Bitcoin (BTC) has made headlines again, surging over $2K in the past 24 hours. Reaching $47,685 at one point this morning, it subsequently experienced a sharp retreat of about $700, hovering just below $47K as of 9:30 am. With current speculation hinting at a potential climb to $48K, could the long-awaited $50K mark finally be within reach?

The recent uptick in Bitcoin’s value comes after a dip below $39K following a notable decline on January 23. Initially attributed to South Korean investors cashing out profits from Bitcoin’s previous high of $48,494 on January 11, the market has since witnessed a significant recovery.

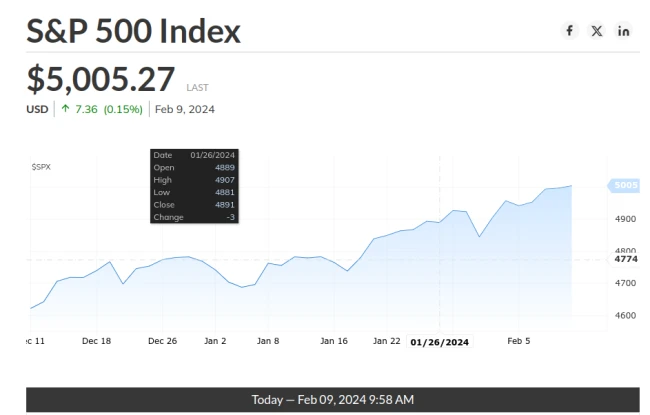

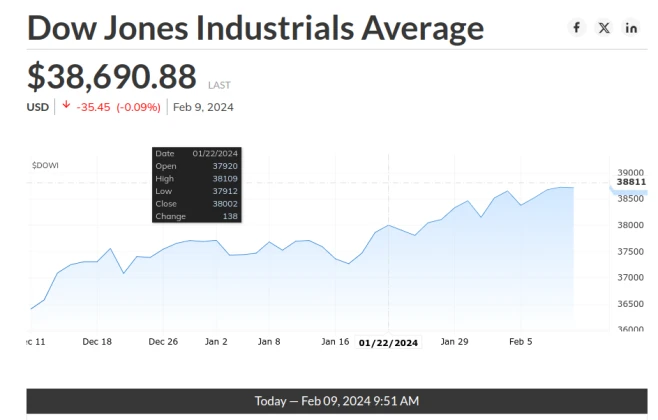

Interestingly, Bitcoin (BTC) ascent seems to mirror the performance of major indices. The Dow Jones Index, having surpassed $37K in mid-December, soared to $38K by January 22, hitting a record high of $38,701 this morning. Similarly, the S&P 500 recently breached the $5K mark, with both indices primarily buoyed by a select few companies.

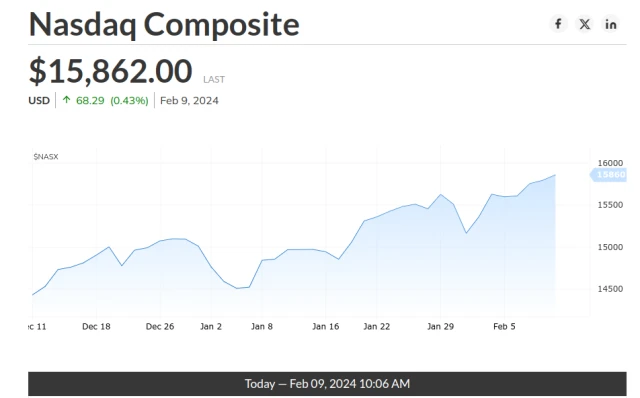

The Nasdaq has also experienced a remarkable rise since December 11, climbing over $1.4K to its current level of $15,862.

Amidst this market fervor, investors are flocking to oil, driving prices upward despite environmental concerns. WTI crude surged 1.2% this morning to $77.15, while Brent crude surpassed $80, reaching $82.36. Heightened geopolitical tensions in the Middle East further contribute to the bullish trend in oil prices.

In the realm of precious metals, gold remains resilient despite the strengthening US Dollar. While typically inversely correlated, gold has maintained its position above $2K since December, signaling its continued relevance as a safe-haven asset.

With ongoing shifts in global economics and geopolitics, the landscape of investments is evolving rapidly. Stay informed and adapt to these changes to navigate the dynamic world of finance successfully.