In this comprehensive analysis, we delve into the intricacies of Bitcoin price action during the month of October. As seasoned experts in the cryptocurrency market, we understand the importance of dissecting the data to provide you with invaluable insights. Our aim is to offer you a profound understanding of Bitcoin’s historical trends and potential future movements, allowing you to make informed decisions in this ever-evolving market.

October: A Historical Perspective

October’s Historical Performance

October has always been an intriguing month for Bitcoin enthusiasts. Historical data reveals intriguing patterns. Over the past decade, October has witnessed remarkable volatility, characterized by significant price fluctuations. This volatility is an outcome of various factors, including market sentiment, regulatory developments, and macroeconomic trends.

Seasonal Factors

Several seasonal factors contribute to Bitcoin’s October price movements. The anticipation of holiday spending, tax considerations, and institutional investment decisions all come into play. Additionally, the heightened market activity leading up to the end of the year often generates substantial trading volumes.

Regulatory Impact

Regulatory Developments

One crucial factor affecting Bitcoin’s October performance is regulatory developments. Governments and regulatory bodies worldwide continue to refine their approach to cryptocurrency regulation. Any major announcements or changes in regulatory stance can significantly impact the market.

SEC and ETF Speculation

The U.S. Securities and Exchange Commission (SEC) plays a pivotal role in shaping investor sentiment. Speculation regarding the approval of Bitcoin Exchange-Traded Funds (ETFs) often leads to market fluctuations in October. Investors keenly await SEC decisions, as they have the potential to catalyze substantial price movements.

Market Sentiment

Sentiment Analysis

Market sentiment is a driving force behind Bitcoin’s October price action. Traders and investors closely monitor social media, news outlets, and sentiment analysis tools for insights into market sentiment. Positive or negative sentiment can influence buying and selling decisions, leading to rapid price swings.

Fear and Greed Index

The Fear and Greed Index, a popular sentiment indicator, gauges market sentiment on a scale from extreme fear to extreme greed. High readings of greed can indicate an overbought market, potentially leading to a correction, while fear can signal a buying opportunity.

Technical Analysis

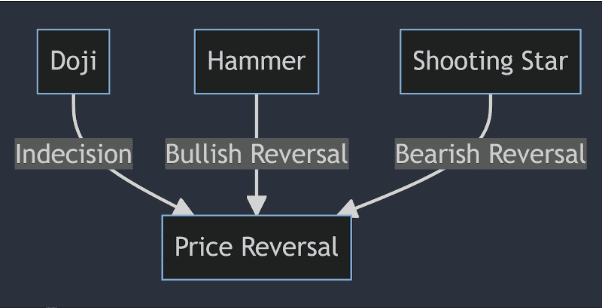

Candlestick Patterns

Traders often rely on technical analysis to make informed decisions. In October, specific candlestick patterns can provide valuable insights into potential price reversals or continuations. Patterns such as Doji, Hammer, and Shooting Star can signal important turning points.

Conclusion

In conclusion, Bitcoin’s price action in October is influenced by a multitude of factors, including historical performance, seasonal trends, regulatory developments, market sentiment, and technical analysis. By understanding these dynamics, you can navigate the October Bitcoin market with confidence.

It’s essential to remain vigilant, keep a close eye on market news, and consider a diversified portfolio strategy to mitigate risks associated with October’s heightened volatility. As always, making informed decisions is the key to success in the ever-evolving world of cryptocurrency.

For personalized insights and -time updatesreal on Bitcoin’s October price action, please don’t hesitate to contact us. We’re here to help you stay ahead in the world of digital assets.

FAQs

-

How does Bitcoin perform in October?

Bitcoin’s performance in October is historically characterized by significant price volatility. Various factors, including market sentiment, regulatory developments, and seasonal trends, can influence its performance during this month.

-

Why does Bitcoin’s price fluctuate?

Bitcoin’s price fluctuates due to a combination of factors, including market sentiment, news events, regulatory changes, investor sentiment, and macroeconomic factors. These dynamics can lead to both upward and downward price movements.

-

Does Bitcoin rise and fall?

Yes, Bitcoin’s price experiences both upward and downward movements. It is known for its price volatility, and its value can rise during bull markets and fall during bear markets. Traders and investors closely monitor these fluctuations for opportunities.

-

What is the progress of Bitcoin’s price?

Bitcoin’s price progress is subject to change over time. It has shown significant growth since its inception, but its price can experience periods of consolidation or correction. Long-term progress often depends on factors such as adoption, institutional interest, and macroeconomic conditions.