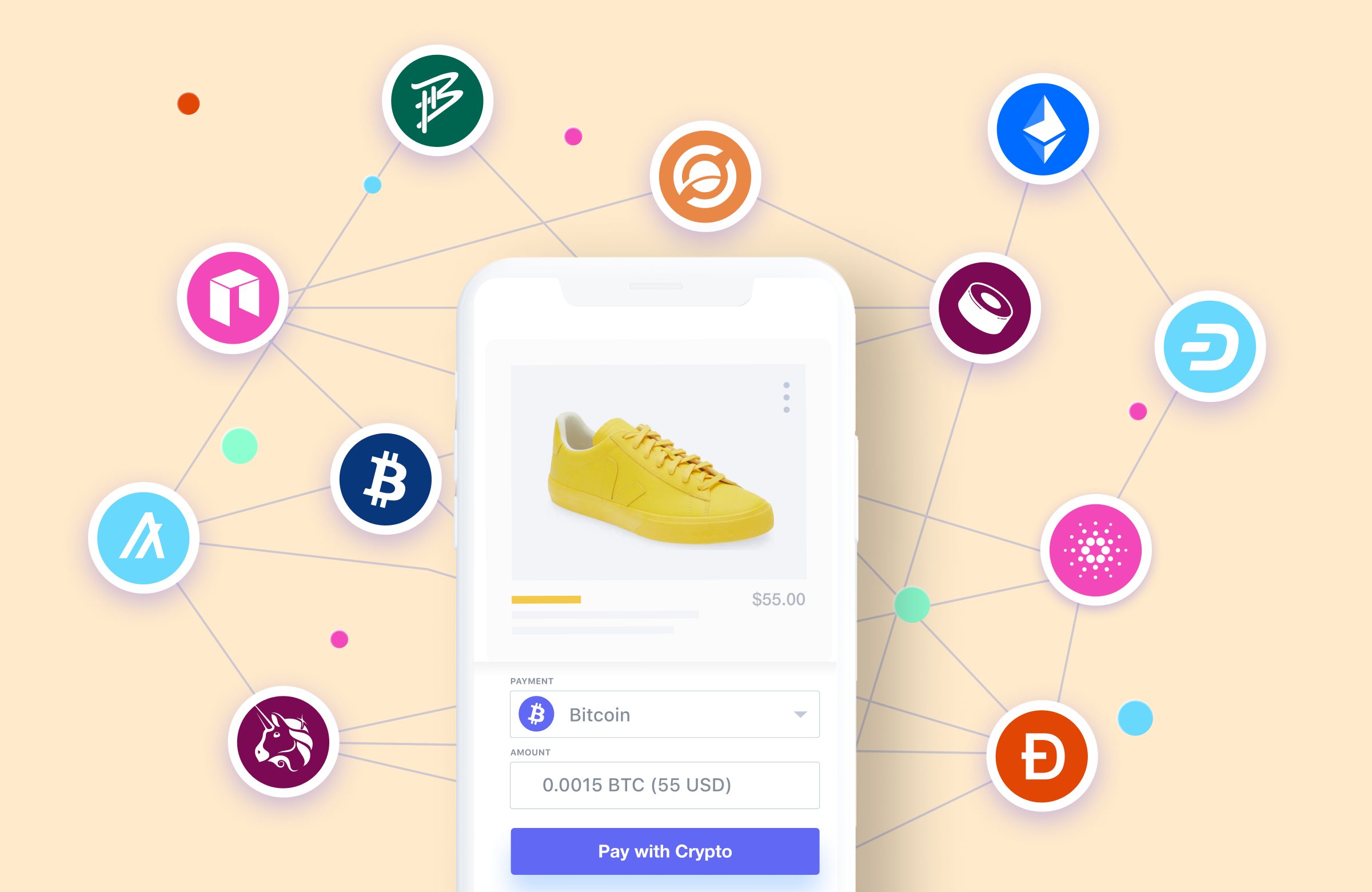

As the world of digital finance evolves, more industries are adopting cryptocurrencies for payments due to their speed, security, and global accessibility. But with thousands of cryptocurrencies available, which ones stand out as the best for crypto payments? Let’s explore!

Key Criteria for Choosing Cryptocurrencies for Payments

Before diving into the specific cryptocurrencies, it’s essential to understand the criteria that make a cryptocurrency suitable for payments:

- Transaction Speed: Fast transaction times are crucial for efficient payment processing.

- Low Fees: Lower transaction fees make it more economical for both businesses and customers.

- Security: Robust security features protect transactions and prevent fraud.

- Adoption: Widespread acceptance and use increase the utility of the cryptocurrency.

- Stability: Price stability ensures predictable transaction values.

Which Cryptocurrencies Are the Best for Crypto Payments?

- Bitcoin (BTC): As the pioneer of cryptocurrencies, Bitcoin remains a popular choice for payments due to its widespread adoption and high liquidity. Many businesses accept Bitcoin, making it a reliable option for transactions. Moreover, Bitcoin’s established infrastructure, which includes a wide range of wallets, exchanges, and payment processors, supports seamless integration into existing financial systems and makes it easier for businesses to accept Bitcoin payments.

- Ethereum (ETH): Ethereum, the second-largest cryptocurrency by market capitalization, offers unique features that make it an excellent choice for payments. Beyond its role as a digital currency, Ethereum’s smart contract capabilities, robust ecosystem, and scalability contribute to its growing popularity as a payment method.

- Litecoin (LTC): One of Litecoin’s standout features is its faster block generation time compared to Bitcoin. While Bitcoin blocks are created every 10 minutes, Litecoin blocks are generated every 2.5 minutes. This results in quicker transaction confirmations, making it ideal for businesses that require rapid payment processing.

- Bitcoin Cash (BCH): Bitcoin Cash is popular for payments due to its low transaction fees. Unlike Bitcoin (BTC), which can have higher fees during periods of network congestion, BCH maintains relatively low fees, making it cost-effective for small and frequent transactions. This is particularly beneficial for merchants who want to keep their operating costs low and for consumers who want to avoid high fees.

- Ripple (XRP): Ripple’s network is highly scalable, capable of handling 1,500 transactions per second (TPS). This capacity far exceeds that of Bitcoin (7 TPS) and Ethereum (15-30 TPS), making Ripple suitable for handling a large volume of transactions simultaneously. This scalability is essential for mainstream adoption and for businesses that experience high transaction volumes.

- Dash (DASH): Dash offers a feature called PrivateSend, which enhances transaction privacy by mixing multiple transactions together, making it difficult to trace individual transactions. This added layer of privacy is attractive to users who prioritize confidentiality in their financial dealings.

- Stellar (XLM): Stellar aims to facilitate low-cost cross-border transactions. Its network is designed to be fast and efficient, making it a strong contender for international payments.

- Binance Coin (BNB): Binance Coin is widely used within the Binance ecosystem for transaction fee discounts and payments. Its utility and growing acceptance make it a viable payment option. Binance has cultivated a large and active community of users and developers, which helps drive adoption and innovation around BNB, leading to new use cases and integrations that enhance its utility as a payment method.

- Tether (USDT): The stability of USDT makes it an attractive option for both merchants and consumers. Businesses can accept payments in Tether without worrying about significant fluctuations in value that could affect their revenue. Consumers can use Tether knowing that their purchasing power will remain consistent.

- Cardano (ADA): Cardano’s secure and scalable platform makes it suitable for a wide range of payment applications. Its focus on sustainability and interoperability enhances its appeal.