Stephen Ehrlich, engaged in the issuance of unregistered securities in the form of VGX tokens. The tokens, which were offered to the public, were allegedly not registered as required by U.S. securities laws.

Misrepresentation of Returns

Another significant allegation in the lawsuit is the misrepresentation of returns to investors. The CFTC argues that Voyager Digital and its former CEO, Ehrlich, provided misleading information about the potential returns on investments in VGX tokens. This alleged misrepresentation may have enticed investors to buy tokens based on inaccurate or incomplete information.

Market Manipulation

The CFTC also accuses Voyager Digital of market manipulation. The lawsuit contends that the company, with Ehrlich at the helm, artificially inflated the price of VGX tokens through wash trading and other manipulative tactics. Market manipulation undermines the integrity of the cryptocurrency market and can have far-reaching consequences.

Potential Implications

Legal Ramifications

If the CFTC’s allegations are proven, Voyager Digital and its former CEO could face substantial legal penalties. This could include fines, disgorgement of ill-gotten gains, and potentially even criminal charges. Legal actions against prominent cryptocurrency companies send a strong message about the importance of regulatory compliance in the industry.

Impact on Crypto Investors

The lawsuit may also have implications for VGX token holders and other investors in the cryptocurrency market. If Voyager Digital is found liable, investors who purchased VGX tokens under false pretenses may seek remedies, including potential compensation.

Regulatory Scrutiny

The CFTC’s actions against Voyager Digital highlight the increasing regulatory scrutiny that the cryptocurrency market faces. As the industry continues to grow, government agencies are becoming more vigilant, emphasizing the need for transparent and compliant practices.

Conclusion

The CFTC’s lawsuit against Voyager Digital and its former CEO, Stephen Ehrlich, underscores the evolving regulatory landscape of the cryptocurrency industry. Allegations of fraudulent token issuance, misrepresentation of returns, and market manipulation carry significant implications for both the company and the broader crypto market. As the case unfolds, it serves as a stark reminder that regulatory compliance and transparency are essential for the long-term sustainability of the cryptocurrency ecosystem.

Please note that this article provides an overview of the CFTC’s lawsuit against Voyager Digital and should not be considered legal advice. The case’s outcome will depend on the legal proceedings and evidence presented.

FAQs

Who is the CEO of Voyager Digital LLC?

The CEO of Voyager Digital LLC is Steve Ehrlich.

Who is the CEO of Group Voyagers?

Group Voyagers does not have a publicly known CEO.

Who is suing Voyager?

The U.S. Commodity Futures Trading Commission (CFTC) is suing Voyager.

Who owns VGX?

VGX is owned by Voyager Digital, the company itself.