Most investors overlook the importance of crypto portfolio management, mistakenly believing they can do without it.

Effective crypto portfolio management entails utilizing tools and mental frameworks to enhance performance. Neglecting these resources could lead to significant losses in the near future.

A prudent approach involves humbling oneself and emulating experts in the crypto investment realm.

While joking about impulsively investing in trendy altcoins or “puppy coins” may seem amusing, it’s crucial for crypto investors to prioritize asset preservation and maintain a long-term perspective.

Crypto Portfolio Management

Managing a crypto portfolio involves leveraging appropriate tools and mental strategies to optimize investment outcomes.

Unfortunately, introspection and technology-driven investing are often overlooked in the realm of crypto investments. Fortunately, valuable tools and insights are readily available online, but consistency is key.

Many investors and traders sabotage their own success due to emotional decision-making. Effective cryptocurrency portfolio management helps in controlling emotions, tracking performance, and identifying investment strengths and weaknesses.

Despite the inherent uncertainty of cryptocurrencies, many investors are drawn to high-risk strategies such as going all-in or trading with leverage. However, a sound crypto management strategy necessitates a diversified portfolio.

Diversification Matters

Diversification is paramount. Spreading risk across various assets reduces the likelihood of catastrophic losses and helps maintain emotional composure. Proper portfolio diversification mitigates impulsive decision-making.

However, diversifying within the crypto space is challenging due to asset interdependence. To minimize the risk of total capital loss, it’s advisable to allocate a significant portion of your portfolio to Bitcoin and other large-cap currencies. While Bitcoin may yield lower returns compared to other cryptocurrencies, it also tends to lose less during downturns. Investors often underestimate the emotional toll of losses and overestimate their ability to withstand prolonged downturns.

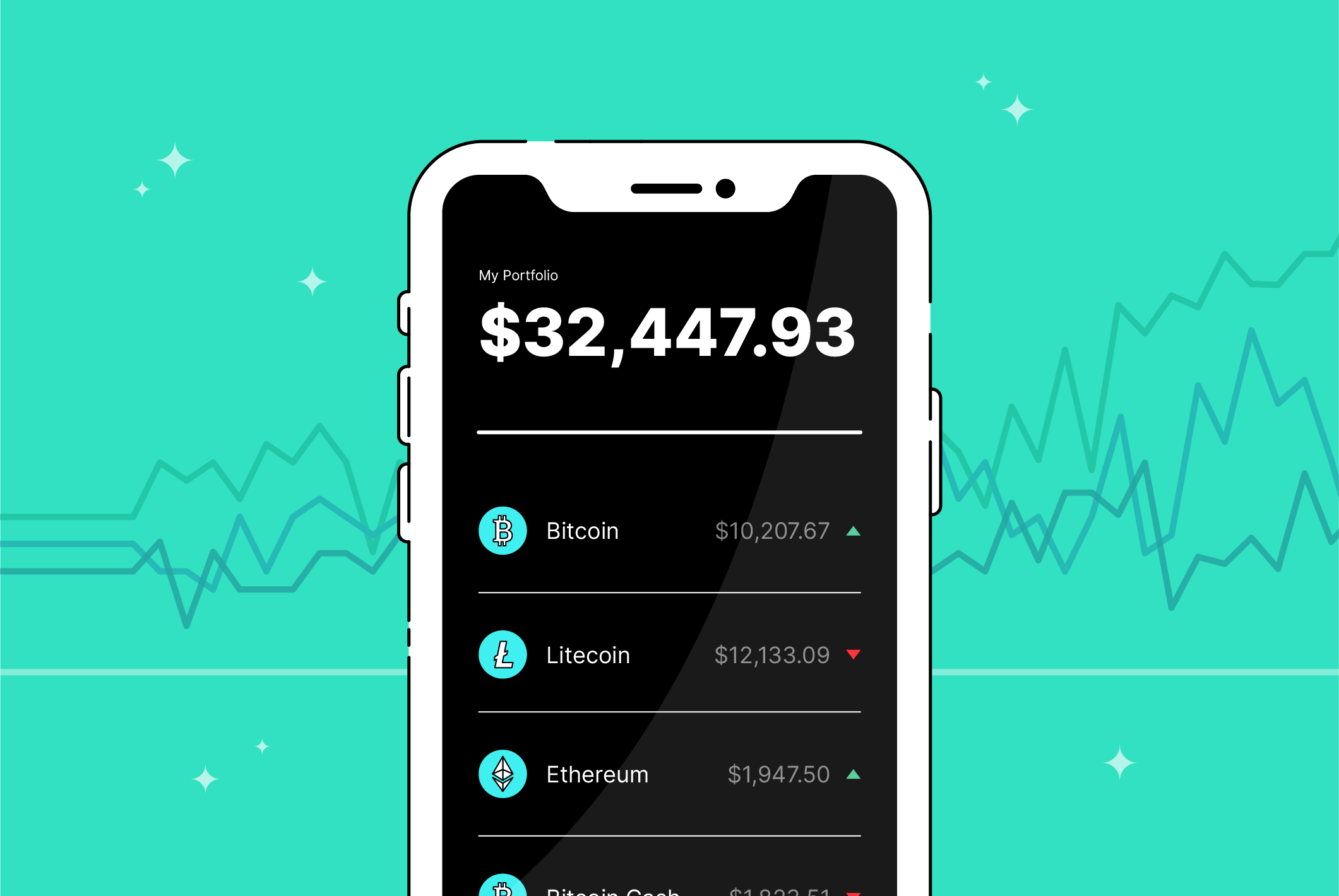

Tracking performance becomes increasingly complex as your investment spans multiple assets, exchanges, and wallets. Fortunately, crypto portfolio management apps provide the tools needed to monitor and adjust investments effectively.

How to Diversify Your Crypto Portfolio

- Invest in multiple cryptocurrencies: Adding new tokens to your portfolio is a straightforward way to diversify. Evaluate your existing holdings to inform your decision on new coins.

- Tokenized assets: Blockchain technology enables investors to purchase tokenized assets, representing partial or complete ownership of digital or physical assets. Investing in tokenized assets may also result in the acquisition of NFTs reflecting ownership stakes.

- ICO investments: While ICO investments can be risky, they offer potential diversification opportunities for your crypto portfolio. Investing in ICOs introduces “small-cap” assets to your portfolio. While these investments can yield significant gains, they also carry substantial risks. Exercise caution and conduct thorough research before diversifying your crypto investments through ICOs.