Today, let’s delve into strategies for managing underperforming assets. Please note that the following is not financial advice, so always conduct thorough research before making any decisions.

Recently, while assessing my crypto portfolio, I noticed a consistent uptrend in most holdings. However, one coin, appeared stagnant. Reflecting on its historical data prompted me to question: Should I continue holding or cut my losses?

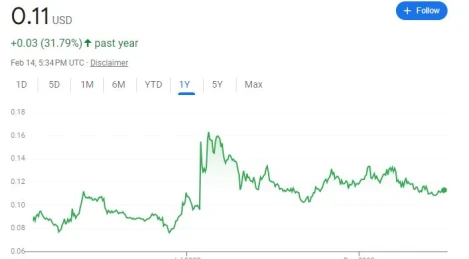

Let’s examine its one-year performance below:

As illustrated in the chart above, the above coin peaked at $0.16 USD in July of last year but has since stabilized around $0.11 USD. Now, I’m faced with three decisions applicable to any coin in my portfolio:

Sell My Coins at a Realized Loss

This strategy involves selling coins at a loss. Despite seeming counterintuitive, there’s a potential tax benefit depending on your country of residence. These losses can be offset against any realized gains throughout the tax year. Although it results in a financial loss, it can safeguard more capital if you anticipate further decline in the asset’s value.

Buy More of the Asset

In contrast to the previous strategy, this entails increasing your investment. It’s advantageous if you anticipate the asset’s future appreciation, potentially leading to higher gains. However, there’s a risk of further losses if the asset continues to decline. This strategy has proven lucrative for some, particularly during market downturns like those seen with Bitcoin.

Take No Action

This strategy is suited for those with a long investment horizon. It involves maintaining the asset without making any changes. While it exposes you to the risk of depreciation, it also allows for potential gains during market upswings. The downside risk is limited to the initial investment amount, making it suitable for those comfortable with higher risk.

Conclusion

None of us possess a crystal ball for predicting the future, so we rely on statistical analysis, intuition, and personal risk tolerance to make informed decisions. Whether to sell, buy more, or hold onto underperforming assets depends on individual circumstances and goals.