In this comprehensive analysis, we delve deep into the historical Bitcoin price trends, specifically examining the remarkable fractal crash below the critical $20,000 mark. Our aim is to provide you with a detailed insight into this significant event in the world of cryptocurrency, equipping you with knowledge that not only informs but empowers your understanding of the crypto market.

The Bitcoin Fractal Crash: A Brief Overview

Understanding Fractals in Cryptocurrency

Before we dive into the specifics of Bitcoin’s historical crash below $20,000, it’s essential to grasp the concept of fractals in the world of cryptocurrency. A fractal is a self-replicating pattern that occurs at every scale, from the smallest to the largest. In Bitcoin, fractals refer to recurring price patterns that exhibit striking similarities, regardless of the time frame being analyzed.

The $20,000 Threshold: A Psychological Barrier

The $20,000 mark has long been a psychological barrier for Bitcoin traders and enthusiasts. This price level represents a historical milestone, as it was during December 2017 that Bitcoin reached its all-time high, briefly touching $20,000 before experiencing a significant pullback.

Analyzing the Historical Fractal Crash

Examining the 2017 Fractal Crash

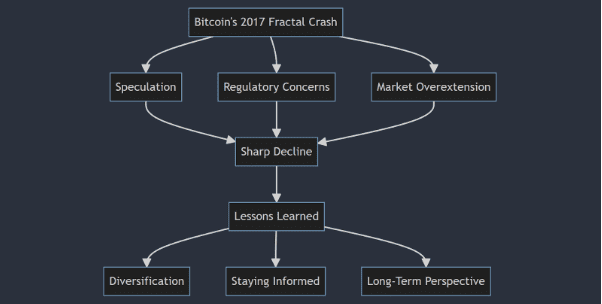

The 2017 Bitcoin price surge to $20,000 was followed by a sharp decline, leaving many investors puzzled. This crash had a cascading effect on the market, triggering panic selling and widespread uncertainty. To understand the 2021 fractal crash below $20,000, we must first revisit the events of 2017.

The 2021 Fractal Crash: A Deeper Dive

Fast forward to 2021, and Bitcoin once again approached the $20,000 mark. Investors and analysts closely watched as history seemed to repeat itself. But what caused this remarkable fractal crash, and what lessons can we glean from it?

Market Sentiment and Speculation

One key factor contributing to the fractal crash in 2021 was market sentiment and speculative trading. The fear of missing out (FOMO) led to a frenzied buying spree, causing Bitcoin’s price to skyrocket. However, when this speculative bubble burst, a sharp correction followed suit, bringing Bitcoin’s value crashing down.

Regulatory Concerns

Regulatory concerns played a pivotal role in the 2021 fractal crash. Governments worldwide began to take a more active stance on cryptocurrency regulation, causing unease among investors. News of potential bans and restrictions further fueled market uncertainty.

Market Overextension

Another critical aspect of the crash was the overextension of the market. Bitcoin’s rapid ascent had left it overbought and overvalued, making it susceptible to a substantial correction. This overextension contributed to the fractal crash below $20,000.

Learning from the Past: Insights and Takeaways

Diversification and Risk Management

One crucial lesson from the historical fractal crashes is the importance of diversification and risk management. Investors should not put all their eggs in one basket and should be prepared for market volatility.

Staying Informed

Keeping abreast of regulatory developments and market sentiment is vital for anyone involved in cryptocurrency. Being well-informed can help mitigate risks and make informed investment decisions.

Long-Term Perspective

Lastly, it’s essential to maintain a long-term perspective when investing in cryptocurrencies. While short-term gains are enticing, the crypto market is known for its volatility. Patience and a strategic outlook can yield more significant rewards in the long run.

Conclusion

In this detailed analysis, we’ve explored the historical Bitcoin fractal crash below $20,000, providing a comprehensive overview of the events leading up to it and the lessons we can extract from it. Understanding the dynamics behind such crashes is crucial for anyone involved in the cryptocurrency space. By staying informed, diversifying investments, and adopting a long-term perspective, investors can navigate the volatile world of cryptocurrencies with greater confidence and success.

This comprehensive guide should serve as a valuable resource for those seeking to understand the intricacies of Bitcoin’s price trends and the significance of the $20,000 threshold. By applying the lessons learned from these historical fractal crashes, you can navigate the volatile cryptocurrency market with confidence and make informed investment decisions.

FAQs

-

Why is Crypto Crashing in 2023?

Cryptocurrency crashes in 2023 can be attributed to a combination of factors, including regulatory changes, market sentiment shifts, and macroeconomic events.

-

Is Bitcoin crashing in 2023?

Bitcoin’s price in 2023 has experienced fluctuations, but it’s important to note that Bitcoin’s price can be highly volatile. Specific crashes may occur due to various factors.

-

When did bitcoin cross $20,000?

Bitcoin first crossed the $20,000 mark in December 2017 during a historic bull run.

-

Why BTC crashes?

Bitcoin crashes can happen due to factors like market speculation, regulatory developments, overextension, and profit-taking by investors.

-

Is 2023 good for Crypto?

The performance of cryptocurrencies in 2023 can vary. It’s essential for investors to stay informed and consider their risk tolerance before entering the crypto market.