With the Bitcoin halving less than a month away, it’s crucial to assess its potential impact on Bitcoin. The recent surge to Bitcoin’s all-time high has underscored the significance of the impending halving – potentially acting as a catalyst for BTC’s value. While many anticipate high returns, some recall Bitcoin’s subpar performance, diverging from ETF-driven expectations.

Will the halving be a game-changer for Bitcoin, and can we expect a new all-time high this year? Instead of posing questions, let’s provide answers and delve into Bitcoin’s trajectory post-halving.

Context:

After enduring the “crypto winter,” investors looked to 2024 as a beacon of hope. Two factors, the introduction of Bitcoin exchange-traded funds (ETFs) and the upcoming halving, were poised to propel the market into a bullish phase.

Spot Bitcoin ETFs received approval on January 10 amid heightened expectations for market development. Despite briefly hitting $49,102, the asset faced corrections and volatility.

However, a significant shift occurred within macroeconomic liquidity cycles, with Bitcoin ETF inflows propelling BTC to a new historical high of $73,573.91 and a market cap exceeding $1.45 trillion, according to CoinMarketCap.

While opinions on the significance of the Bitcoin halving vary, understanding its potential impact is crucial.

What Is Halving, and Why It Matters:

To grasp Bitcoin halving’s significance, it’s essential to comprehend how the Bitcoin network functions. Bitcoin’s underlying technology, blockchain, comprises a network of computers (nodes) responsible for transaction validation. Miners, rewarded with Bitcoin for validating transactions, play a crucial role in this process.

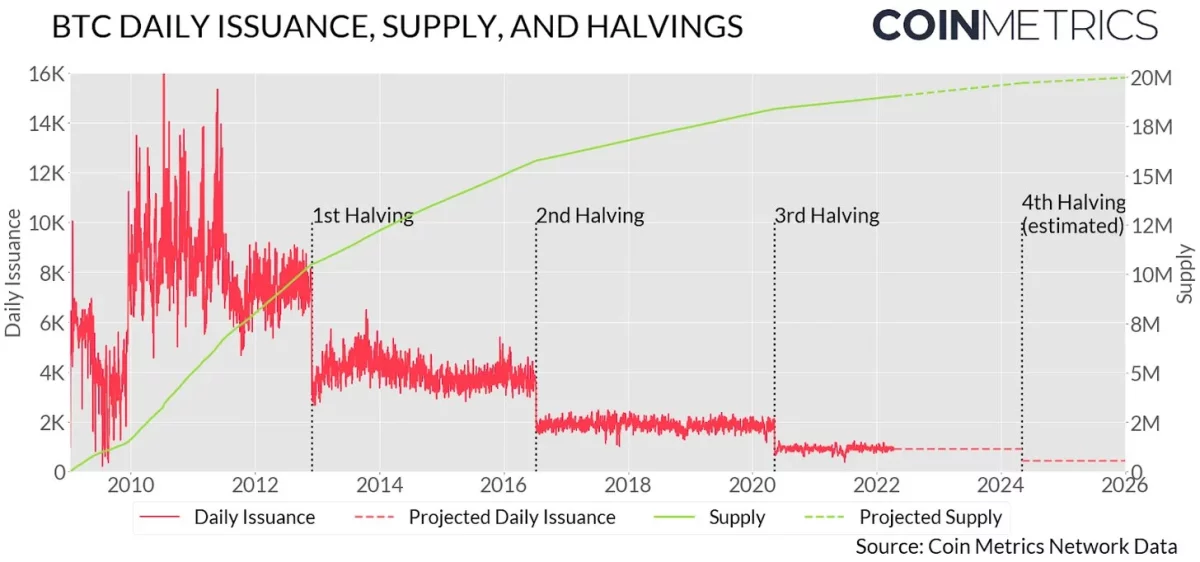

However, the mining reward isn’t static. Every 210,000 blocks mined (approximately every four years), the reward halves. This event, known as halving, reduces the rate at which new Bitcoins enter circulation.

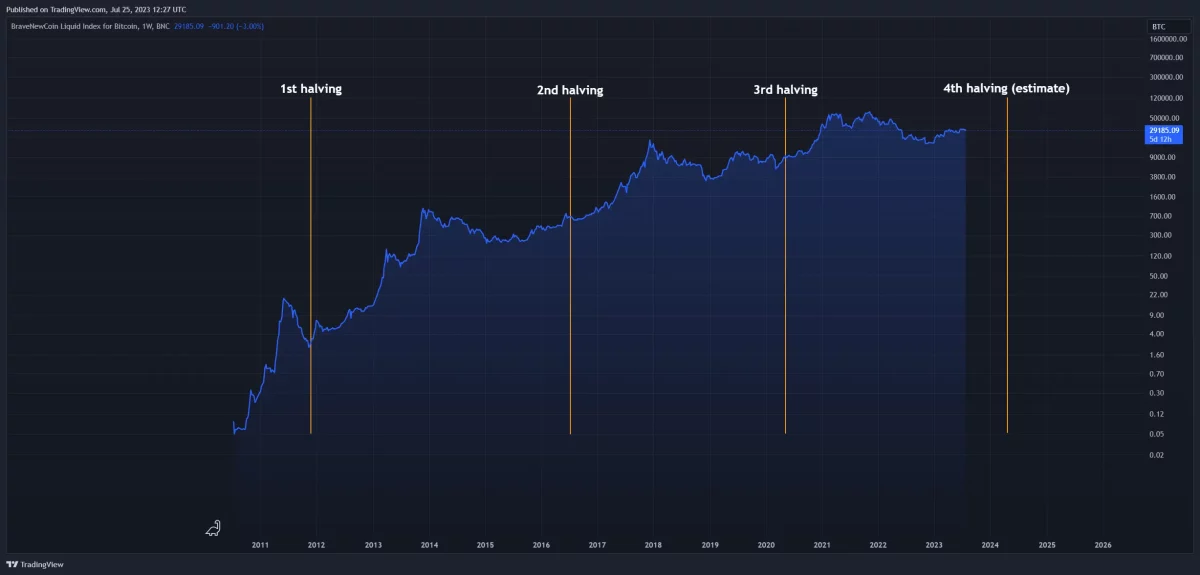

As of January 2024, there have been three halvings: in November 2012, July 2016, and May 2020. Each event signaled significant price surges for Bitcoin.

The first Bitcoin halving in 2012 marked a pivotal moment in the crypto world, sparking discussions about halving’s implications and why it leads to price increases.

However, the noticeable effect on Bitcoin’s price wasn’t immediate. It manifested three months later, with the coin’s value steadily increasing. Notably, at the onset of halving, Bitcoin was trading around $12.

Bitcoin’s first halving timeline: 2012-2013. Source: StormGain

In October 2015, nine months before the second halving, steady growth began again. After the July 2016 event, the sharp rise of Bitcoin eventually took it to its all-time high of $19,700 in 2017. After that, a long bearish trend set in.

Bitcoin second halving timeline: 2016-2017. Source: StormGain

The 2020 halving, despite coinciding with the Covid-19 pandemic, saw Bitcoin’s price soar from $8,740 to over $69,000.

Bitcoin second halving timeline: 2016-2017. Source: StormGain

Anticipation for the fourth halving, expected in April 2024, is palpable, rallying investors and the community alike. CoinMarketCap and several exchanges have initiated countdowns to the halving.

But will the fourth halving mirror its predecessors?

“History Repeating Itself”:

While opinions are varied, the prevailing view suggests that the fourth halving cycle mirrors previous ones.

Tone Vays, an analyst and esteemed trader, underscores this resemblance, citing Bitcoin’s promising performance in 2024 and 2025. He views halving not only as a technical adjustment but also as a catalyst for wider crypto adoption.

Michaёl van de Poppe echoes this sentiment, believing that history is repeating itself.

Bitcoin market capitalisation dominance chart. Source: Michaёl van de Poppe/X

The past-grounded notion of Bitcoin halving appears to be dominant within the community, not to mention its optimism in conclusion.

Jon Nielsen, an expert for CoinCodex, predicts Bitcoin’s price peaking above $170,000 in August 2025 before retracing to levels near $95,000.

Bitcoin halving cycles chart. Source: Jon Nielsen/CoinCodex

Crypto enthusiast and trader BitQuant is even more optimistic, envisioning a new all-time high for Bitcoin pre-halving and post-halving prices exceeding $250,000.

In his post for X, he claims:

“No, Bitcoin is not going to top before the halving. Yes, it’s going to reach a new all-time high before the halving. No, BTC is not going to $160K because the magnitude of every pullback is large. This means it will peak after the halving, in 2024. And yes, the target price is around $250K.”

BTC/USD chart prediction. Source: BitQuant/X

However, skepticism exists regarding halving’s impact. Seasoned trader Peter Brandt believes halving hype may temporarily boost Bitcoin prices but could be hindered by low supply rates.

Bitcoin daily issuance, supply, and halvings. Source: Coin Metrics Network Data

Colin Talks Crypto shares this skepticism, suggesting that halving events may create psychological impact rather than an economic effect.

As of the report’s publication, Bitcoin (BTC) is trading at $42,900.

BTC/USDT 1D chart. Source: WhiteBIT TradingView

Closing Remarks:

Despite diverse opinions, optimism surrounding Bitcoin halving remains prevalent. While the market outcomes are uncertain, halving events continue to be pivotal in shaping tokenomics and will undoubtedly influence future market dynamics.