The recent surge in Bitcoin’s price has brought a mix of excitement and FOMO (fear of missing out) to the cryptocurrency market. Social media data indicates that investors are displaying signs of euphoria, which may foreshadow a potential reversal in the ongoing rally.

Bitcoin Traders Exhibit Clear Bullish Bias

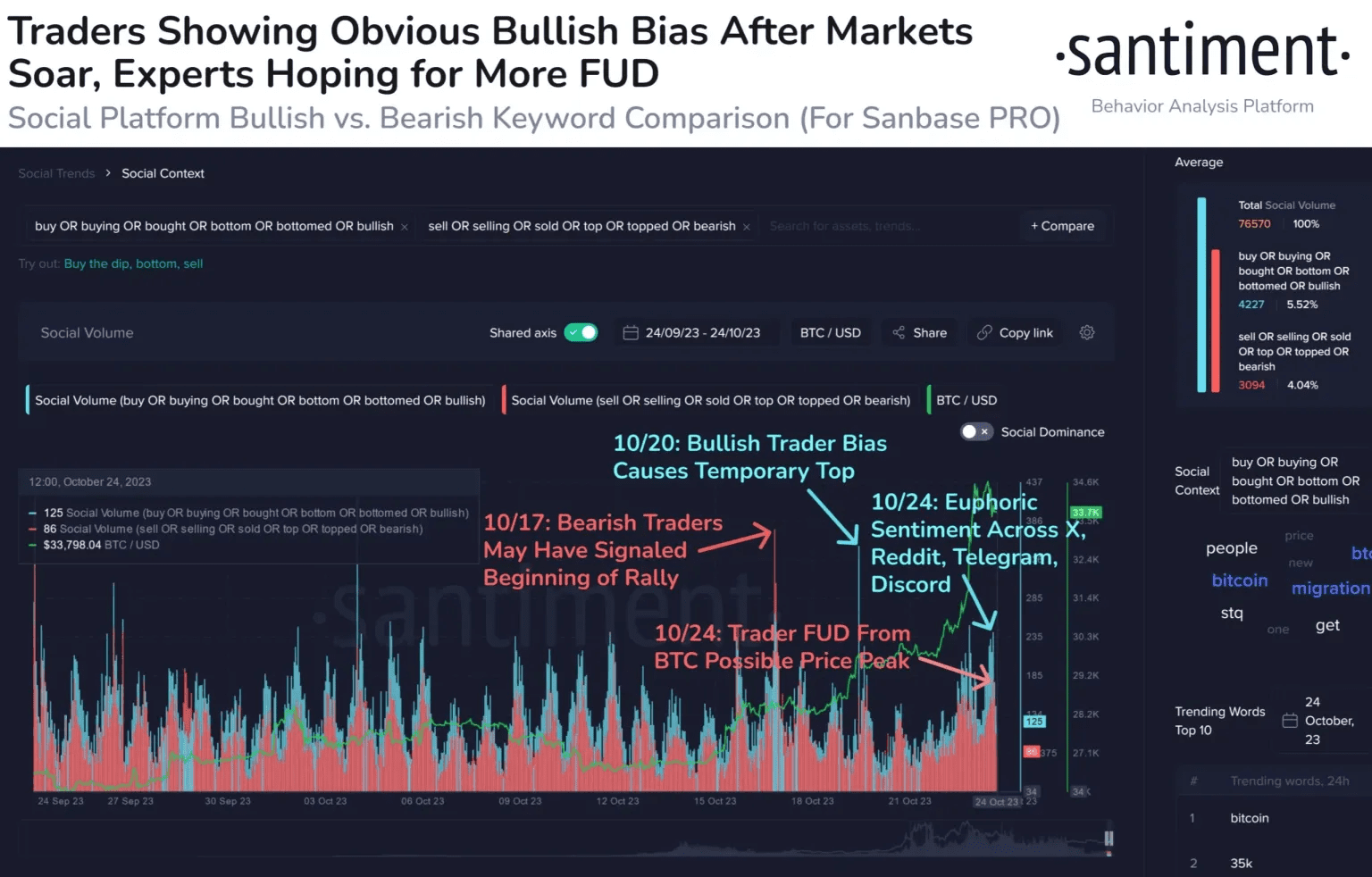

Santiment, an on-chain analytics platform, has recently shared data from its X (formerly Twitter) platform, offering insights into the social media sentiment surrounding the current market surge. According to the data, Bitcoin traders have adopted a positive outlook in response to the latest price trend.

The study primarily focuses on ‘social volume,’ which quantifies the number of discussions occurring within the crypto community on social media. Social volume is determined by considering the number of posts, threads, and messages related to the given topic. This metric ensures that each post is counted only once, regardless of how many times the topic is mentioned.

Santiment refined this social volume to identify sentiment-specific keywords related to Bitcoin, extracting information from posts addressing the market.

“Bitcoin’s recent +19% rise over the past week, along with its surging market capitalization, has generated a notable uptick in keywords associated with greed,” Santiment reported.

To narrow down posts associated with bullish sentiments, Santiment used keywords such as “bullish” or “buy.” Conversely, to identify posts linked to bearish sentiment, the company used terms like “bearish” or “sell.”

The results are depicted in the chart below:

Upon analyzing the chart, it is evident that the volume of terms related to Bitcoin’s bullish sentiment has seen a significant increase recently, indicating a rise in FOMO among traders. In contrast, the volume related to bearish terms is currently quite low.

Will the Bitcoin Rally Persist?

Historical trends have shown that the sentiment prevailing among the majority of investors can influence Bitcoin’s price trajectory. Prices of the asset have often moved in the opposite direction of what the majority of investors expected.

In simpler terms, the stronger the inclination toward a particular sentiment among investors, the greater the likelihood of a price movement opposing that sentiment. As we’ve seen this month, despite an initial wave of bearish sentiment in the market, the ongoing rally ensued.

With the current bullish sentiment prevailing on social media, it’s possible that Bitcoin might experience a significant price drop, potentially putting an end to the ongoing rally.

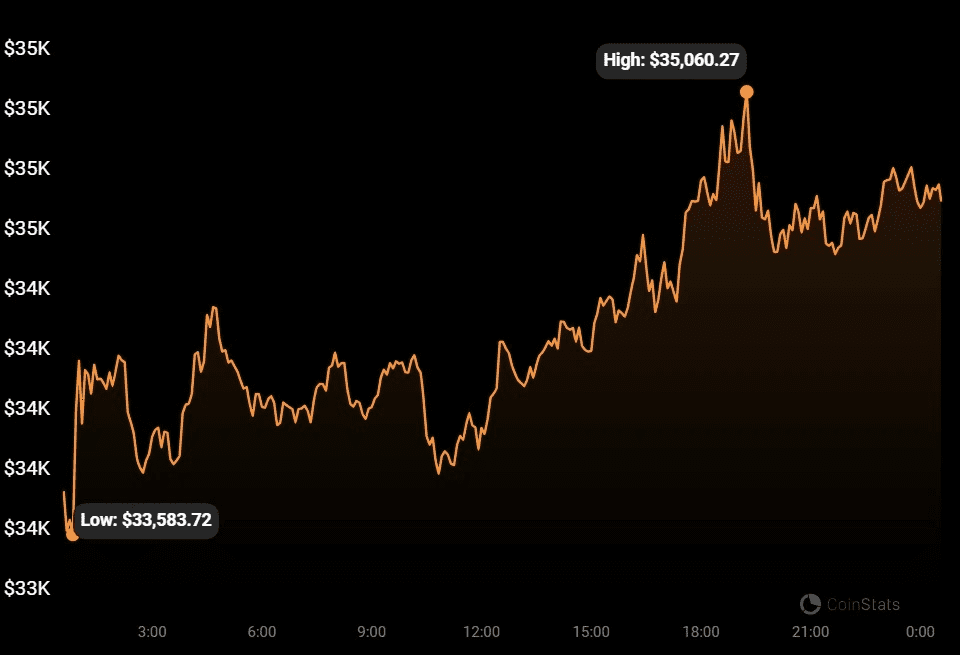

Bitcoin (BTC) Price Today

According to real-time data from Coinstats, Bitcoin is currently trading at $34,697, marking a 2.97% increase in the last 24 hours. Additionally, Bitcoin (BTC) boasts a 24-hour trading volume of $39.2 billion, with a live market cap of $677 billion.