The United States is gearing up for a significant shift in its tax regulations concerning cryptocurrencies in a bid to address the challenges of categorizing crypto within taxation norms.

Navigating Taxation in Light of Economic Goals

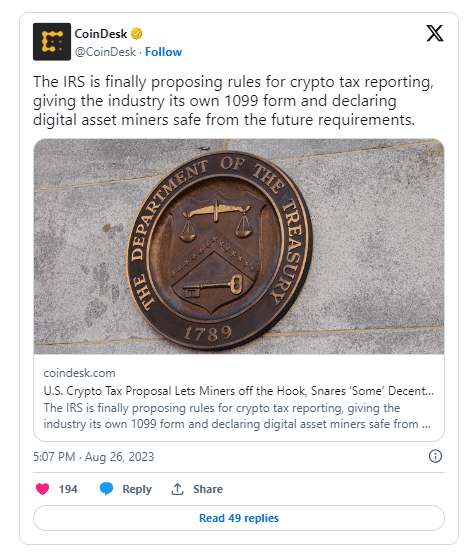

Driven by the 2021 Infrastructure Investment and Jobs Act, the Treasury Department is crafting policies aimed at transforming the cryptocurrency sector into an investment and job-generating industry while establishing a clear taxation framework. In response, the IRS has introduced a fresh regulatory measure, the Form 1099-DA, specifically tailored for tax reporting within the crypto domain.

Entities Subject to Taxation and Clarity on Taxed Parties

The recent legislation encompasses the term “broker” within the taxation scope. While the exact parameters of this classification remain somewhat ambiguous, it has direct relevance to the digital asset sector. This encompasses trading platforms, wallet service providers, payment processors, and asset issuers. Furthermore, this designation extends to decentralized exchanges and un-hosted wallets tied to crypto transactions.

Tax Relief for Miners

Crucially, the new regulations exclude activities like Proof of Work (PoW) mining and transaction validation fees on distributed ledgers from the “broker” categorization. Hence, the mining sector is poised to be exempted from these newly proposed tax rules. Speculatively, the government might be endorsing Bitcoin and other PoW mining endeavors or certain influential individuals could stand to gain from such exemptions.