The Bitcoin halving approaches, heralding an imminent shift in its value. Voskcoin has pinpointed crucial prospects for miners and crafted forecasts on navigating the Bitcoin (BTC) landscape in 2024.

Significant Changes Ahead

In April 2024, a pivotal event awaits all miners of the leading cryptocurrency – the Bitcoin halving. This process entails halving the rewards for miners, a planned reduction in Bitcoin emission tied to its limited total supply, encoded in the cryptocurrency’s source code. As known, a total of 21 million BTC can be mined worldwide.

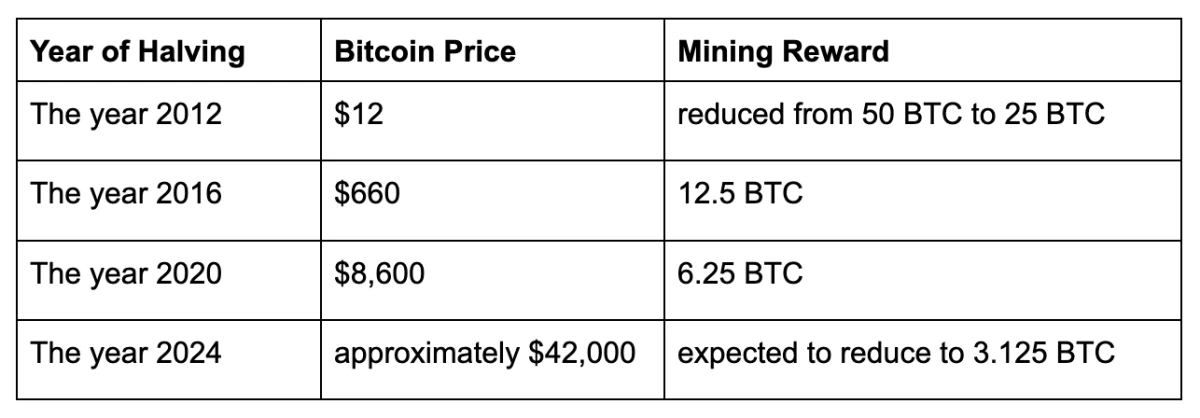

Halving occurs consistently every four years or every 210,000 blocks. Refer to the table below for more details:

Bitcoin Halving Dates History

Is There Life After Halving?

What will happen to Bitcoin post-halving? Let’s explore the possibilities:

- The rate of new coin mining might decrease.

- The Bitcoin price might rise.

- Cryptocurrency market volatility might change.

- Mining profitability will decrease.

- Bitcoin’s attractiveness as a long-term and protective asset might increase.

All these factors indicate the inevitable transformation of the cryptocurrency market, impacting all participants. Investors and traders should already be preparing and integrating this crucial event into their trading strategies.

Prospects for Bitcoin Miners after the Halving

CoinShares experts have conducted assessments and forecasted that after April 2024, the average cost of mining 1 BTC will be $37,856. In their report, CoinShares’ investment strategist, James Butterfill, noted that the main challenges for miners currently include commercial, general, and administrative expenses. It’s likely that these aspects will need to be reduced in the near future to sustain mining operations. This also applies to energy consumption, expected to decrease to an average of 10 W/T by mid-2026 (currently at 34 W/T).

Additionally, experts reminded that in 2023, the Bitcoin network hash rate increased by 90%. By the time of the halving, it is forecasted to be around 450 EH/s. A decline to 410 EH/s is possible six months after, with an expected rise to 550 EH/s by year-end.

How to Proceed with Bitcoin Going Forward?

Currently, it appears that the high costs of Bitcoin mining are covered by the miners themselves. In some cases, resorting to borrowed funds may be necessary. However, abusing loans can disrupt the overall mining cost structure, leading to higher interest costs that expose companies to additional risks during Bitcoin downturns.

As mentioned earlier, after the 2024 halving, the Bitcoin price is expected to reach around $40,000. If it falls below this mark, the profitable mining of many companies is at risk, with a high probability of operating at a loss and potential failure.

According to CoinShares experts, if the price of Bitcoin falls below $40,000 after the 2024 halving, only a few companies, including Bitfarms, Iris, CleanSpark, TeraWulf, and Cormint, will be able to continue mining.

Halving, Mining, and Ecology

In 2023, discussions about the necessity of transitioning to “green” mining intensified. This refers to a more environmentally friendly form of mining based on the use of renewable energy sources (hydro, solar, wind, geothermal).

According to CoinShares research, more than half of the electricity used for halving is currently generated through eco-friendly means. Experts hope that after the 2024 halving, with reduced rewards and increased costs, companies will not abandon eco-friendly practices and revert to traditional mining.

It’s essential to note that traditional or less environmentally friendly mining has led to:

- Deforestation

- CO2 emissions into the atmosphere

- Noise pollution

- Pollution of earth, water, and air

The Most Important Event in Bitcoin’s History

Halving stands as a pivotal event in Bitcoin’s history, affirming the cryptocurrency’s foundational principles of decentralization, transparency, and protection against inflation. It should either fortify Bitcoin’s market position or provide an opportunity for an altcoin to vie for the title of the world’s leading cryptocurrency.

Preparation for the 2024 halving appears to be progressing successfully, with leading mining companies striving to improve efficiency levels by acquiring new equipment or upgrading existing ones to reduce energy consumption. Modern devices have already been procured by companies like CleanSpark, Phoenix Group, and Cipher.