Investment strategies often draw from long-studied mathematical schemes and regularities. New interpretations of basic principles help modern entrepreneurs build capital as successfully as they did 100-200 years ago. The scenery may change, but the ideas remain the same – yet another proof of the cyclical nature of all events in our world.

One of such fundamental ideas is the Lindy Effect. Let’s delve into why it’s commonly referred to as the “most universal” concept and the pivotal role it plays in shaping investment strategies.

From Broadway to Investments:

The Lindy Effect was initially observed on Broadway when attempts were made to calculate the longevity of a particular show on stage. Through brief calculations and lengthy observations, it was revealed that if a show “survived” on the stage for, let’s say, 100 days after its premiere, it could be expected to survive for another similar period in the future. In other words, the potential lifespan of a phenomenon was determined by how long it had already existed at the time the forecast was made.

The theory’s origin is credited to a finance figure named Albert Goldman, who authored an article titled “The Lindy Law” in 1964. In it, he speculated that the length of a comedian’s successful career depends on how frequently they perform in public. The concept’s name was derived from the New York restaurant “Lindy,” a popular haunt among American comedians in the 1960s.

The Lindy Effect encapsulates the notion that the older a product, technology, etc., is now, the longer it is likely to “survive” in the future.

How Does the Lindy Effect Drive Profit?

Imagine you are planning to enter the market with a new product. While the specifics are unclear, it needs to be in demand and profitable for at least 10 years. Is it possible, based on such criteria, to roughly determine its potential? Yes, by leveraging the Lindy Effect in market analysis.

For instance, suppose you decide to enter the “coffee to go” market. After research, you discover that pumpkin spice latte has been consistently purchased every autumn for the past 5 years. According to the Lindy Effect, there is a high probability it will continue to be bought for another 5 years. However, in 50 years, pumpkin spice latte may go out of fashion, unlike Americano, which has remained relevant since the mid-60s. Including Americano as the main drink in your menu might be a prudent decision.

What Does It Have to Do with Investments?

Investors seek profits without taking active actions. To prevent investments from becoming charitable donations and investors from going bankrupt, certain skills and knowledge are necessary. Studying the market and its history is one of the most critical aspects.

Experts adeptly apply the Lindy Effect to investment realities. Its main principle boils down to “search for something that has stood the test of time.” Essentially, a company that has endured for 20 years is likely to endure for another 20 years, indicating that its stocks can be acquired.

It stands to reason that older companies boast robust connections and extensive experience in running businesses. While the Lindy Law doesn’t guarantee larger profits when investing in older companies compared to newer ones, there is evidence that this strategy yields favorable results in the long run.

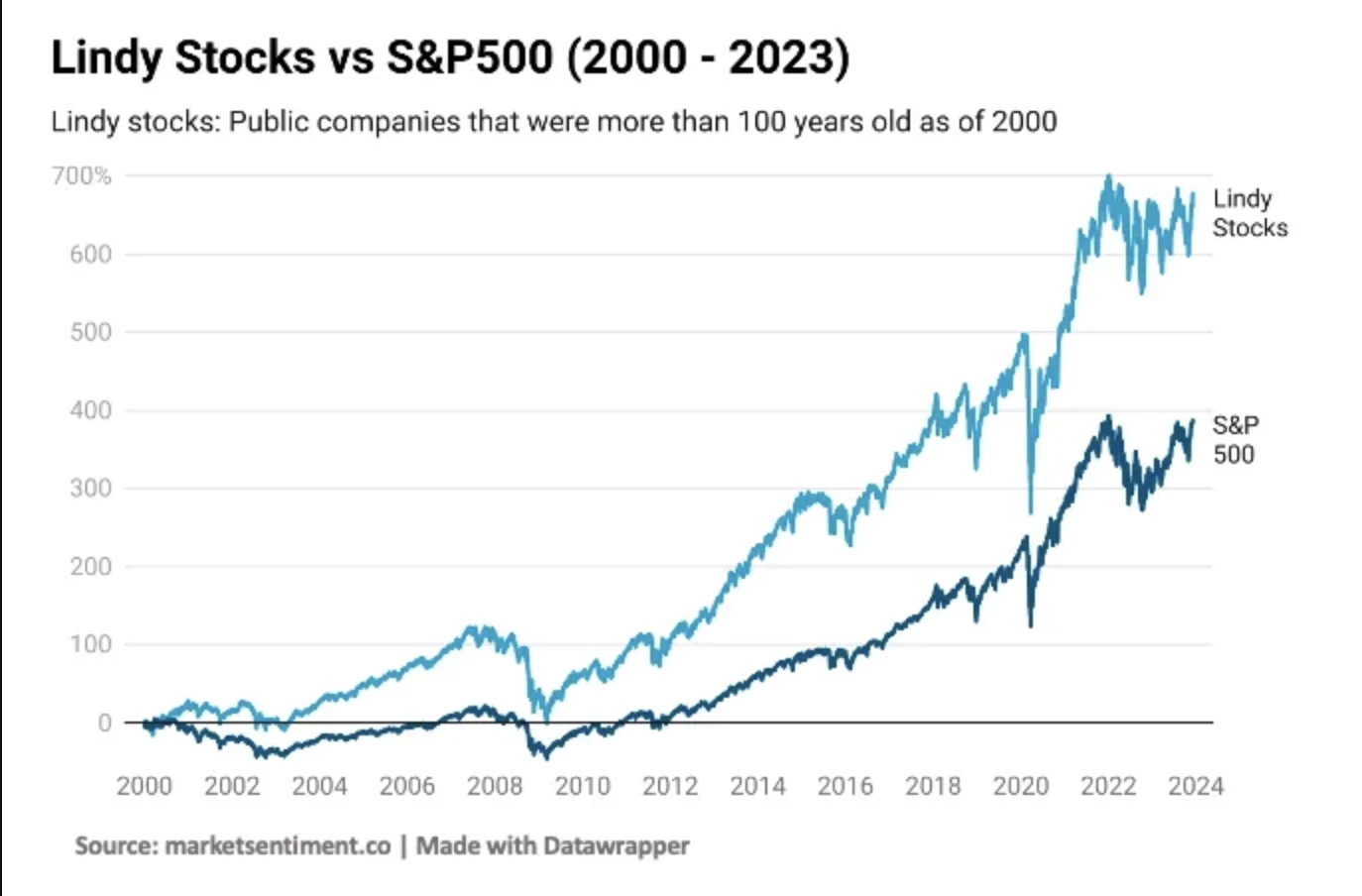

Analysts from Market Sentiment investigated the outcome of investing $100 in companies over 100 years old versus putting the same amount into assets from the S&P 500 index.

Lindy stocks VS S&P 500 (2000 – 2023)

What they discovered was intriguing. From 2000 to 2023, “Lindy stocks” surged by 676%. Meanwhile, during that same period, the S&P 500 index only increased by 386%.

Connection with the Crypto World:

One distinguishing aspect of the Crypto World is its instability. Compared to the traditional economy, cryptocurrencies offer numerous attractive prospects, alongside increased risks. Let’s compare the application of the Lindy Effect to the largest financial conglomerate, JPMorgan, and the leading cryptocurrency exchange, Coinbase.

JPMorgan has thrived for over two centuries, whereas Coinbase has been in existence for about a decade. JPMorgan has already established its name, cultivated a vast partner base, forged connections, and garnered a remarkable index of economic influence in the market. Coinbase, propelled by innovative technology, has also amassed a significant partner base but lacks the stability and authority of its counterpart. Referring to the Lindy Effect, analysts can speculate that the venerable JPMorgan will successfully endure another 200 years, while Coinbase may fade away amidst the influx of new projects within a decade.

What about Bitcoin (BTC)? With a track record of 15 years, BTC is poised to remain in demand for at least another 15 years. Furthermore, Bitcoin’s prospects are promising, as it introduced the world to the concept of decentralized currencies. While Bitcoin exhibits remarkable resilience, the same cannot be said for the altcoin market.

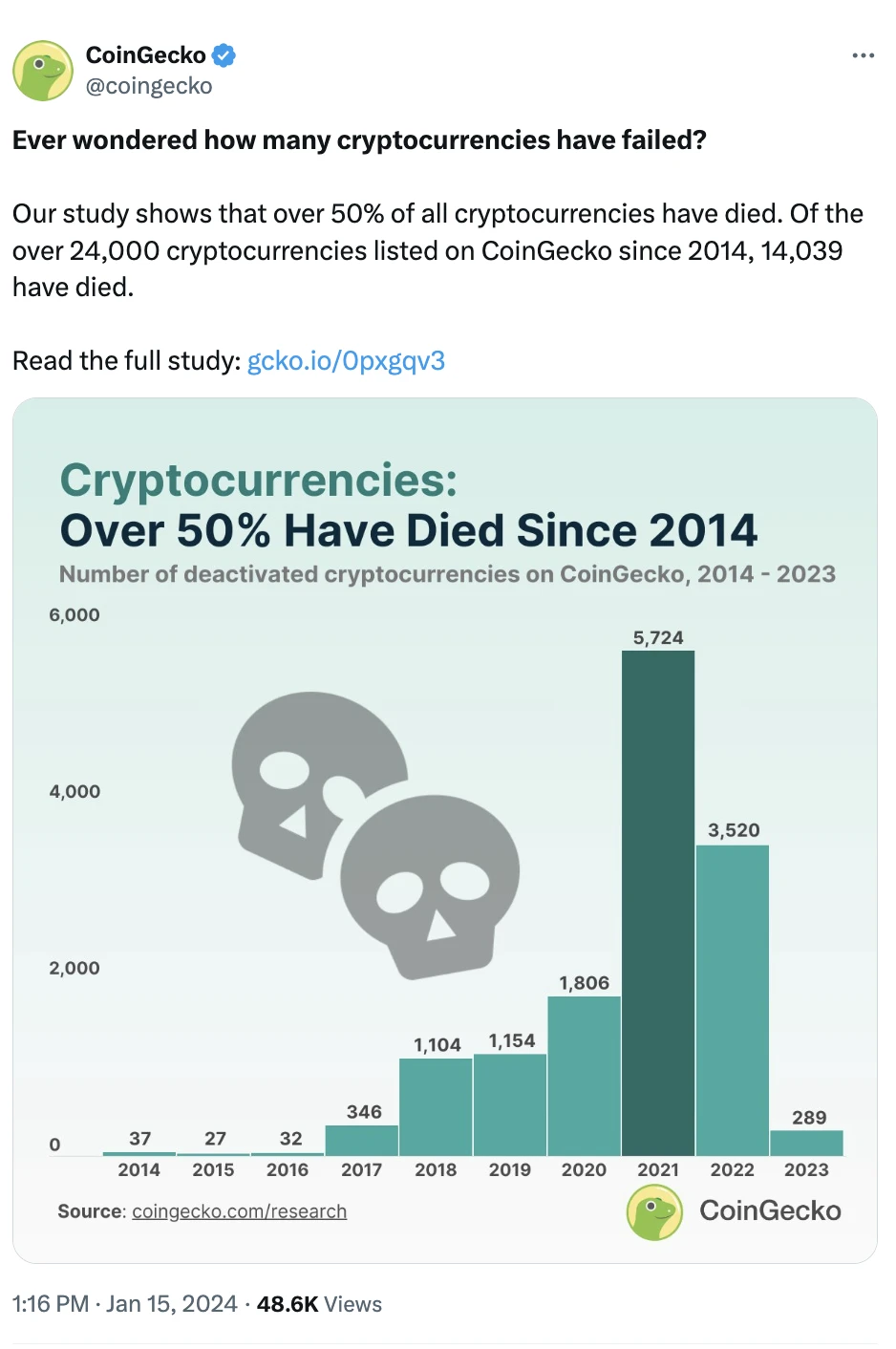

Analysts often highlight the cyclical nature of cryptocurrency prices, which is believed to correlate with the roughly four-year periods between Bitcoin halvings. According to CoinGecko statistics, over 50% of all cryptocurrencies listed on their platform have ceased to exist. The service reports that since 2014, 14,039 projects have “died”. Cryptocurrencies launched during the bullish market of 2021 suffered the most significant losses.

So, applying the Lindy Effect to altcoins, we might conclude that only tokens that have “survived” at least two Bitcoin halving cycles, or around eight years, should be considered as good investment opportunities. Thus, the Lindy Effect significantly aids crypto investors in crafting strategies, spotlighting the most profitable projects for investment and enabling long-term forecasts.

Conclusion:

In the realm of cryptocurrency investments, where volatility and uncertainty prevail, the Lindy Effect offer a framework for evaluating projects and making predictions about their long-term viability. By acknowledging the enduring nature of established entities like Bitcoin and the potential fragility of newer ventures, investors can navigate the ever-changing landscape of digital assets with heightened confidence.

If you’re interested in learning more fascinating insights about crypto, be sure to explore our blog!